In a video shared broadly throughout social media, the Securities and Alternate Fee Chair, Gary Gensler says that the 2 most distinguished cryptocurrencies, Ethereum (ETH) and Bitcoin (BTC) usually are not securities.

Though the video dates again to 2018, Gensler explicitly says that “Over 70% of the crypto market is Bitcoin, Ether, Litecoin, Bitcoin Money. Why did I identify these 4? They’re not securities.”

Based on a associated report by Cointelegraph, again then, Gary Gensler held a school place on the esteemed Massachusetts Institute of Expertise (MIT). The footage dates again practically two years previous to his eventual ascension to the Chair of the Securities and Exchange Commission (SEC).

In a stark juxtaposition to his earlier stance, Gensler’s subsequent actions on the SEC paint a unique image. The current months have witnessed the regulatory physique plunge right into a wave of enforcement initiatives inside the cryptosphere.

Final week, Gensler listed 68 cryptos as securities, together with Cardano (ADA), Solana (SOL), and Polygon (MATIC) in the newest lawsuits. Furthermore, the regulatory chair as soon as declared that each one cryptocurrencies aside from Bitcoin are securities, which contradicts his assertion within the 2018 video.

Chair Gensler in 2018 at a Bloomberg convention in NYC:

“Bitcoin. Ether. Litecoin. Bitcoin Money. Why did I identify these 4? They’re not securities.”

What’s Goldman Gary going to say about this one? Deep pretend? pic.twitter.com/p7DJlYkJIt

— Ryan Selkis 🪳 (@twobitidiot) June 12, 2023

Evaluating The Ethereum Worth Profitability This Week

Ethereum, like a lot of its friends, began the week whereas consolidating losses after a ugly week within the wake of the intensified crackdown on the crypto market by the US SEC.

As Coinbase, Binance, and the foundations of chosen cryptos like ADA, SOL, and MATIC begin their respective authorized battles, traders could wish to know methods to modify their crypto portfolios.

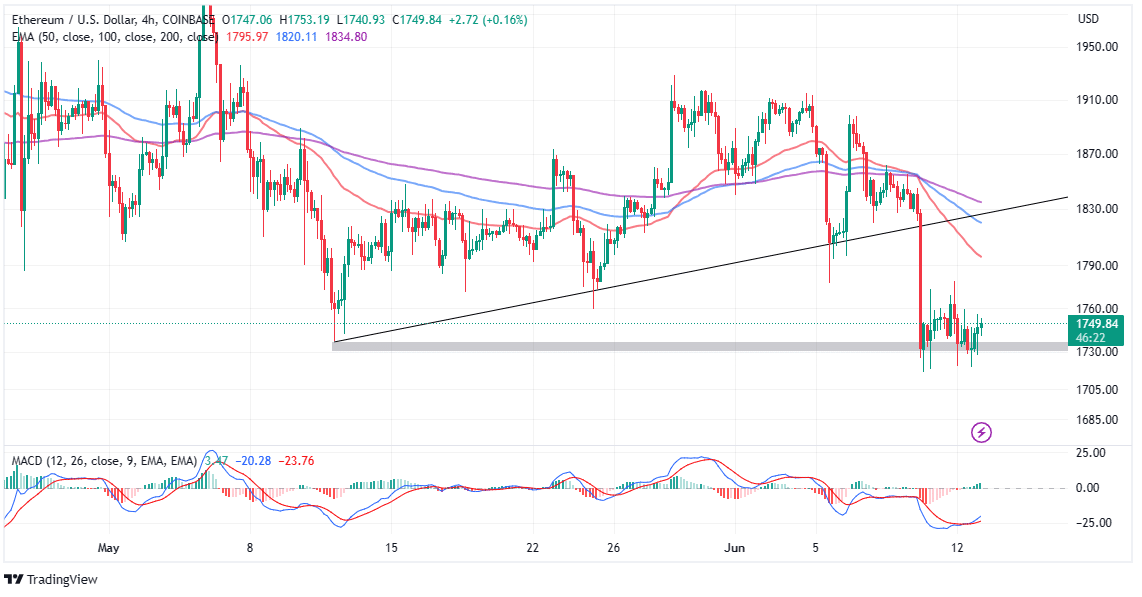

On the time of writing, ETH is buying and selling at $1,750 with help at $1,730 holding firmly. Aayush Jindal, an analyst at NewsBTC believes Ether solely must reclaim help at $1,800 to validate an even bigger restoration transfer to $2,000.

Nonetheless, Ethereum should first take care of resistance at $1,760 to shut the hole to $1,800. On the brilliant facet, the Shifting Common Convergence Divergence (MACD) indicator dons a vivid purchase sign.

Merchants eyeing new lengthy positions in Ethereum price could be inspired to activate their orders so long as the MACD line in blue holds above the sign line in crimson.

Insights from the on-chain analytics platform Santiment recommend that the crypto market might begin to rise, now that the dust lifted by the SEC going after Binance and Coinbase has settled. The rebound is predicted to proceed “till the following growth with the lawsuits.

👨⚖️ With merchants nonetheless very a lot conscious of the #SEC going after #Binance and #Coinbase, the mass hysteria has no less than settled down. Till the following developments with the lawsuits, we might see some gradual rising of costs again to pre-crash ranges. https://t.co/Za7tchgeUx pic.twitter.com/BSZEHrjQNP

— Santiment (@santimentfeed) June 12, 2023

Furthermore, most altcoins skilled excessive capitulation final week, leaving many merchants and traders in losses. The sharp value drop will probably set off elevated accumulation amongst whales. If this accumulation pattern continues, “there’s purpose to imagine a robust rebound can happen,” Santiment states.

Associated Articles:

The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.