Key Notes

- SharpLink Gaming disclosed buying 19,271 ETH at $3,892 common value, doubling its focus ratio to 4.0 since June this yr.

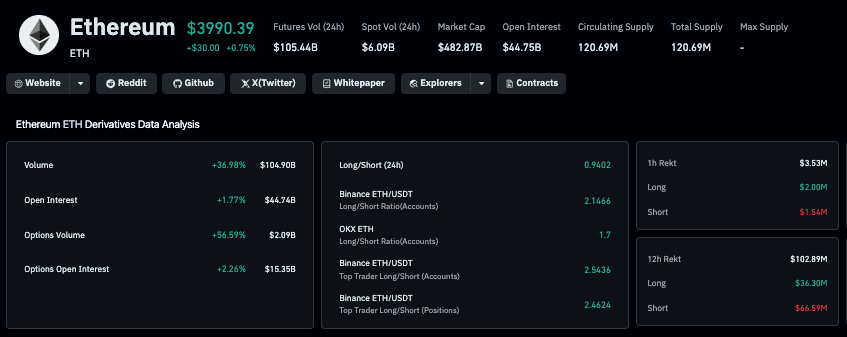

- Derivatives information reveals 37% quantity spike however solely modest open curiosity development, indicating lively repositioning reasonably than sustained capital inflows.

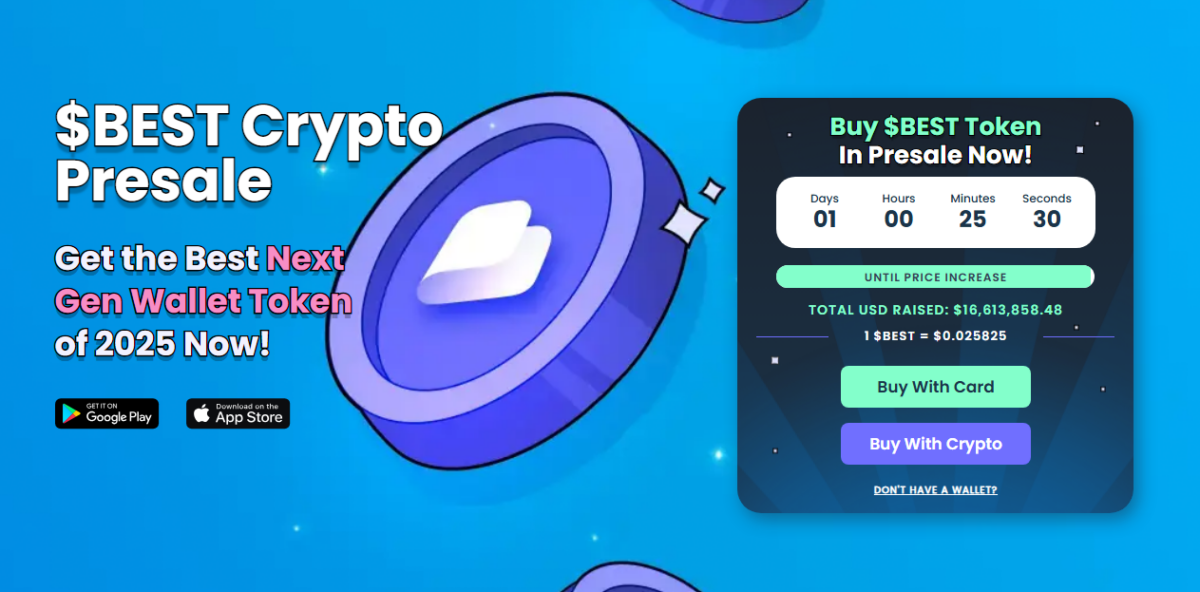

- Finest Pockets’s presale has attracted over $16.6 million as traders search multi-chain options amid Ethereum’s consolidation section close to key resistance.

Ethereum

ETH

$4 001

24h volatility:

0.3%

Market cap:

$483.75 B

Vol. 24h:

$43.12 B

value climbed above $4,000 on Tuesday, October 21, posting a 3% every day acquire amid a broader market rebound. The upside momentum adopted SharpLink Gaming’s announcement of recent ETH acquisitions, strengthening bullish sentiment across the second largest cryptocurrency by market cap.

Ethereum Worth Rises 3% as SharpLink Expands ETH Treasury

In a submit shared on X (previously Twitter), SharpLink Gaming disclosed it had bought 19,271 ETH at a median value of $3,892, bringing complete holdings to 859,853 ETH, price roughly $3.5 billion as of October 19, 2025.

The company’s treasury update additionally highlighted optimistic staking efficiency, with 5,671 ETH earned in rewards since June 2.

NEW: SharpLink acquired 19,271 ETH at a median value of $3,892, bringing complete holdings to 859,853 ETH valued at $3.5B as of October 19, 2025.

Key highlights for the week ending October 19, 2025:

– Raised $76.5M at a 12% premium to market

– Added 19,271 ETH at $3,892 avg.… pic.twitter.com/Y4Ewu4EiuF— SharpLink (SBET) (@SharpLinkGaming) October 21, 2025

SharpLink’s ETH focus ratio has doubled since June, now standing at 4.0, reflecting aggressive treasury growth. The agency additionally raised $76.5 million at a 12% premium to market, reinforcing market confidence in Ethereum’s institutional enchantment.

ETH trades close to $4,020, sustaining robust footing above its 50-day shifting common, whereas merchants eye potential retests of the $4,200 resistance.

As Coinspeaker reported on Tuesday, Bitmine, Ethereum’s largest treasury agency additionally introduced recent ETH buys price $250 million, bringing its complete reserves to $13.4 billion.

ETH Derivatives Insights Suggests Brief-Time period Volatility

Derivatives metrics present a substantial improve in Ethereum buying and selling exercise on Tuesday, however restricted proof of long-term capital inflows. Coinglass data reveals a pointy 37% rise in Ethereum futures buying and selling quantity, however solely a modest 1.77% improve in Open Curiosity (OI), bringing the whole OI to $44.74 billion.

Ethereum derivatives markets evaluation, Oct 21, 2025 | Coinglass

This imbalance signifies that extra of the intraday market exercise got here from ETH merchants repositioning current contracts, reasonably than new inflows.

In the meantime, the lengthy/quick ratio sits at 0.94, reflecting a slight bearish bias as quick merchants preserve a marginal edge. This means that, whereas Ethereum’s spot market momentum leans optimistic, derivatives merchants stay cautious.

Failure to shut above $4,000 might see merchants unwind extra positions, giving solution to retest of the $3,900 ranges. On the upside, the construct of short-positions will increase the chance of a fast breakout to $4,200 if macro catalysts set off a short-squeeze.

Finest Pockets Presale Crosses $16.6 Million Amid Ethereum Worth Consolidation

As Ethereum’s value momentum hangs within the stability, Finest Pockets (BEST), a next-generation multi-chain crypto pockets, is drawing investor consideration. Designed for each institutional and retail customers, Finest Pockets provides non-custodial, institutional-grade safety, and excessive staking rewards throughout a number of blockchain networks.

Finest Pockets Presale

At press time, the Finest Pockets presale has surpassed $16.6 million, with tokens priced at $0.026. With lower than 48 hours earlier than the subsequent value tier unlocks, early traders nonetheless have a window to take part by means of the official Best Wallet website and entry unique early-joiner advantages.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any choices based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.