On-chain knowledge reveals derivatives exchanges have simply obtained massive Ethereum deposits, one thing that might result in volatility in ETH’s worth.

Ethereum Change Netflow Has Seen A Sharp Optimistic Spike Just lately

As defined by an analyst in a CryptoQuant Quicktake post, the Change Netflow for ETH has registered a big spike not too long ago. The “Exchange Netflow” right here refers to an on-chain indicator that retains observe of the web quantity of ETH shifting into or out of the wallets related to centralized exchanges.

When the worth of this metric is constructive, it means the buyers are depositing a internet variety of tokens to those platforms. How these transactions have an effect on ETH is dependent upon the alternate to which the holders are shifting cash.

Within the case of spot exchanges, buyers often make deposits each time they need to sell, so constructive alternate netflows to platforms of this kind can result in a bearish consequence.

For derivatives exchanges, that are related platforms within the present dialogue, the connection with the worth doesn’t are typically so easy. Holders switch their cash to those exchanges to open up contemporary positions on the derivatives market.

As new positions usually accompany some leverage, the general danger within the sector might be assumed to go up when buyers deposit to derivatives exchanges. This will result in extra volatility for the ETH worth.

A destructive Change Netflow is often bullish irrespective of the platforms concerned, because it implies the buyers are shifting their cash to self-custodial wallets, probably as a result of they plan to carry into the long run.

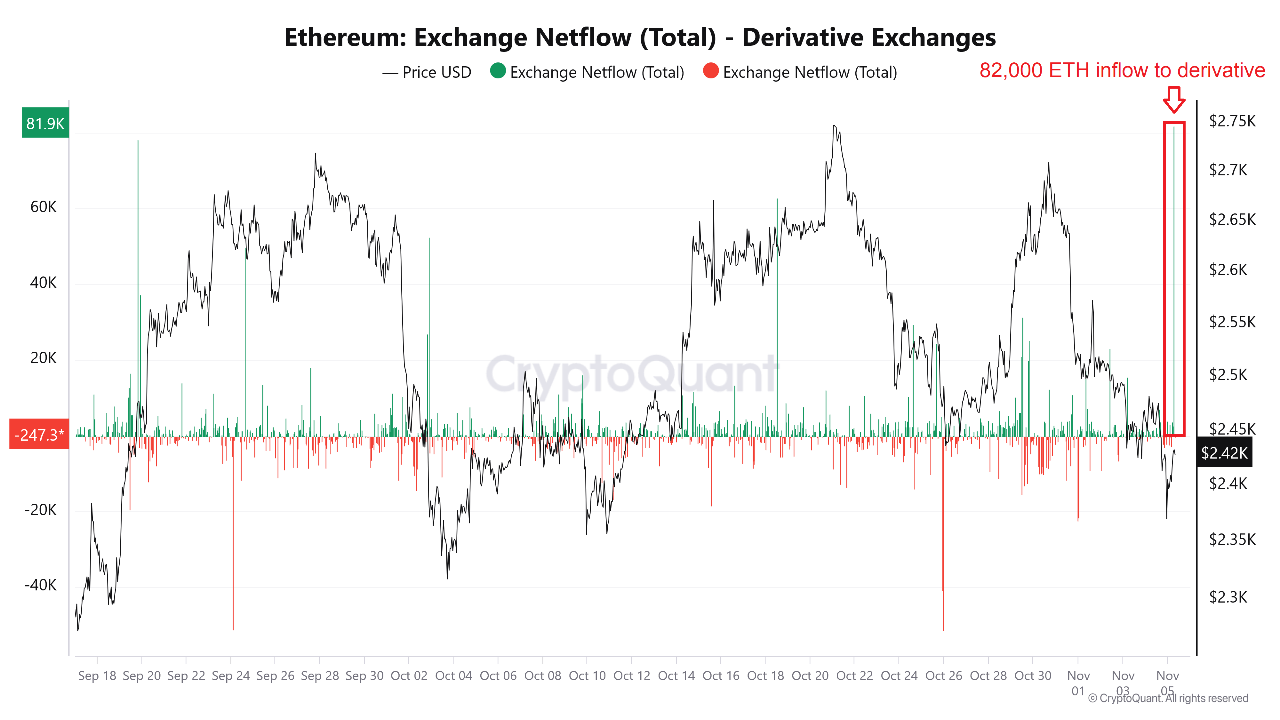

Now, here’s a chart that reveals the pattern within the Ethereum Change Netflow for the derivatives platforms over the previous couple of weeks:

As displayed within the above graph, the Ethereum Change Netflow has seen a big spike into constructive territory not too long ago, which suggests the buyers have simply made massive internet deposits to the derivatives platforms.

The holders have transferred about 82,000 ETH to those exchanges with this internet influx spree. As talked about earlier, this pattern can result in larger volatility for ETH.

It’s onerous to say which route any rising volatility may take the cryptocurrency in, as different constructive spikes within the final couple of months have confirmed to be a blended bag.

Provided that the most recent spike has coincided with a plunge in Ethereum’s worth, although, quite a lot of these could also be brief positions predicting an additional decline. In that case, a swing to the upside might result in liquidating these positions, which might add gas to the rally.

ETH Value

On the time of writing, Ethereum is buying and selling at round $2,400, down nearly 7% over the past week.