Ethereum worth has steadied above $1,800 for practically two months and traded at $1,864 on Friday. On the upside, worth motion has been capped underneath $2,000, amid a common stoop within the buying and selling quantity.

Following the Ripple ruling in early July, buyers targeted much less on Bitcoin (BTC) and Ethereum, favoring different main altcoins like XRP, Cardano (ADA), Polygon (MATIC), Solana (SOL), and most not too long ago Dogecoin (DOGE).

The largest process amongst Ethereum is holding the worth above $1,800 – a transfer more likely to stop doable declines to $1,700 and $1,600.

If a restoration ensues from the present market worth, the token powering the most important good contracts token would possibly set off a surge in investor curiosity, who’re nonetheless ready on the sideline for an uptrend affirmation above $2,000.

Right here’s What It Will Take Ethereum to Rally?

Ethereum price is in the midst of nurturing a probably large breakout that might propel it not solely above $2,000 however enable bulls to shut the hole to $2,400 for the primary time since Could 2022.

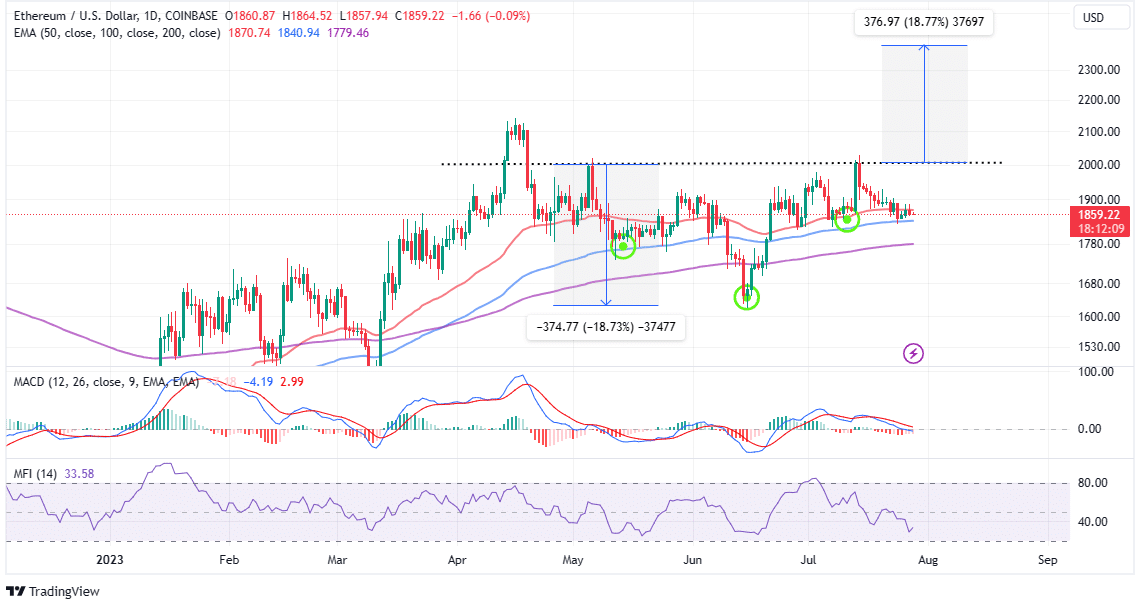

The each day chart exhibits the formation of an inverse head-and-shoulders (H&S) sample, promising a 19% bullish transfer to $2,385.

The inverse H&S sample exhibits a downtrend ending and an uptrend beginning. It has three lows: the center one is the bottom (head) and the outer ones are increased (shoulders).

This sample is validated when the worth breaks above a line becoming a member of the highs of the shoulders (neckline), situated round $2,000 for Ethereum worth.

Merchants are at all times suggested to purchase when this occurs or watch for a pullback to the neckline to make certain that the breakout is sustainable and never a bull entice. Observe that the worth goal is the gap from the pinnacle to the neckline (19%) added to the breakout level.

Different indicators should be consulted when buying and selling the H&S, particularly the Cash Stream Index (MFI), which screens the influx and outflow of funds in Ethereum markets. That stated, the MFI as offered on the each day chart, has a bullish outlook, which means {that a} breakout is within the offing.

Evaluating the Bullish Case in Ethereum Value

Including credence to the bullish outlook on the each day chart is the Shifting Common Convergence Divergence (MACD) indicator – more likely to ship a purchase sign over the weekend.

Merchants in search of recent publicity to ETH lengthy positions must be looking out for bullish crosses within the momentum indicator, marked by the MACD line in blue crossing under the sign line in pink.

To be on the protected aspect, Ethereum price must break and hold above the immediate hurdle, as highlighted by the 50-day Shifting Common (EMA) at $1,870. Revenue reserving can begin at $2,000 however extraordinarily bullish merchants could need to maintain on for the H&S sample breakout to $2,385.

Associated Articles

The offered content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.