Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) has seen a 17% drop within the final month, buying and selling beneath $1,850 for the previous few days. Amid its present efficiency, an analyst has warned buyers the cryptocurrency dangers dropping to 17-month lows if it fails to reclaim key resistance ranges.

Associated Studying

Ethereum May See Drop To $1,550

Ethereum has been buying and selling beneath a key help zone for the previous two days, hovering between $1,750-$1,840 after failing to get well the $1,900 mark on Wednesday. The second-largest cryptocurrency by market capitalization misplaced its 15-month vary in early March, dropping beneath $2,100 for the primary time since December 2023.

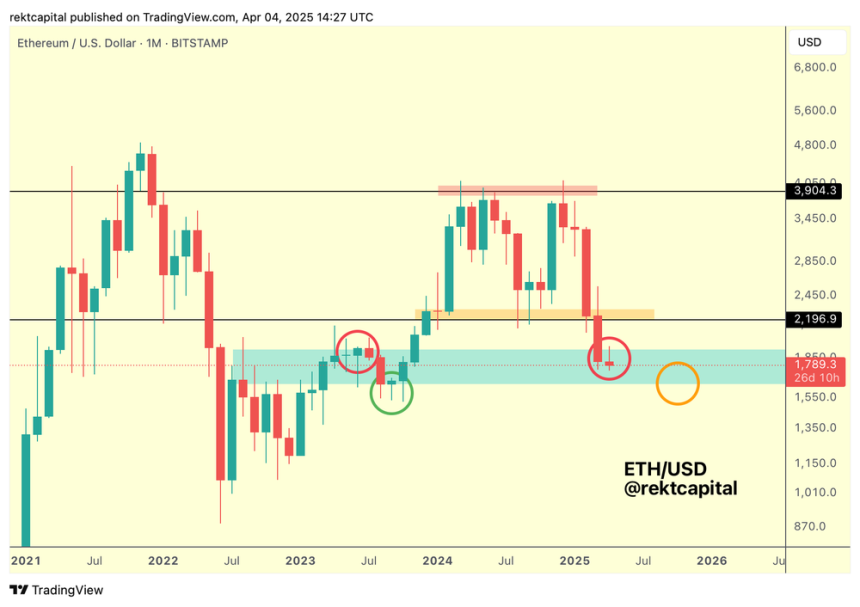

Since shedding this stage, ETH has seen its worst efficiency in seven years, recording a destructive month-to-month shut for the fourth consecutive month. Analyst Rekt Capital highlighted that this efficiency validated Ethereum’s double prime formation that developed inside its $2,196-$3,904 Macro Vary.

After breaking down from this vary, Ethereum trades inside a historic liquidity pool, between the $1,640-$1,930 vary, and “successfully has positioned itself for a bearish retest” of the vary’s prime with its month-to-month shut inside this space, which may flip this stage into a brand new resistance.

Because the analyst explains, turning this stage into resistance has traditionally seen ETH’s worth drop to the present vary’s decrease zone. “In different phrases, turning the pink stage into resistance (pink circle) has traditionally preceded a drop into the help on the backside of the sunshine blue historic demand space (orange circle),” he detailed.

As such, Ethereum should reclaim the highest of this demand space “to problem a transfer to the previous Macro Vary Low of $2,196.” In the meantime, a rejection from the $1,930 mark, which it has been unable to reclaim over the previous week, would see ETH threat a 15% drop to the $1,550 space.

Is A 20% Rally Coming?

Rekt Capital additionally pointed out that since June 2023, ETH’s Dominance has dropped from 20% to eight%, traditionally a reverse space for the cryptocurrency. When Ethereum’s Dominance touched the $7.5%-8.25% vary, it reversed “to develop into extra market-dominant,” which may sign a reversal for the King of Altcoins.

A number of analysts consider that the important thing ranges to look at are the $1,750 help and the $2,100 resistance, as a break above or beneath these ranges will decide ETH’s subsequent vital transfer.

Associated Studying

Analyst Sjuul from AltCryptoGems suggested that Ethereum may eye a 20% rally based mostly on a Energy of three setup in ETH’s decrease timeframe chart. The analyst highlighted that the cryptocurrency had an accumulation section after dropping beneath the $2,150 help, hovering inside the $1,840 and $2,100 ranges since March 10.

After dipping beneath the $1,840 mark, the cryptocurrency has been within the manipulation section, the chart exhibits, which may set off a push to the $2,150 resistance if ETH breaks out and begins the distribution section.

As of this writing, Ethereum trades at $1,808, a 2.2% surge within the day by day timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com