Is the newest Ethereum rally a bull entice or the beginning of a contemporary bull market? Right here’s what the ETH-taker buy-sell ratio says about it.

Ethereum Taker Purchase/Promote Ratio Has Fallen Beneath 1 Not too long ago

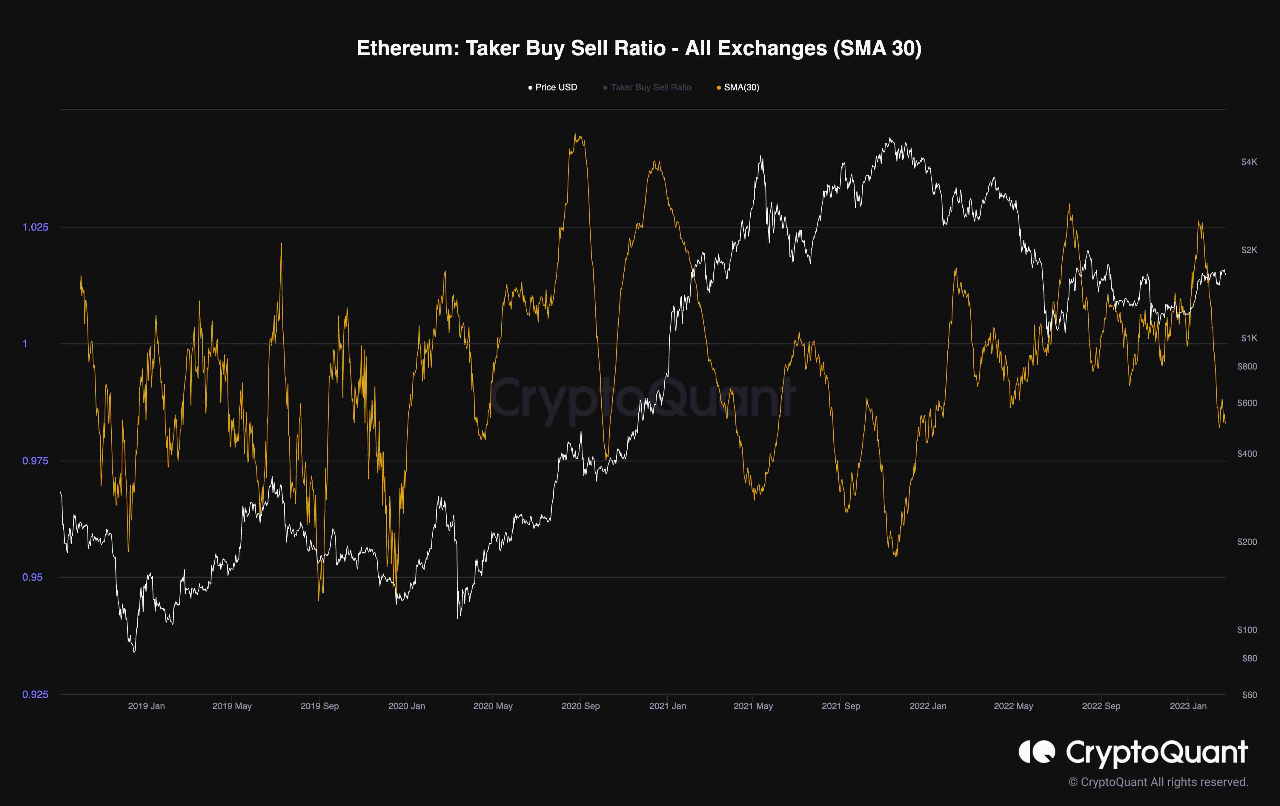

An analyst in a CryptoQuant post pointed out that the current sentiment has been bearish in line with the metric. The “taker buy-sell ratio” is an indicator that measures the ratio between the taker purchase and taker promote volumes within the Ethereum futures market.

When the worth of this metric is bigger than 1, it suggests the “lengthy” or the taker purchase quantity is greater than the “quick” or the taker promote quantity at present. Such a pattern means extra patrons are keen to amass cryptocurrency at a better value.

Then again, values of the ratio lower than the edge suggest the taker promote quantity is the extra dominant quantity within the futures market. Thus a bearish sentiment is shared by the bulk in the intervening time.

Now, here’s a chart that reveals the pattern within the 30-day easy transferring common (SMA) Ethereum taker buy-sell ratio over the previous few years:

The 30-day SMA worth of the metric appears to have taken a deep plunge in current days | Supply: CryptoQuant

As displayed within the above graph, the 30-day SMA Ethereum taker buy-sell ratio had shot above the 1 line with the latest rally within the asset value.

Because of this the bulk sentiment within the ETH futures market had turned bullish because the coin’s worth rose. Nonetheless, the indicator’s worth dropped when the rally slowed, and the value moved sideways.

The taker buy-sell ratio decline continued, and the metric quickly plunged beneath the one mark. This means that the quick quantity dominated the futures market following the consolidation.

The metric hit a low not too long ago that had simply been seen a yr in the past. From the chart, it’s obvious that with the newest leg up within the rally, the metric hasn’t proven any important will increase in its worth, and the dominant sentiment remains to be bearish.

Traditionally, the cryptocurrency has often encountered tops at any time when the 30-day SMA taker buy-sell ratio has assumed such bearish values. A distinguished instance seen within the graph is the November 2021 bull run high (that’s, the present all-time excessive value), which fashioned with values of the metric deep beneath the one mark.

The metric’s present worth isn’t as underwater as then, so it may nonetheless see some restoration within the coming days because the sentiment would possibly flip bullish once more with the rally persevering with.

Nonetheless, the quant cautions:

(…) the current rally ought to be intently monitored within the weeks forward to find out whether or not this was simply one other bull entice or a starting of a brand new bull market, as sellers would possibly dominate once more.

ETH Worth

On the time of writing, Ethereum is buying and selling round $1,600, up 4% within the final week.

It appears like the worth of the asset has declined over the past couple of days | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com