Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is buying and selling beneath the $1,900 stage, dealing with ongoing promoting stress because the broader crypto market continues to weaken. After a pointy rejection from the $2,500 mark in late February, bulls have didn’t regain momentum, and ETH has steadily declined — disappointing many buyers who entered the yr with excessive expectations for a bullish pattern. The lack of key assist ranges has additional broken sentiment, and Ethereum’s worth motion stays bearish within the quick time period.

Associated Studying

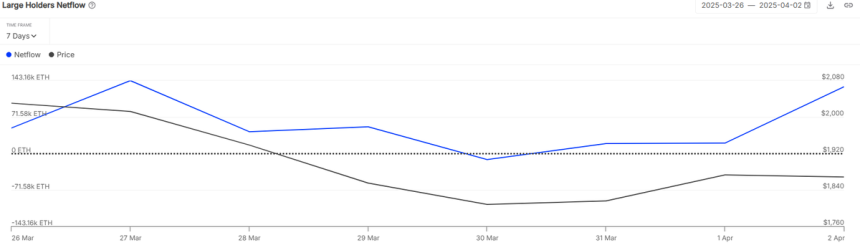

Regardless of the unfavourable outlook, there are indicators of accumulation beneath the floor. In line with knowledge from IntoTheBlock, Ethereum whales are shopping for the dip. The biggest ETH wallets added over 130,000 ETH to their holdings simply yesterday — a transfer that implies confidence from long-term gamers whilst retail sentiment wavers.

This accumulation might sign a shift in momentum if sustained, particularly if whales proceed to soak up provide whereas costs stay low. Nevertheless, for any actual restoration to take maintain, Ethereum should reclaim important resistance ranges and present stronger shopping for exercise throughout the board. For now, the market remains under pressure, however whale conduct might provide a touch of what’s to return as soon as the present downtrend begins to ease.

Ethereum Huge Gamers Purchase Amid Market Uncertainty

Ethereum is at the moment down 55% from its December excessive, reflecting the broader ache throughout the crypto market. The selloff has been fueled largely by rising macroeconomic uncertainty, with U.S. President Donald Trump’s aggressive commerce insurance policies and unpredictable tariff bulletins including to world monetary instability. As conventional markets wrestle to search out footing, high-risk property like Ethereum have been among the many hardest hit.

Bulls are having a troublesome time defending key assist ranges, and worth motion suggests the downtrend might proceed within the quick time period. With Ethereum buying and selling nicely beneath the $1,900 mark and no clear indicators of bullish momentum, the outlook stays fragile.

Nonetheless, not all indicators are bearish. In line with data from IntoTheBlock, Ethereum whales seem like accumulating. On a single day, the biggest ETH wallets added over 130,000 ETH to their holdings — a transfer that implies quiet confidence amongst main gamers. This stage of accumulation, particularly in periods of worry and weak point, typically hints at a long-term bullish outlook.

Whereas worth continues to pattern decrease, the conduct of those massive holders provides to the speculative setting, signaling that some buyers could also be positioning early for a possible surge. If macro circumstances start to stabilize or sentiment shifts, Ethereum may benefit from this quiet accumulation section — however for now, the market stays in correction mode.

Associated Studying

Technical Evaluation: ETH Bulls Defend Essential Assist

Ethereum is buying and selling at $1,830 following a wave of heavy promoting stress that pushed the value sharply beneath the important thing $2,000 stage. Panic promoting has gripped the market, with bulls struggling to regain management amid a broader downturn throughout the crypto area. The breakdown beneath $2,000 marked a big shift in sentiment, turning what was as soon as considered as a consolidation section right into a deeper correction.

At this stage, bulls should maintain the $1,800 assist stage — a important threshold that, if misplaced, might result in an additional decline towards $1,750 or decrease. Holding above $1,800 would enable for stabilization and the possibility to construct a basis for restoration. Nevertheless, to sign a significant reversal, Ethereum must reclaim the $2,100 stage, which now acts as short-term resistance.

Associated Studying

Solely a decisive push above that mark would verify renewed power and probably reestablish bullish momentum. Till then, ETH stays susceptible to additional draw back. With broader market circumstances nonetheless unsure, Ethereum’s subsequent transfer round these assist ranges can be essential in figuring out whether or not it could get well within the close to time period or slide deeper into correction territory.

Featured picture from Dall-E, chart from TradingView