On-chain information reveals Bitcoin trade reserves have now reached new 4-year lows, an indication that might show to be bullish for the crypto’s worth.

Bitcoin Change Reserve Has Sunk Down Additional Lately

As identified by an analyst in a CryptoQuant post, the BTC trade reserve has been happening, suggesting shopping for has been going available in the market.

The “all exchanges reserve” is an indicator that measures the whole quantity of Bitcoin at present saved in wallets of all centralized exchanges.

When the worth of this metric goes up, it means buyers are depositing a internet quantity of cash to exchanges proper now.

Such a development, when extended, could be bearish for the worth of the crypto as holders often switch their crypto to exchanges for promoting functions.

Associated Studying | When Greed? Bitcoin Market Crushed Under One Full Month Of Fear

Then again, a downtrend within the reserve suggests buyers are withdrawing their BTC from exchanges in the meanwhile. This type of development could be bullish for the worth of the crypto.

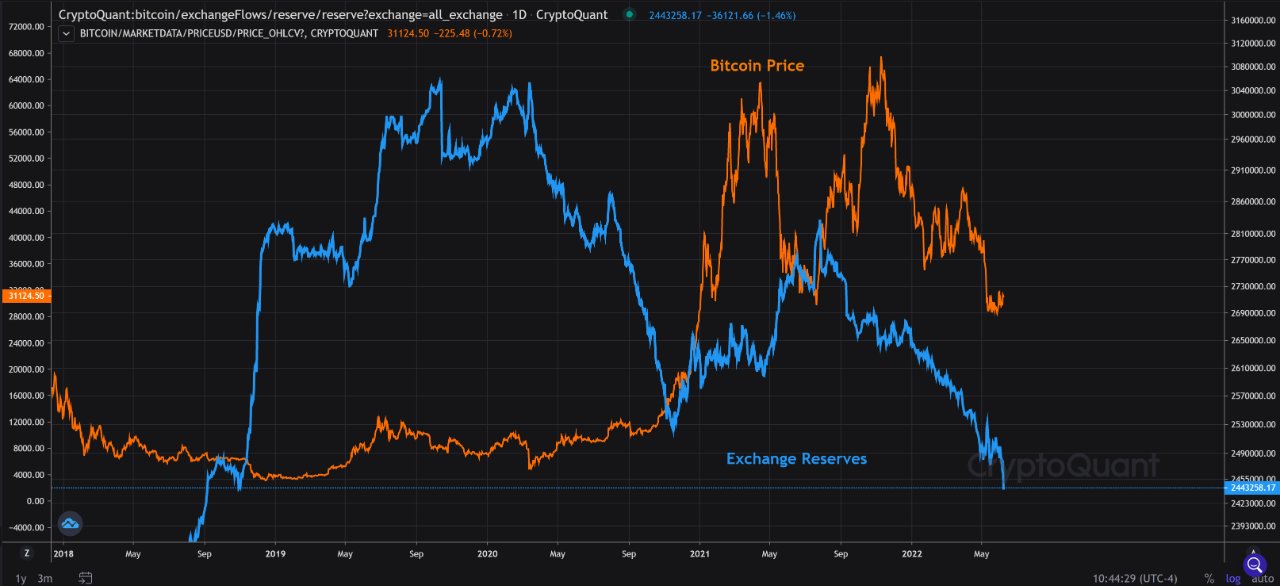

Now, here’s a chart that reveals the development within the Bitcoin trade reserve over the previous few years:

The worth of the metric appears to have skilled downwards motion during the last 12 months | Supply: CryptoQuant

As you’ll be able to see within the above graph, the Bitcoin trade reserve has noticed some sharp motion down just lately, taking its worth to new 4-year lows.

It is a continuation of the general downtrend within the indicator that has been happening for nearly a full 12 months now.

Associated Studying | U.S. Macro Pressure Responsible For Entire Bitcoin Downtrend

This will likely suggest that the market has been in a state of fixed accumulation, which might imply a provide shock may very well be deepening within the BTC market.

As a result of supply-demand dynamics, such a shock could be constructive for the worth of the cryptocurrency in the long run.

Nonetheless, some information from December 2021 suggests that the expansion of latest funding devices like ETFs are doubtless one of many causes behind the trade reserve’s decline.

The cash are merely shifting from one supply of promoting stress into one other. Such a shift would imply {that a} provide shock wouldn’t happen simply by declining trade reserves.

Nonetheless, a number of the decline ought to nonetheless be from shopping for available in the market so a lowering reserve can nonetheless be bullish for the worth of Bitcoin.

BTC Value

On the time of writing, Bitcoin’s price floats round $30.1k, up 1% prior to now week. During the last month, the crypto has misplaced 12% in worth.

Appears to be like like the worth of the crypto has moved sideways over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com