Ethereum has confronted an 8% correction since Monday, cooling off from its latest rally and slipping under the important thing $3,850 degree. This transfer means that the bullish momentum that carried ETH larger in July is starting to fade, with value now coming into a important consolidation section. Bulls are nonetheless holding key assist ranges, however the specter of a deeper correction is rising as promoting stress intensifies.

Associated Studying

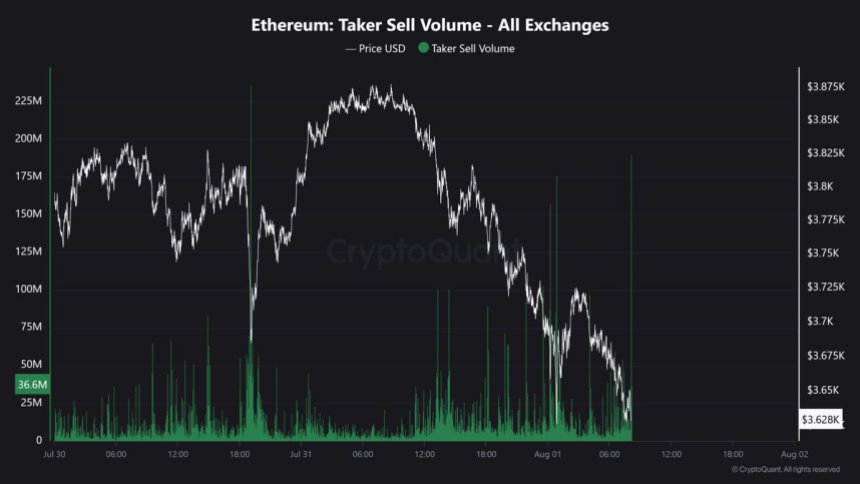

On-chain information exhibits indicators of profit-taking from massive buyers, including to short-term volatility and uncertainty. Heavy promoting quantity over the previous two days has sparked hypothesis throughout the market, particularly as Ethereum stays under latest native highs. Analysts are cut up of their outlook—some argue that this can be a wholesome pullback inside a broader uptrend, whereas others warn of a possible slide towards the $3,400–$3,500 vary if sentiment worsens.

Regardless of the latest drop, Ethereum’s long-term construction stays intact, with fundamentals like rising DeFi utilization and Layer 2 adoption persevering with to assist the narrative. Nonetheless, the subsequent few days shall be important. If bulls can defend present ranges and regain momentum, ETH may try one other transfer towards $4,000. If not, the market might even see prolonged draw back stress earlier than a clearer restoration emerges.

Ethereum Sees Large Promote-Off In Two Minutes

According to high analyst Maartunn, Ethereum skilled a dramatic spike in taker promote quantity, reaching $335 million in simply two minutes. This large wave of promote orders alerts a key second out there, one that would mark both the height of profit-taking or the tip of panic-driven capitulation. Whereas some interpret the occasion as massive buyers securing good points after the latest rally, others consider this might replicate emotional promoting from retail merchants spooked by short-term volatility.

Regardless of the heavy promoting stress, Ethereum’s long-term bullish narrative stays intact. Giant gamers proceed to build up, making the most of dips and shopping for from weaker palms. This exercise suggests strategic positioning forward of anticipated progress in adoption, particularly as Ethereum cements its dominance in decentralized finance (DeFi) and real-world asset (RWA) tokenization.

ETH spent months in a downtrend earlier this 12 months, weighed down by macro uncertainty and regulatory fears. But, whereas the broader market confirmed weak point, refined buyers appeared to build up. Now, with sentiment shifting and the worth construction strengthening, Ethereum appears well-positioned for the months forward.

The $335 million sell-off highlights market vulnerability—but additionally exhibits that whales are stepping in. If value holds present ranges and sentiment stabilizes, Ethereum may see a renewed push towards the $4,000 mark as confidence returns.

Associated Studying

ETH Checks Help After Breakdown

Ethereum (ETH) has formally damaged under its important resistance zone close to $3,860, signaling elevated promoting stress and short-term weak point. After sustaining a gentle vary for almost two weeks, the worth has dropped to $3,619 on the 4-hour chart, discovering momentary assist simply above the 100-period SMA (inexperienced line), at the moment close to $3,670.

This breakdown comes amid an uptick in bearish quantity, suggesting momentum could favor sellers within the quick time period. The 50-period SMA (blue line), positioned round $3,762, has now was near-term resistance, capping any quick restoration makes an attempt. If bulls fail to reclaim the $3,760–$3,800 zone, Ethereum may danger deeper draw back towards the subsequent key assist round $3,175 (200 SMA, crimson line) and even $2,852, which served as a base in early July.

Associated Studying

Regardless of this weak point, the broader pattern stays structurally bullish so long as value stays above the 200 SMA. Nonetheless, bulls should reclaim the $3,860 degree and construct momentum above it to regain power. Till then, volatility is anticipated, particularly as profit-taking and macro uncertainty weigh on sentiment.

Featured picture from Dall-E, chart from TradingView