Charles Edwards, the founding father of Capriole Investments, has just lately supplied an evaluation in Capriole’s Replace #13, predicting a major upswing within the Bitcoin worth to $58,000. His forecast is rooted in an in depth examination of market developments, ETF developments, technical patterns, and elementary indicators.

In-Depth Market Evaluation Of The Bitcoin Market

The evaluation begins with an in depth take a look at the market’s current habits, specializing in the aftermath of Bitcoin ETF launches. Edwards factors out, “Two months of chop and ETF readings beneath the microscope seems to be resolving to the upside as of writing.”

He highlights the numerous shift in momentum following the preliminary “promote the information” response to the ETF launches, noting a substantial lower in outflows from the Grayscale Bitcoin ETF. This variation, in line with Edwards, aligns together with his earlier predictions.

Moreover, Edwards highlights the huge success of Blackrock and Constancy’s Bitcoin ETFs (IBIT and FBTC), which have collectively absorbed over $6 billion in property in lower than a month. This achievement not solely underscores the ETFs’ historic launch success but additionally alerts a broader acceptance of Bitcoin inside the conventional finance sector.

“Bitcoin [is] probably the most profitable ETF launch in historical past by a really broad margin,” Edwards notes, referencing knowledge from Eric Balchunas to emphasise the unprecedented scale of Bitcoin’s entry into the ETF market.

Here is a take a look at the Prime 25 ETFs by property after 1 month available on the market (out of 5,535 whole launches in 30yrs). $IBIT and $FBTC in league of personal w/ over $3b every they usually nonetheless have two days to go. $ARKB and $BITB additionally made record. pic.twitter.com/Yyi1nxukUk

— Eric Balchunas (@EricBalchunas) February 8, 2024

A significant milestone in Bitcoin’s institutional adoption is Constancy’s resolution to incorporate Bitcoin in its “All-in-One Conservative ETF.” Edwards considers this transfer a major endorsement of Bitcoin’s worth as an funding asset, stating, “Bitcoin is lastly being acknowledged in conventional funding automobiles.”

He predicts that this might set a precedent, with most main ETFs prone to allocate between 1-5% to Bitcoin within the subsequent 12-24 months, emphasizing the vital significance of this growth for Bitcoin’s mainstream acceptance.

Technical Outlook And BTC Value Prediction

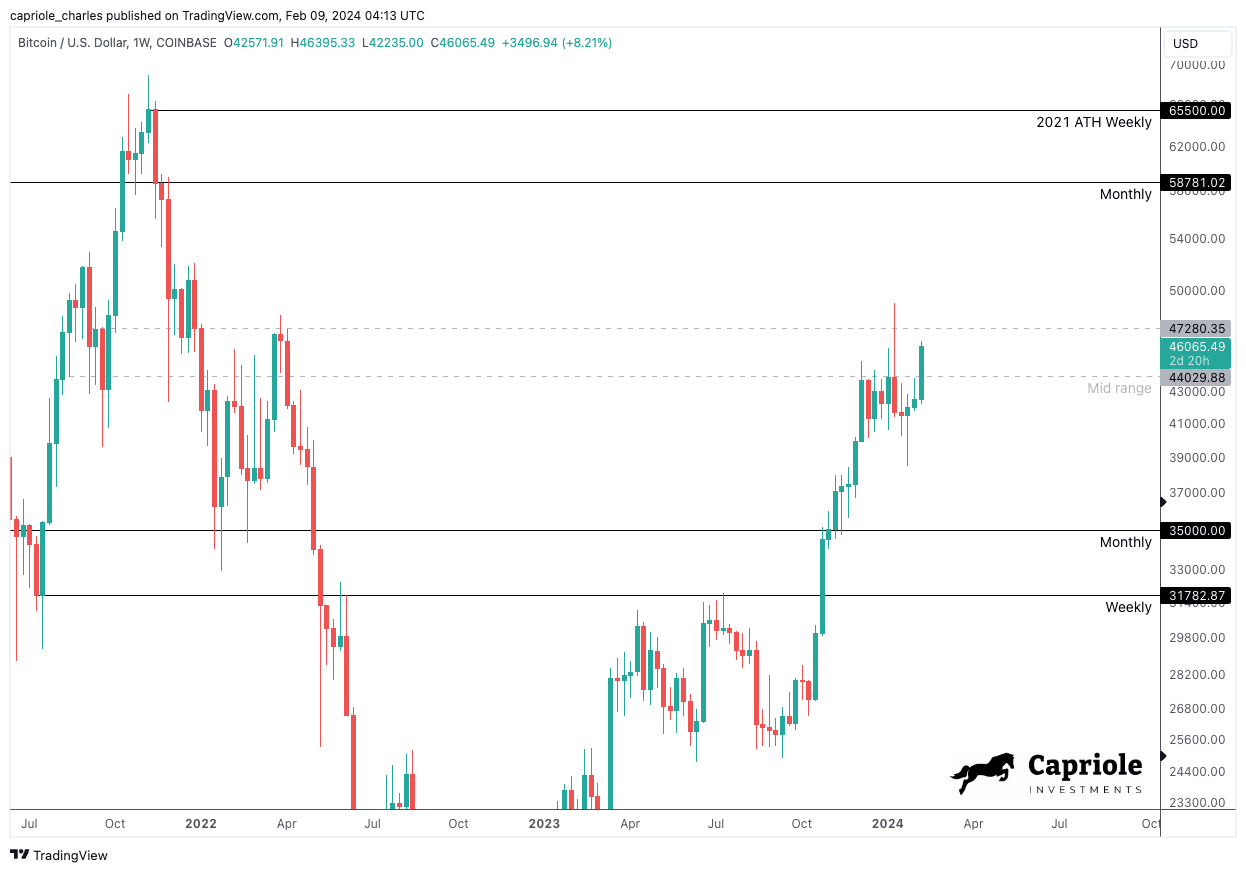

Turning to the technical evaluation, Edwards factors out the bullish pattern that has taken form, with Bitcoin breaking past the $44,000 resistance stage. This breakout, in line with Edwards, is a powerful indicator of the market’s bullish sentiment and a precursor to additional positive aspects.

He notes, “The Weekly closing above $47K mid-range certain on Sunday would give an excellent technical affirmation of a brand new bullish pattern,” highlighting the importance of this stage as a determinant of the market’s course.

Moreover, Edwards elaborates on the low timeframe technicals, indicating a measured transfer in direction of the month-to-month resistance, which presents a horny risk-to-reward (R:R) setup for buyers. This technical breakout, mixed with the strategic administration of threat, underscores the potential for important worth appreciation within the close to time period.

A clear breakout on the day by day timeframe of the $44K resistance is suggestive of a measured transfer to Month-to-month resistance. It is a good R:R setup. ‘Threat’ could be simply managed (a detailed again into the vary at $44K could be a logic cease) with “Reward” 3-4X greater at $58-65K.

Fundamentals Flip Bullish

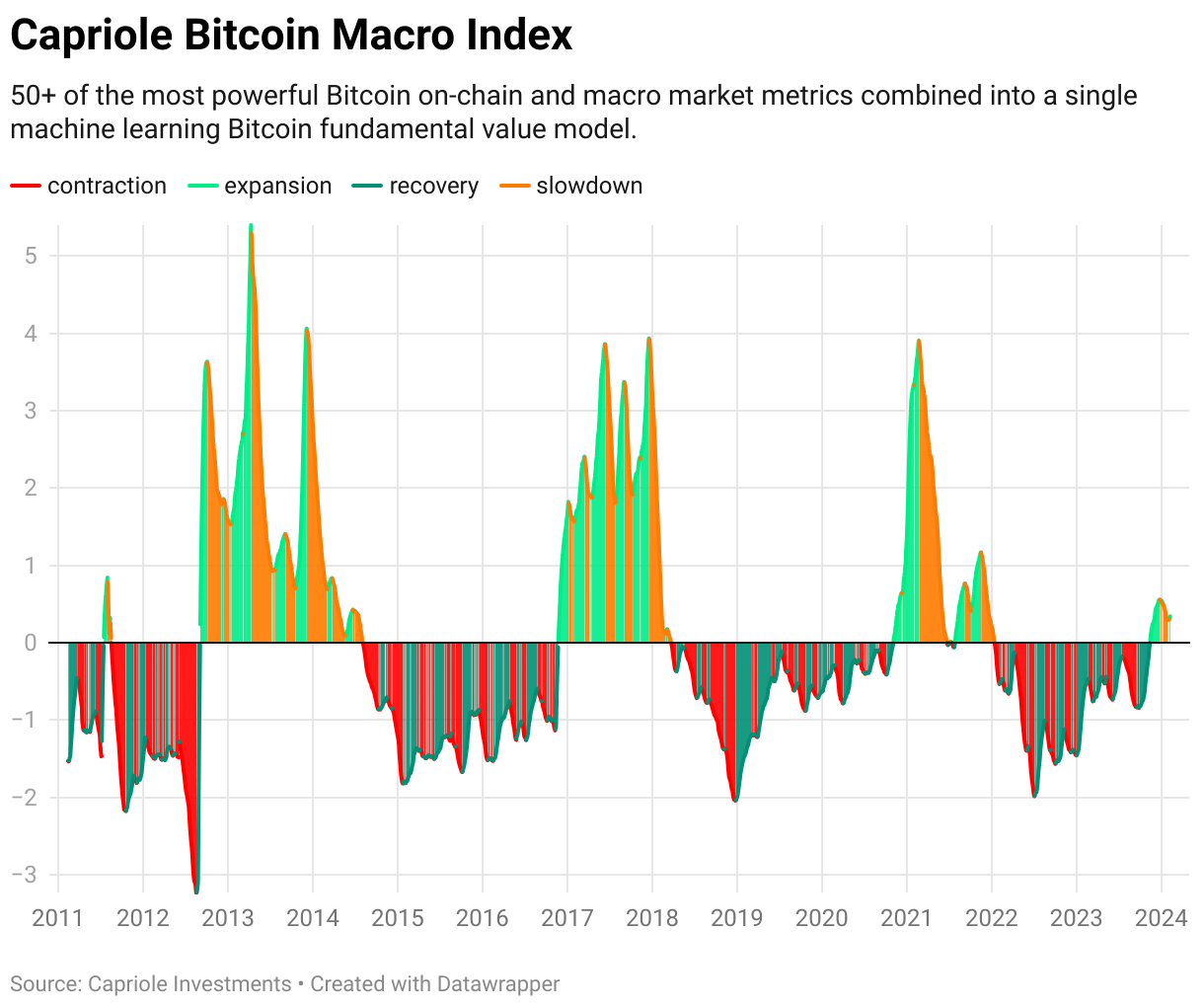

The muse of Edwards’ bullish outlook can be constructed on a sturdy evaluation of fundamentals and on-chain knowledge. The Capriole’s Bitcoin Macro Index, which aggregates over 50 Bitcoin-related metrics right into a single mannequin, performs an important position on this evaluation.

“The elemental uptrend resumed on Wednesday which can be supportive of continuation of the technical transfer. We need to see on-chain elementary development proceed with worth to help affirmation of this mid-range breakout. Monday’s studying will likely be significantly vital,” Edwards states.

Edwards’ evaluation concludes on a bullish observe, with a transparent technical breakout and a transition of on-chain fundamentals into development territory. “ETF FUD cleared. A Technical breakout on the day by day timeframe and on-chain fundamentals transitioning into development,” he summarizes, pointing in direction of a powerful begin to February and setting an optimistic tone for Bitcoin’s short-term future.

At press time, BTC traded at $46,790.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site solely at your personal threat.