Key Notes

- Europe’s high fund supervisor cites inflation safety and diversification as core causes for embracing cryptocurrency merchandise.

- The launch follows MiCA regulatory readability and arrives two years after US spot Bitcoin ETF approvals remodeled institutional entry.

- Amundi’s €2T asset base positions it to problem BlackRock’s dominance within the world crypto funding product market.

Amundi, with €2.3 trillion in belongings below administration, is making ready to enter the crypto ETF market, based on French analyst and TheBigWhale co-founder Gregory Raymond. In an unique report on Monday, Raymond confirmed that Amundi’s management has greenlit preparations to roll out Bitcoin

BTC

$115 874

24h volatility:

1.3%

Market cap:

$2.31 T

Vol. 24h:

$81.97 B

Alternate-Traded Notes (ETNs).

🔴 Unique @TheBigWhale_: Amundi is (lastly) coming into Bitcoin

After watching the BlackRock hurricane from afar for a very long time, the European asset administration large is taking the plunge.

In accordance with our sources, Amundi is making ready to launch its first Bitcoin ETNs in early… pic.twitter.com/6mvjNJjCCd

— Grégory Raymond 🐳 (@gregory_raymond) October 13, 2025

The Paris-based fund supervisor referenced inflation resilience and portfolio diversification as the first drivers behind its transfer into crypto-linked funding merchandise. Amundi’s deliberate Bitcoin ETNs, Europe’s equal to the US ETFs, are anticipated to launch in early 2026, signaling a strategic push to seize rising institutional demand for compliant publicity to crypto.

The timing aligns with crypto rules’ openness in Europe, with the Polish parliament adopting the Markets in Crypto-Assets Regulation (MiCA) framework in late September, providing fund managers clearer authorized frameworks to introduce blockchain-based monetary merchandise.

Amundi Set to Rival BlackRock as US Rules Set International Requirements

In accordance with Gregory Raymond’s publish, Amundi’s imminent Bitcoin ETNs will debut two years behind US spot Ethereum

ETH

$4 260

24h volatility:

2.9%

Market cap:

$514.49 B

Vol. 24h:

$50.61 B

and Bitcoin ETFs which started buying and selling in January 2024. The analyst predicts that Amundi’s transfer might propel the worldwide crypto secondary market to new heights by enhancing Bitcoin’s legitimacy amongst institutional traders in Europe.

With over €2 trillion in belongings, Amundi might rival Wall Road’s dominance within the crypto ETF race. BlackRock’s iShares Bitcoin Trust (IBIT) at the moment holds greater than 4% of Bitcoin’s circulating provide, buying over 800,000 BTC, at the moment valued at practically $100 billion inside simply 20 months of buying and selling.

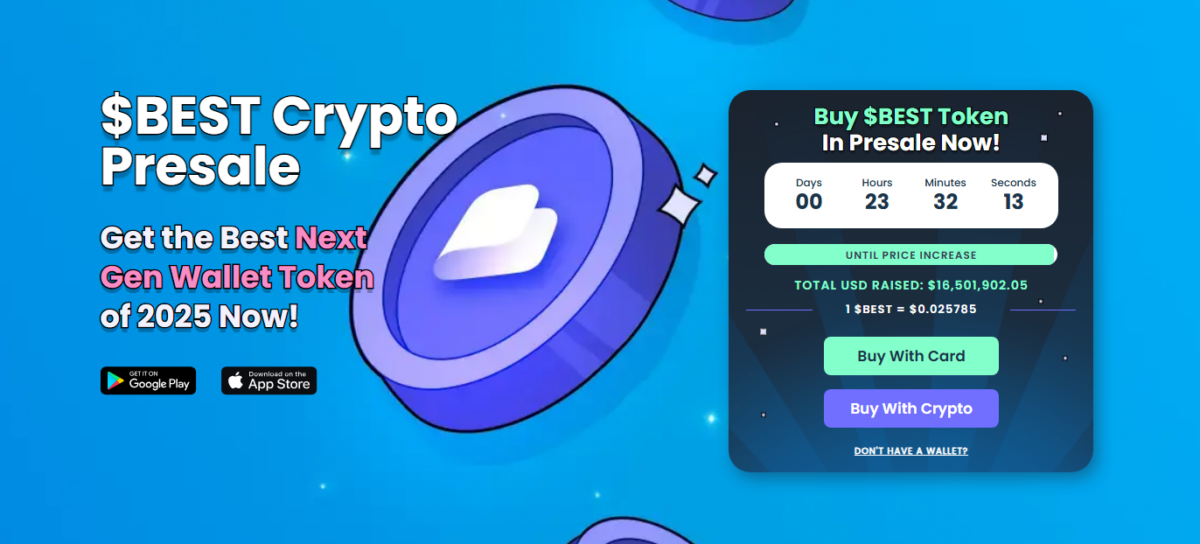

Greatest Pockets Presale Hits $16.5M as Amundi Sparks Renewed Institutional Crypto Curiosity

As Amundi, Europe’s largest asset supervisor, prepares to launch Bitcoin ETNs in 2026, the constructive tailwinds hit early-stage tasks like Greatest Pockets (BEST). Greatest Pockets affords multi-chain asset administration and excessive staking rewards.

Greatest Pockets Presale

At press time, the Greatest Pockets presale has surpassed $16.5 million, with tokens buying and selling at $0.026. With lower than 24 hours earlier than the following worth tier unlocks, potential traders can nonetheless be part of through the official Best Wallet website to safe early-access staking rewards forward of the mission’s public rollout.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.