Ethereum staking elevated considerably after the Shanghai upgrade on April 12, with deposits outpacing withdrawals. In accordance with Etherscan, ETH staking deposits on the Beacon Chain reached one other all-time excessive, with 24.17 million ETH value $46.03 billion at a value of $1903 as of June 3.

Furthermore, whole ETH deposits post-Shanghai improve is 6 million ETH, whereas whole withdrawals accounts for less than 3 million, as per Nansen deposit contract data.

Furthermore, Ethereum (ETH) stability on the crypto exchanges has reached a brand new five-year low. CryptoQuant knowledge signifies that the full quantity of ETH held in crypto exchanges dropped to important ranges. ETH on exchanges now stands at virtually 16 million, reaching ranges not recorded since July 2018. Actually, it has declined 50% because the all-time excessive.

Curiously, Nansen knowledge signifies ETH locked has additionally reached an all-time excessive of twenty-two.4 million. ETH locked means all ETH that’s out of circulation, it consists of ETH staked on the Beacon Chain, ETH deposited to the Beacon contract however not validating but, and rewards on the Beacon chain.

Usually, a rise within the quantity of ETH locked and staking led to a lower within the general provide of Ethereum tokens accessible available in the market. The lower in ETH will trigger costs to rally greater.

Additionally Learn: Celsius $800M ETH Staking Extends Ethereum Queue

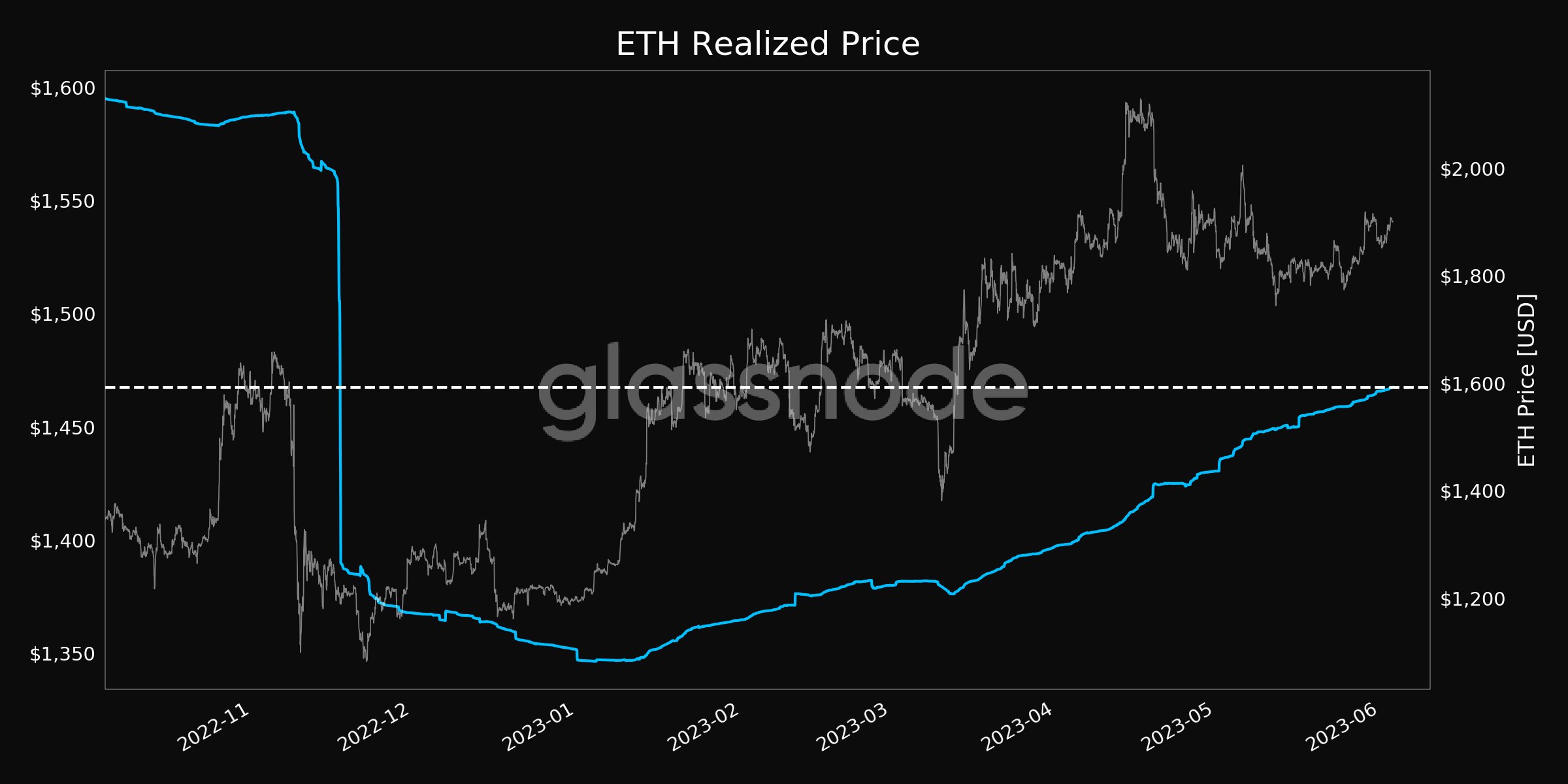

Ethereum Realized Value At 6-Month Excessive

Because of low ETH provide available in the market, Ethereum realized value has hit a 6-month excessive of $1470. It may be interpreted because the on-chain assist for ETH value. The worth has now much less likelihood of falling under the extent, making institutional investors more inclined to Ethereum than Bitcoin.

As per CoinGape Markets, ETH price can hit $2500 as a result of bullish morning star candlestick sample shaped after ETH breakout above the 2-month resistance trendline. As well as, a bullish breakout from the wedge sample has set the Ethereum value on a restoration monitor.

ETH price presently trades above $1900, up 5% upside in every week. It signifies that traders are shopping for on dips in anticipation of a serious upcoming rally.

Additionally Learn: Terra Classic Officially Releases Its Biggest v2.1.0 Parity Upgrade Proposal

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.