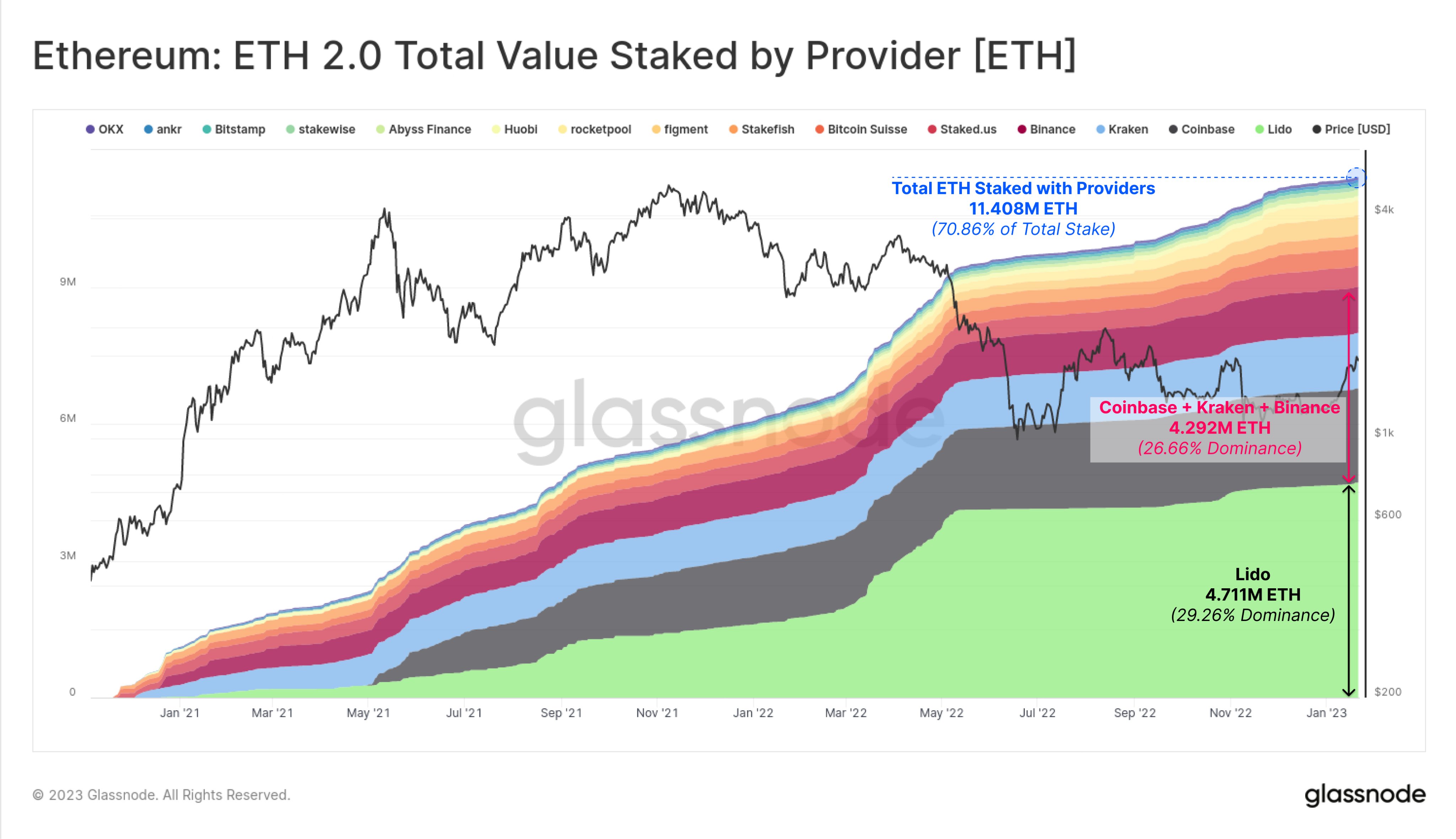

Information reveals greater than 70% of the full staked Ethereum provide is contributed by staking companies, with Lido accounting for probably the most quantity.

Ethereum Staking Service Suppliers Have Locked In A Whole Of 11.4 Million ETH

Final yr, ETH efficiently accomplished a transition to a Proof-of-Stake (PoS) consensus mechanism, which meant that miners now not had a task to play on the community as chain validators referred to as “stakers” stuffed of their position.

Similar to miners, stakers earn rewards for appearing as community nodes and dealing with transactions, however to turn out to be a staker, all an investor must do is lock in a collateral of 32 ETH into the Ethereum staking contract, and in contrast to what mining wants, the validator right here doesn’t require any vital computing energy to hold out the duty.

However because the 32 ETH requirement is a bit too excessive for the common investor (on the present trade price, a 32 ETH stack could be value round $52,400), some firms have began offering staking pool companies, the place holders can usually deposit any quantity of tokens and earn staking rewards on them. These companies often work by pooling collectively the cash locked in by the totally different customers, in order that the mixed quantity exceeds a minimum of 32 ETH.

As per information from the on-chain analytics agency Glassnode, the full worth locked into the Ethereum staking contract is now round 16.1 Million ETH within the total community (that’s, together with all platforms in addition to traders with self-custodial wallets). That is about 13.4% of the full circulating provide of the cryptocurrency.

Here’s a chart that reveals how a lot of this ETH is coming from the totally different staking companies out there:

Seems like Lido is the biggest participant out there proper now | Supply: Glassnode on Twitter

As displayed within the above graph, the full quantity of Ethereum staked by all these companies provides as much as 11.4 million ETH, which is just below 71% of your complete staking provide. Lido alone contributes 4.7 million ETH, which is greater than 29% of the full coming from these platforms.

Lido is a decentralized liquid staking pool, which is a kind of platform that provides the traders’ ETH to the staking pool and provides them one other token in return that’s backed 1:1 with their authentic place. This token gives liquidity to the customers on their locked ETH, that means that they’ll promote it each time they like, or make use of it in different companies (like spinoff positions).

Coinbase, Kraken, and Binance, the subsequent three largest suppliers within the sector, mixed have locked in about 4.3 million ETH. Their particular person dominances are 12.8% for Coinbase, 7.6% for Kraken, and 6.3% for Binance. Clearly, even their mixed dominance at 26.6% remains to be lesser than Lido’s by itself.

ETH Value

On the time of writing, Ethereum is buying and selling round $1,600, up 6% within the final week.

The worth of the crypto appears to have been transferring sideways for the reason that surge just a few days in the past | Supply: ETHUSD on TradingView

Featured picture from Zoltan Tasi on Unsplash.com, charts from TradingView.com, Glassnode.com