Ethereum, mirroring the efficiency of Bitcoin and different high altcoins, is again above $3,000, days after the autumn beneath $2,800. Because the second most precious coin recovers, injecting optimism amongst crashed token holders and merchants, an in depth above $3,200 will probably be essential in catalyzing demand.

Ethereum Rising: Will Bulls Push Above $3,200?

In response to IntoTheBlock on July 10, if Ethereum edges above the $3,200 stage, will probably be an enormous growth for merchants. When this occurs, an estimated two million entities who traded ETH at this worth level will probably be within the cash.

Subsequently, if costs retest this stage, those that went lengthy can exit at break even. Alternatively, different “diamond palms,” anticipating extra positive aspects on the horizon, can double down and trip the anticipated leg up.

Associated Studying

So far, there are hints of energy. Nevertheless, although sellers are nonetheless in management, a breach of $3,300 will probably be essential within the quick to medium time period. The $3,300 stage, wanting on the ETHUSDT candlestick association within the each day chart, is earlier assist, however it’s now resistance.

A breakout, ideally with rising quantity, will doubtless function a base for extra positive aspects, lifting the coin in direction of a key liquidation stage at $3,700 and later $3,900.

Conversely, if sellers take over, reversing latest positive aspects and aligning with the July 4 and 5 losses, a drop beneath $2,800 will sign development continuation. Taking a look at candlestick preparations, Ethereum will dump to new multi-week lows in that occasion, even dropping to $2,500.

Eyes On Spot ETFs, Whales Accumulating As ETH Turns into Scarce

Total, analysts are optimistic, anticipating Ethereum to drift greater. The anticipated launch of spot Ethereum exchange-traded funds (ETFs) within the coming days is an enormous catalyst behind this bullish outlook.

Like the way to spot Bitcoin ETFs opened the floodgates for institutional publicity on the planet’s most precious coin, the identical influx will doubtless be seen in ETH. With institutional demand, helps assume ETH will tear greater, breaching $4,100 and registering new 2024 highs within the coming months.

Associated Studying

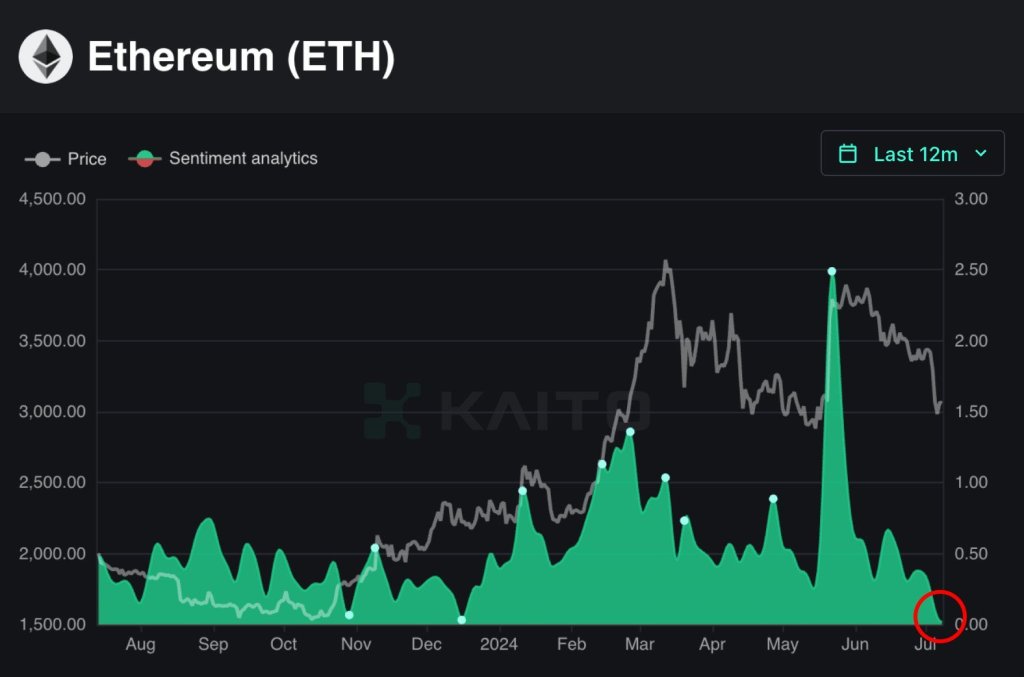

Apparently, even the spot Ethereum ETF launch expectations don’t appear to vary merchants’ outlook. On-chain knowledge reveals that bullish sentiment is at a one-year low, pointing to warning amongst ETH holders.

In the meantime, as on-chain knowledge illustrates, ETH outflows from exchanges have elevated lately. All exchanges, together with Binance and Coinbase, management 10.17% of ETH in circulation. Parallel knowledge additionally shows that one other chunk, representing 28% of all ETH in circulation, is staked.

Function picture from DALLE, chart from TradingView