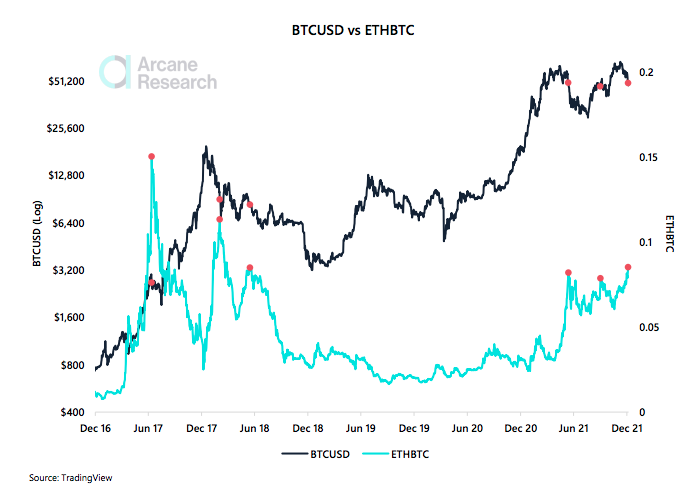

As Bitcoin (BTC) is popping out of a harsh weekend with a 5% drop and an enormous sellout, ether (ETH) nonetheless maintains its energy compared, which has been occurring since October. Arcane Research’s weekly update reveals that the ETHBTC pair reached its highest stage since Might 2018 reaching 0.085 BTC, seeing attainable alerts of maturity and an upcoming alt-season.

In 2021, ETH has proven higher energy than bitcoin. The cryptocurrency could possibly be signaling its maturity because it sees increased lows –in comparison with BTC– than it did in 2017 and 2018.

Nonetheless, Arcane Analysis famous that again in 2021 and 2018 the energy of ETH and altcoins’ performances in durations when BTC noticed lows additionally signaled decrease costs to return, so the same situation might occur throughout 2021’s fourth quarter.

The present ETHBTC pair peak is just like the one seen in Might, which was adopted by Might nineteenth’s crash throughout huge liquidations and new consumers panic –which some customers known as the second worse day ever for Ethereum, though related phenomenons had occurred in earlier years–. Then, the ETHBTC pair noticed one other spike at the start of September as Bitcoin noticed lows on the seventh.

Moreover, we could possibly be dealing with froth out there as altcoin’s energy has signaled earlier than.

Ether was additionally down on Saturday however surged to the talked about 0.086 Bitcoin excessive throughout Sunday. The worth dropped 5.5% on Monday to $3,965, and total, it traded down by 0.51% prior to now week in comparison with BTC’s 10.06% decline.

At the moment, the Ethereum worth is up once more round $4,352.74, up 2.93% within the day-to-day, surging greater than 24% from the low. Despite the fact that it’s 9% away from its all-time excessive, additionally it is 496% up compared to 2021’s early days. ETH additionally reveals a 24-hour buying and selling quantity of $23,566,690,676 and a market cap of $512,648,545,331.

Associated Studying | Ethereum “Accumulation” Nears Liftoff Phase: What This Could Mean For Bitcoin

Bitcoin Dominance Sees New Lows

At the moment, Bitcoin’s dominance is 40.65%, seeing no improve over the day. It had fallen in the direction of 40% on December fifth because it noticed its latest bloodshed. BTC additionally noticed its dominance drop in September and Might, nevertheless it has not seen different lows alike since Might 2018.

Because the crypto market began to fall on Friday –with 372,000 liquidated crypto accounts by Monday totaling $2.3 billion-, Saturday’s early morning noticed bitcoin drop $10,000 in worth, going from round $57,000 to $47,000.

Over the weekend, the drop reached a $14,000 loss and specialists noticed no clear motive for it, however since then merchants have advised a reference to the concern across the Omicron variant plus market strikes exaggerated by decrease buying and selling liquidity.

In comparison with its November all-time-high, BTC is down by $21,000, but in addition up over 75% in all 2021. The worth has climbed again as much as over $50,000, greater than 4% increased, and the overall crypto market cap surged 5% to $2.5 trillion.

Some count on a tough finish of the yr for Bitcoin because it has not proven its common energy, however on the similar CNBC quoted Will Clemente, insights analyst at Blockware Options, who thinks these dynamics are “wholesome and present provide continues to maneuver to long run traders” and BTC might truly see a brand new bull run initially of subsequent yr:

There’s an inexpensive case that we might see the alternative impact heading into Q1, as funds are keen to tackle extra danger for the brand new yr with contemporary revenue and loss, … This impact assisted in bitcoin’s huge transfer in January 2021.

Associated Studying | Ethereum Lacks Momentum Above $4,200, But Dips Likely To Be Limited