Ethereum is exhibiting renewed power after a pointy however short-lived pullback. Following its current excessive of $3,860, ETH dipped to the $3,500 zone — a key stage that shortly attracted shopping for curiosity. Now, worth motion is pointing upward once more, with Ethereum pushing to reclaim the $3,700 vary, signaling bullish momentum could also be again in management.

Associated Studying

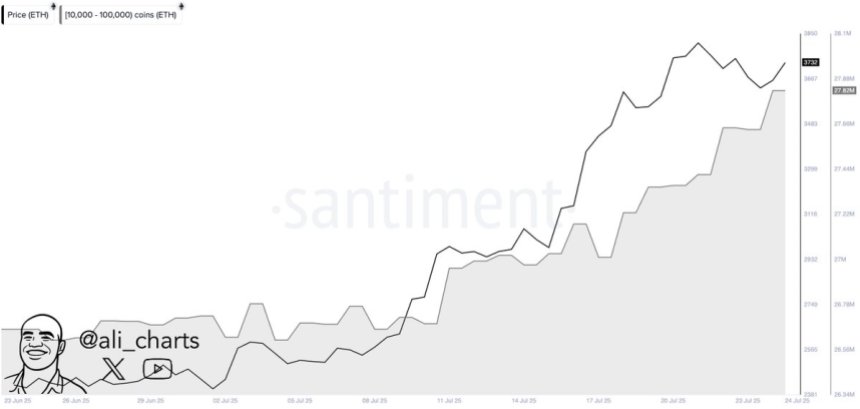

Regardless of the current volatility, on-chain information assist the case for continued upside. In keeping with Santiment, whales have been aggressively accumulating ETH all through the pullback. This surge in accumulation means that institutional gamers are positioning themselves forward of the following leg of the rally, anticipating power within the coming months. These strategic inflows have traditionally preceded sustained upward developments.

The resilience across the $3,500 stage, mixed with the swift restoration try, underscores Ethereum’s sturdy bullish construction. With a good macro surroundings, regulatory readability, and mounting institutional curiosity, Ethereum seems poised for continued enlargement because the second half of the yr unfolds. All eyes at the moment are on whether or not this bounce holds and results in a renewed breakout above resistance.

Whales Add Ethereum as US Authorized Readability Boosts Bullish Outlook

Ethereum’s bullish momentum is being strengthened by aggressive accumulation from main buyers. According to analyst Ali Martinez, whales have bought greater than 1.13 million ETH—value roughly $4.18 billion—over the previous two weeks. This surge in shopping for exercise marks probably the most vital accumulation phases in current months and indicators rising confidence amongst institutional gamers.

The buildup comes at a important time for Ethereum, which has been consolidating close to the $3,700 stage after a short pullback from its $3,860 excessive. This whale exercise not solely provides gasoline to the continuing worth restoration but additionally strengthens Ethereum’s bullish construction heading into the second half of the yr.

Past market habits, macro and regulatory shifts are additionally favoring Ethereum and the broader altcoin market. The current passage of the GENIUS Act and Readability Act by the US Congress marks a pivotal second for crypto laws. These new legal guidelines provide long-sought authorized readability for decentralized finance (DeFi) platforms and digital belongings, encouraging US-based innovation and capital flows into the house.

This evolving regulatory framework removes one of many largest obstacles for institutional adoption of Ethereum and DeFi. With clearer guidelines and a rising urge for food for ETH amongst whales, the stage is ready for a doubtlessly explosive rally if present momentum holds.

Associated Studying

ETH Holds Robust After Pullback

Ethereum (ETH) is exhibiting renewed power after a short correction from its native prime at $3,860. As seen within the 4-hour chart, ETH dipped to $3,500 however shortly bounced, reclaiming the $3,700 zone and shutting in on key resistance at $3,776 and $3,860. This rebound signifies sturdy purchaser curiosity and resilience within the uptrend.

The worth is now buying and selling above all main transferring averages (50, 100, and 200), that are stacked bullishly. The 50-SMA at $3,648 has offered dynamic assist in current periods, whereas the 100-SMA and 200-SMA at $3,304 and $2,883, respectively, stay far under present worth motion—underscoring the power of this upward transfer.

Associated Studying

Quantity is choosing up barely as ETH consolidates in a good vary close to resistance. A breakout above $3,860 would probably open the door to a transfer towards new native highs, whereas failure to breach this stage could end in one other check of the $3,648 assist space.

Featured picture from Dall-E, chart from TradingView