Ethereum has entered a unstable section after breaking its 2021 all-time highs final week, sparking each pleasure and warning throughout the market. After the surge, ETH retraced and examined crucial demand ranges, the place consumers stepped in to defend assist. Bulls are exhibiting resilience, with analysts pointing to the potential for Ethereum rallying previous $5,000 within the close to time period.

Nonetheless, the dangers of a deeper correction weigh closely, fueling uncertainty amongst merchants and traders. Concern is starting to creep into sentiment, as some surprise if Ethereum’s rally is sustainable or if one other pullback is on the horizon.

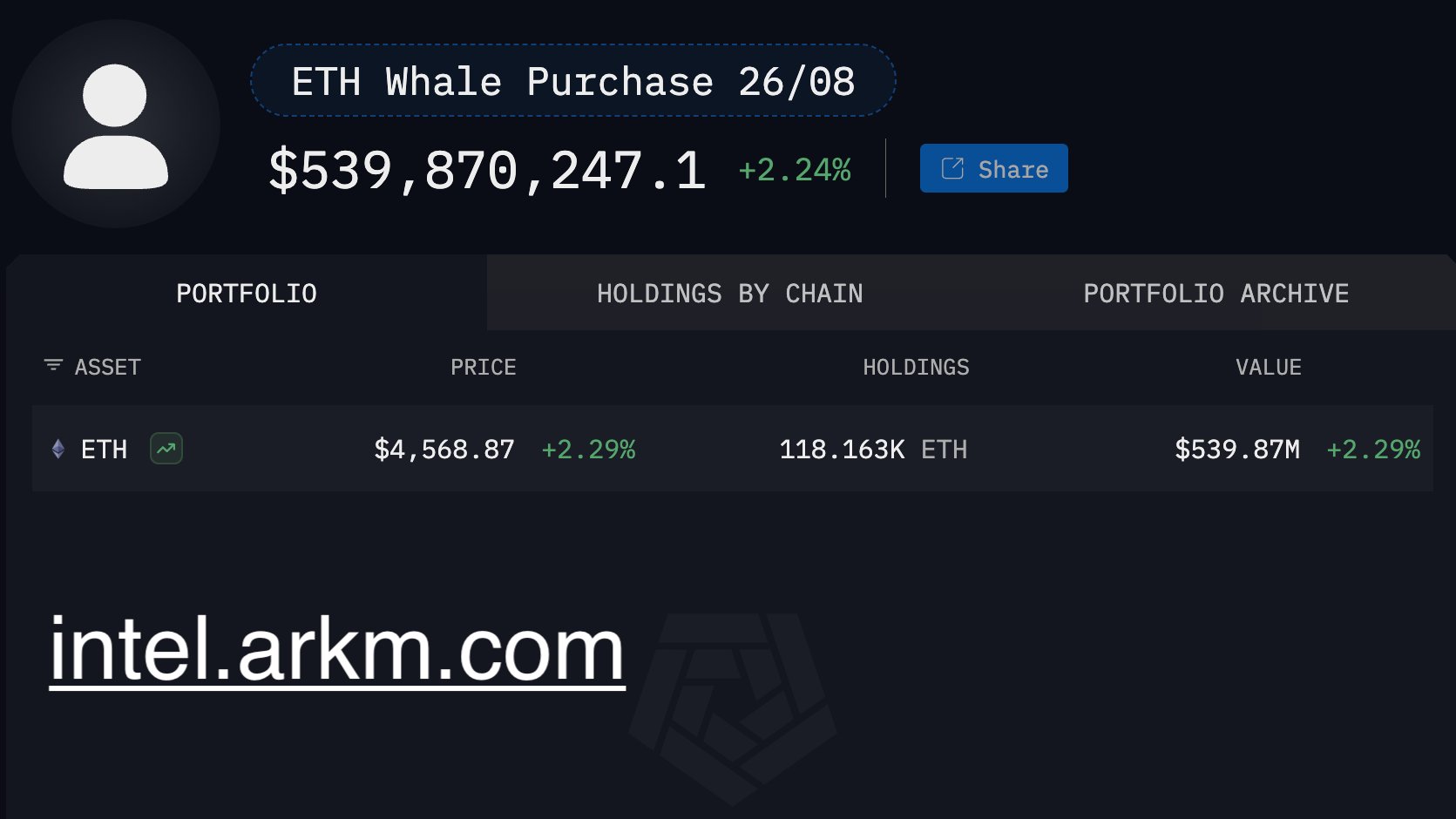

But on this setting, one simple development stands out: whales are accumulating. Arkham Intelligence revealed that 9 whale addresses collectively bought round $450 million value of Ethereum yesterday alone, signaling confidence from the biggest market contributors. This wave of accumulation highlights how deep-pocketed traders are making the most of retracements, probably getting ready for the following leg upward.

Ethereum Whales Sign Confidence

In line with Arkham Intelligence, Ethereum whales are making decisive strikes that might form the following section of the market. Data reveals that 9 large addresses collectively bought $456.8 million value of ETH in a single day. Out of those, 5 wallets obtained inflows instantly from Bitgo, a number one institutional custodian, whereas the opposite 4 acquired their positions via Galaxy Digital’s over-the-counter (OTC) desk. These transactions replicate not solely particular person whale confidence but additionally the rising position of institutional-grade platforms in facilitating large-scale Ethereum accumulation.

This surge in whale exercise highlights a crucial market dynamic: deep-pocketed traders are positioning themselves for what could possibly be the following leg greater in Ethereum’s value cycle. Traditionally, whale accumulation during times of volatility has preceded vital upward momentum, offering a robust basis for bullish narratives. With ETH already testing essential demand zones after its breakout above 2021 all-time highs, these inflows could assist stabilize value motion and construct momentum towards uncharted territory.

Past whales, public firms are additionally coming into the image. Companies like Bitmine and Sharplink Gaming have just lately disclosed Ethereum positions, additional validating ETH’s position as an institutional-grade asset. Their involvement echoes what Bitcoin skilled in its early company adoption section—when public firms added BTC to their steadiness sheets, fueling robust market confidence.

Taken collectively, the mix of whale accumulation, institutional OTC purchases, and public firm adoption paints a transparent image: confidence in Ethereum’s long-term trajectory is strengthening. Whereas short-term dangers stay, these traits reinforce a bullish case for ETH to maneuver towards value discovery and probably surpass $5,000. The market is watching intently, however whales and establishments seem like main the cost.

Ethereum Holds Floor as Bulls Eye $5,000

Ethereum is buying and selling round $4,592 after rebounding from a pointy retrace off native highs close to $4,850. The 4-hour chart reveals ETH regaining power above the 50-day and 100-day shifting averages, signaling that consumers are stepping again in to defend key ranges. This transfer restores confidence within the short-term uptrend, whilst volatility retains merchants on edge.

The broader image stays supportive. With the 200-day shifting common sitting at $4,119, Ethereum has a cushty cushion that highlights its resilience regardless of latest swings. Holding above the quicker averages not solely stabilizes momentum but additionally units the stage for an additional try at resistance. The crucial barrier forward lies at $4,800, the place sellers beforehand capped the rally. A decisive break might clear the trail towards $5,000, a milestone that analysts imagine would gas recent enthusiasm and probably kickstart a brand new leg of value discovery.

Nonetheless, dangers of one other pullback linger. A drop beneath $4,400 might ship ETH again towards the $4,200 demand zone, the place prior shopping for strain emerged. For now, although, sentiment leans cautiously bullish. Whales proceed to build up, technicals stay constructive, and Ethereum seems poised to check greater ranges if momentum carries via.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.