I’m type of getting sick of the phrase “contagion”.

Nonetheless, it seems the C-word is coming for the digital asset house once more. By now we’re aware of the collapse of FTX, one of many world’s largest cryptocurrency exchanges.

Nevertheless it’s removed from over.

LUNA set the precedent

Whereas the crash right here doesn’t evaluate to the notorious dying spiral of UST and LUNA (to refresh my PTSD), that scandal does present how far-reaching the tentacles of such a sudden lack of capital could cause.

UST was value $18.6 billion and LUNA $29.7 billion on the eve of the Terra meltdown in Could. Inside a few days, these figures have been zero. FTX, however, is reportedly a steadiness sheet gap of $8 billion.

So, the numbers will not be as comparable, however the domino impact could possibly be. Quite a few corporations received caught up within the Terra crash by holding UST on their steadiness sheets, in addition to being over-exposed to different crypto property, all of which fell within the aftermath of the scandal.

We noticed Celsius file for chapter, owing $4.7 billion to over 100,000 collectors. Voyager Digital, one other crypto lending agency, additionally had over 100,000 collectors on the hook – though for a decrease sum of $1.3 billion.

Then there was Three Arrows Capital, owing $3.5 billion to 27 totally different corporations. I might go on, however you get the purpose. The crypto business was far to incestuous, with corporations holding items of different corporations, regardless of all being uncovered to the identical systemic threat.

Looking back, all of it reads like a cautionary story for threat administration and diversification. How crypto corporations thought it was sensible to commerce their very own Treasuries, property and no matter different liquidity they’d, on the exact same extremely unstable asset class to which their enterprise was already uncovered, is past me.

However they did, and the domino impact adopted.

Who’s uncovered to FTX?

The query now turns into this: who’s uncovered to FTX?

One hopes that the business realized a lesson from Terra and therefore is extra prudent this time round. Then once more, the flipside is that FTX appeared like they have been as protected as could possibly be: funds have been saved there in stablecoins and fiat – not simply extremely unstable cryptocurrencies.

Very similar to those that fell sufferer to UST thought that it was a steady asset pegged to $1, there are those that received blindsided by FTX, merely leaving their funds within the trade denominated in fiat forex.

We all know now that Sam Bankman-Fried had different concepts, sending these funds to his sister buying and selling agency Alameda Analysis, following a collection of unhealthy investments and loans getting known as in. Satirically, these loans have been seemingly known as within the aftermath of the LUNA crash, when spooked buyers moved to get their funds of crypto by all means doable.

Corporations are already starting to wobble. BlockFi, yet one more crypto lender, paused withdrawals and issued an announcement outlining that the injury was stark.

“We do have vital publicity to FTX and related company entities that encompasses obligations owed to us by Alameda, property held at FTX.com, and undrawn quantities from our credit score line with FTX.US,” BlockFi mentioned.

They’d signed a cope with FTX in July for a $400 million revolving credit score facility. It’s arduous to see them recovering after pausing withdrawals – which we all know by now’s the dying sentence.

The cash really goes past aggressive crypto corporations. Sequoia Capital, SoftBank, and Tiger International, who’re as large and boring as conventional buyers get, have all been burned.

“Primarily based on our present understanding, we’re marking down our funding to $0”, Sequoia mentioned in a notice to LPs. I feel we will all agree that’s a good name.

SoftBank is reported to have misplaced $100 million, whereas Tiger International is outwardly down $38 million.

I used to be let go by Sequoia Capital right now. Buck needed to cease someplace. I used to be the 27 12 months outdated affiliate answerable for copying and pasting income and revenue numbers from a spreadsheet within the FTX information room right into a PowerPoint slide in an funding memo as diligence

— Kyle Russell (@kylebrussell) November 10, 2022

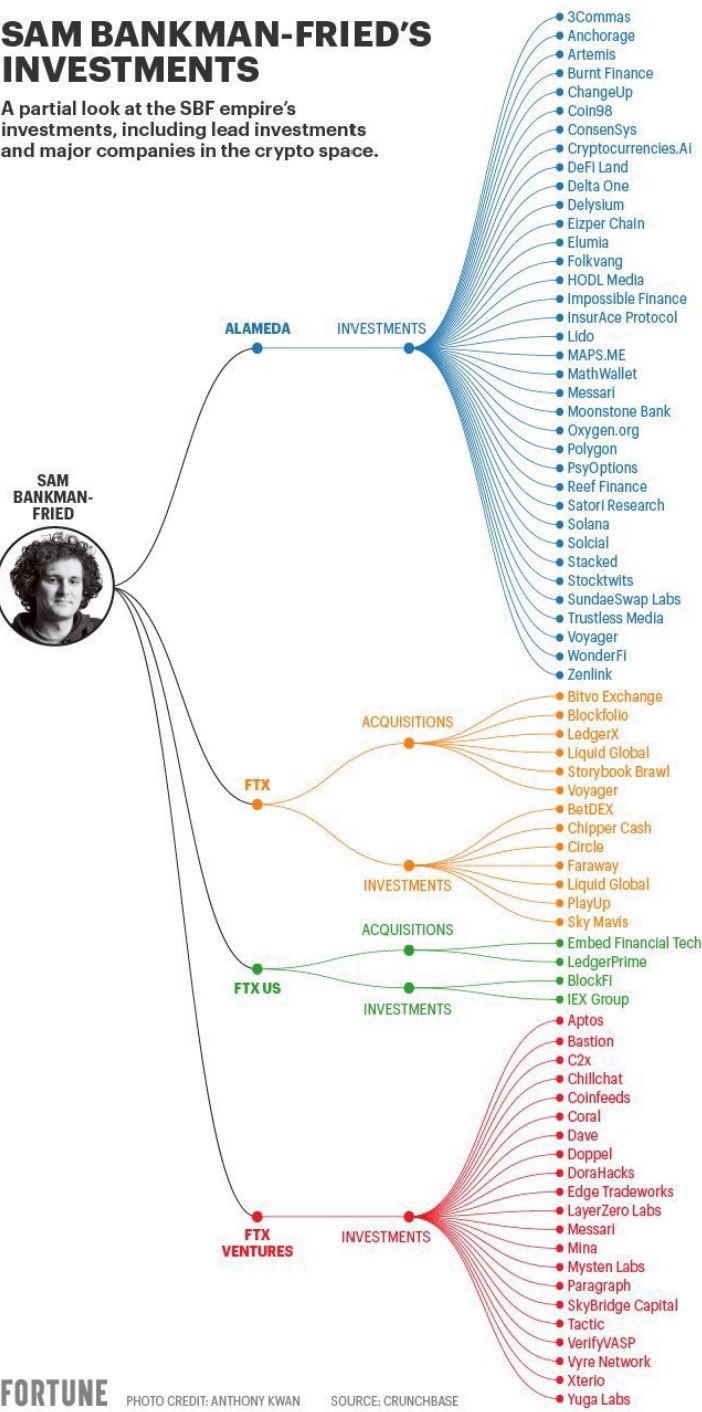

A fast look a the under graphic ought to inform you all it is advisable know:

Going ahead

As I mentioned, I don’t anticipate this to be as grave a liquidity disaster as LUNA. However it might be delusional to not anticipate additional ache – and that features some sombre bulletins which is able to come out of the blue. There shall be corporations caught up on this mess that can take folks without warning.

$10 billion is a hell of some huge cash. It might probably’t disappear with out reverberations elsewhere. Hopefully, the injury is as minimal as could possibly be hoped for, given the teachings proven by the LUNA fiasco.

However certainly it will lastly persuade CEOs and treasury managers to allocate their capital correctly, carry out diligent stress assessments, pay correct consideration to diversification and simply…be smart.

It should, proper? Proper?