Knowledge reveals the Ethereum Open Curiosity has been buying and selling at comparatively low ranges lately. Right here’s what this might imply for the asset’s worth.

Ethereum Open Curiosity Has Been Transferring Sideways Since Its Plunge

As defined by an analyst in a CryptoQuant Quicktake post, the ETH Open Curiosity has adopted the same trajectory as the value of the cryptocurrency lately. The “Open Interest” right here refers back to the complete variety of derivative-related contracts open for Ethereum on all exchanges.

When the worth of this metric goes up, it signifies that buyers are presently opening up new positions on these platforms. Usually, this type of development results in a rise out there’s complete leverage, so the asset worth might grow to be extra unstable.

However, a decline within the indicator implies the buyers are both closing up their positions of their very own volition or getting forcibly liquidated by their platform. Such a drawdown might accompany violent worth motion, however as soon as the drop is over, the market might grow to be extra steady because of the decreased leverage.

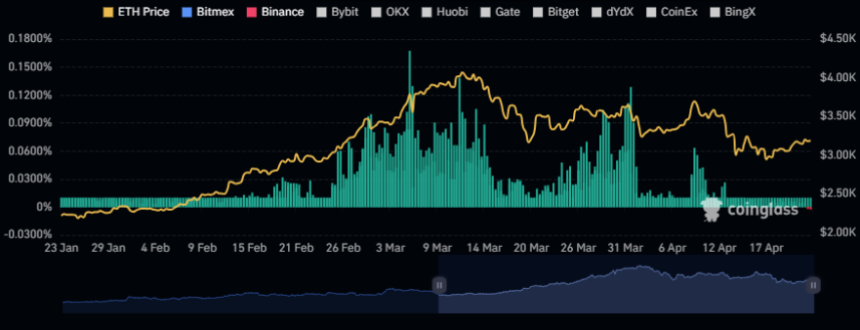

Now, here’s a chart that reveals the development within the Ethereum Open Curiosity over the previous couple of months:

The worth of the metric seems to have witnessed a pointy plunge lately | Supply: CryptoQuant

As displayed within the above graph, the Ethereum Open Curiosity registered a pointy drop earlier alongside the asset’s worth. The plunge within the metric was naturally brought on by the lengthy contract holders being washed out within the worth drawdown.

As the value has largely consolidated sideways for the reason that decline, so has the worth of the Open Curiosity. The quant notes,

This alignment suggests a cooling down of exercise inside the futures market. Consequently, the market seems poised for the resurgence of both lengthy or brief positions, doubtlessly initiating a contemporary and decisive market motion in both path.

One other indicator associated to the by-product market that may very well be related for Ethereum’s future worth motion is the funding rate. This metric tracks the periodic charges that by-product contract holders are presently paying one another.

Optimistic funding charges suggest that the lengthy holders are paying the shorts a premium to carry onto their positions; therefore, that bullish sentiment is dominant. Equally, destructive values counsel {that a} bearish sentiment is shared by the vast majority of the by-product merchants.

The chart under reveals that the Ethereum funding charge has lately turned purple.

The information for the ETH funding charges over the previous couple of months | Supply: CoinGlass

Traditionally, the market has been extra prone to transfer towards the opinion of the bulk, so the truth that the funding charge has flipped destructive could also be a great signal for the possibilities of any potential uptrends to begin.

ETH Worth

Ethereum has progressively elevated over the previous couple of days, as its worth has now reached $3,200.

Appears to be like like the worth of the coin has gone up a bit over the previous few days | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, CoinGlass.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site completely at your personal threat.