On-chain information exhibits Ethereum has noticed large inflows of $505 million into Binance throughout the previous day, an indication that promoting could also be occurring.

Ethereum Change Inflows Have Shot Up Throughout The Previous Day

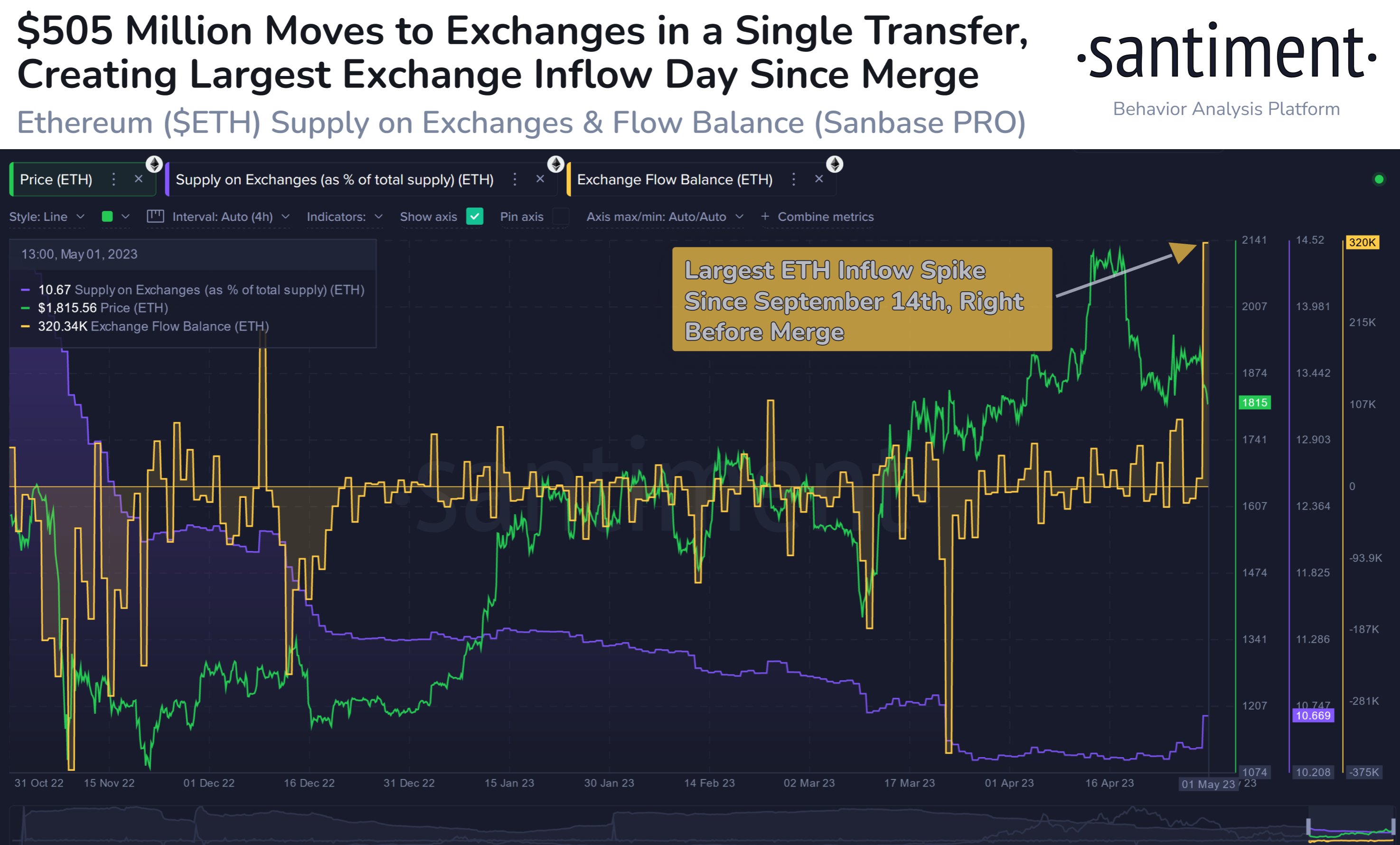

In accordance with information from the on-chain analytics agency Santiment, this enhance within the provide on exchanges is the most important noticed because the day earlier than the Merge. The “supply on exchanges” is an indicator that, as its title already implies, measures the proportion of the entire Ethereum provide that’s at present sitting within the wallets of all centralized exchanges.

Associated Studying: Bitcoin Bearish Signal: Miners Continue To Sell

When the worth of this metric will increase, it means traders are depositing some cash to exchanges proper now. This type of pattern can have bearish penalties for the asset’s worth as one of many major the reason why traders switch their cash to exchanges is for selling-related functions.

However, reducing values of this indicator suggest a web quantity of ETH is exiting these platforms at present. Such withdrawals is usually a signal that the holders are accumulating the cryptocurrency, which might naturally be bullish for the asset’s worth in the long run.

Now, here’s a chart that exhibits the pattern within the Ethereum provide on exchanges over the previous few months:

Seems like the worth of the metric has shot up in current days | Supply: Santiment on Twitter

As displayed within the above graph, the Ethereum provide on exchanges has noticed a pointy rise prior to now day, that means that traders have deposited a considerable amount of ETH to those platforms.

Within the chart, there’s additionally the info for one more ETH indicator: the “exchange flow balance.” This metric measures the online variety of cash which can be flowing into or out of exchanges, that means that the alternate movement steadiness primarily tracks the modifications occurring within the provide on exchanges indicator.

In the course of the previous day, this metric has seen a big optimistic worth, suggesting that inflows have far surpassed the outflows on this interval. In accordance with the metric, round 320,000 ETH ($584.6 million on the present worth) has entered into the wallets of the exchanges with this spike.

This web enhance within the alternate provide is in reality the most important that the cryptocurrency has seen since September 14, 2022, the day earlier than the transition in direction of the proof-of-stake consensus mechanism occurred.

Curiously, the overwhelming majority of the influx spike has been contributed by only one switch, as information from the cryptocurrency transaction tracker service Whale Alert exhibits.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 273,781 #ETH (504,986,096 USD) transferred from unknown pockets to #Binancehttps://t.co/WHqdlSQ5uB

— Whale Alert (@whale_alert) May 1, 2023

This switch to Binance was value nearly $505 million, and it is likely one of the largest transactions between an unknown pockets and an alternate noticed over the last 5 years.

It’s unsure whether or not the whale has made this layer with the intention to promote, or for utilizing every other of the companies provided by the platform. Nonetheless, if promoting is really the purpose right here, then this large influx could be unhealthy information for the asset’s worth.

ETH Worth

On the time of writing, Ethereum is buying and selling round $1,800, up 1% within the final week.

ETH has gone down over the last couple of days | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web