Ethereum is buying and selling under the $1,900 stage after weeks of persistent promoting strain, and indicators counsel that the draw back momentum may proceed. Bulls misplaced management again in late February when ETH failed to carry the $2,500 mark — a key stage that many considered as essential for sustaining a bullish outlook. Since then, Ethereum has continued to underperform, disappointing buyers who had anticipated a robust 2025 rally fueled by rising institutional curiosity and market optimism.

As an alternative, macroeconomic uncertainty, world tensions, and weakening market sentiment have weighed closely on high-risk property like Ethereum. Value motion has remained underwhelming, with failed makes an attempt to reclaim key resistance ranges including to bearish sentiment.

Including to those considerations, crypto analyst Ali Martinez shared insights displaying a big decline in on-chain exercise. Since late February, the variety of giant Ethereum transactions — usually involving whales and institutional gamers — has dropped considerably. This decline means that major market participants could also be stepping again, decreasing their publicity as uncertainty lingers.

Ethereum Underneath Stress As Macroeconomic Fears Develop

Ethereum continues to battle underneath mounting strain as macroeconomic uncertainty and world instability ripple by monetary markets. Among the many most affected are high-risk, risky property like Ethereum, which have seen important outflows in current weeks. The broader market sentiment stays fragile, largely pushed by US President Donald Trump’s unpredictable coverage choices and tariff threats. His administration’s financial stance has injected recent uncertainty into world markets, pushing buyers towards safer property and away from speculative performs like ETH.

Bulls are discovering it more and more troublesome to defend key help ranges. After failing to carry above $2,500 in late February, Ethereum has slipped steadily decrease, now buying and selling under $1,900 — a stage that when served as a essential psychological threshold. With little signal of renewed shopping for strain, the chance of a continued selloff looms giant.

Ali Martinez shared alarming on-chain data displaying that since February 25, the variety of giant Ethereum transactions has dropped by 63.8%. This decline in whale exercise indicators that main holders could also be exiting or sitting on the sidelines, decreasing total market confidence and liquidity.

So long as macroeconomic pressures persist and whales stay inactive, Ethereum is more likely to stay weak. Bulls should step in to stabilize value motion, or danger watching ETH fall additional into decrease help zones. For now, the outlook stays cautious, with continued weak point possible except sentiment shifts or broader financial readability emerges.

ETH Trades Beneath $1,900 As Bulls Defend Key Assist

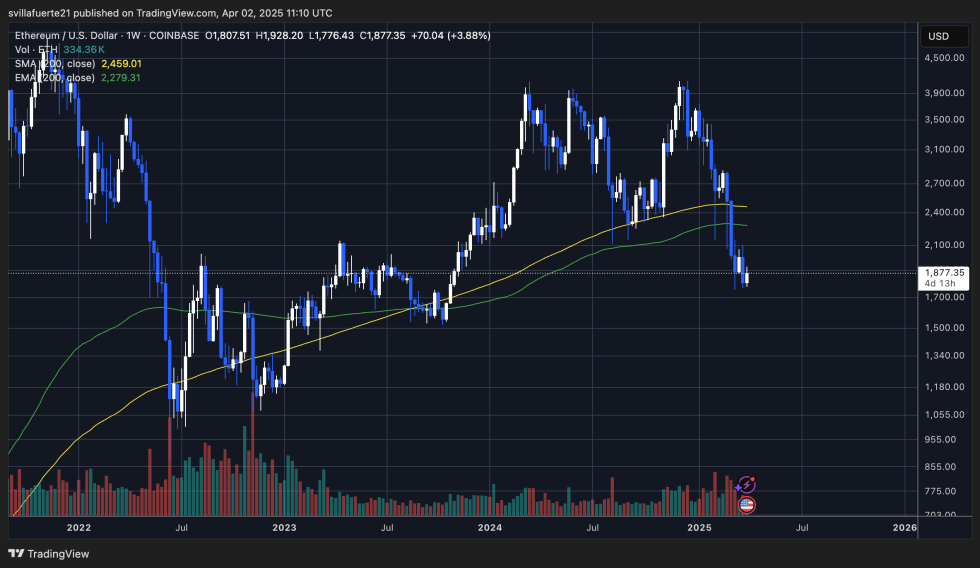

Ethereum is at the moment buying and selling round $1,880, trying to carry above a essential help zone close to $1,750 — broadly seen because the final line of protection for bulls. After weeks of sustained promoting strain, ETH stays in a weak place, struggling to get better misplaced floor. The worth is now nicely under the weekly 200-day transferring common (MA) and exponential transferring common (EMA), each sitting close to the $2,500 stage, which highlights the broader weak point in Ethereum’s market construction.

So long as ETH stays under these long-term development indicators, the general outlook stays bearish. Bulls should step in with conviction to stop a deeper breakdown and shift momentum again of their favor. Probably the most rapid precedence is sustaining help above $1,800, which serves as a psychological and technical stage of energy.

To substantiate a restoration, Ethereum should additionally push again above the $2,000 mark within the close to time period. A break above this stage would assist restore investor confidence and will open the door for a transfer towards reclaiming the 200-week averages. Till then, Ethereum stays in a precarious place, and failure to defend present ranges may set off a deeper correction within the classes forward.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.