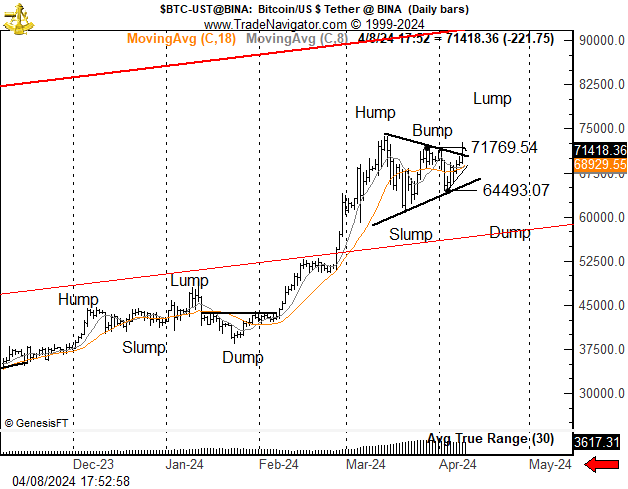

Crypto market rally resumes as pleasure for the upcoming Bitcoin halving elevated BTC value to surpass $72,715, with some headwinds anticipated to withstand BTC value rally in the direction of $80K. Consultants predict a downfall, probably a crash, if BTC value chart sample repeats a historic sample.

A crash in Bitcoin value may set off a market-wide drop as seen throughout earlier Bitcoin halving occasions and up to date spot Bitcoin ETF approval.

Bitcoin Value Correction Looms Amid Halving

Crypto traders keenly await Bitcoin halving for additional upside momentum within the crypto market, however analysts warn a correction may occur if BTC value type the same sample as seen earlier.

Analyst Benjamin Cowen stated if BTC repeats the same sample seen throughout spot Bitcoin ETF because it goes into Bitcoin halving, then a BTC value fall could be anticipated. He expects Bitcoin to make a brand new ATH after halving after which fall beneath the $60,000 stage.

“Often these patterns don’t repeat precisely, however simply exhibiting it right here in case one thing related occurs as soon as once more,: he added.

Veteran dealer Peter Brandt reacted to the submit and Bitcoin tends to comply with related historic patterns in previous Bitcoin halving. He stated the “identical primary sample has been widespread in previous bull markets in Bitcoin.”

Additionally Learn: JPMorgan CEO Jamie Dimon’s Dire Warning on 8% Interest Rate; BTC to $100K?

Bitcoin Value to Slide Beneath

BitMEX co-founder Arthur Hayes anticipates a decline in Bitcoin costs earlier than and after the halving occasion subsequent week. He suggests that in this era, US dollar liquidity will probably be constrained, contributing to heightened promoting stress on crypto belongings.

Furthermore, the entire outflows from the spot Bitcoin ETFs had been $223 million, with Grayscale Bitcoin ETF dragging the entire circulate in the direction of unfavourable attributable to outflows surging previous $300 million.

Choices buying and selling skilled Greekslive revealed Bitcoin has entered a pullback as merchants primarily offered short-term bitcoin possibility. The market remains to be skeptical in regards to the future pattern with the primary time period IV fell barely. Nonetheless, an enormous whale traded 350 requires the $200,000 strike value expiring March 2025. Additionally, the whale has stockpiled practically 30,000 calls above $100,000 in any respect phrases.

BTC price jumped 4% up to now 24 hours however the value has pared some good points, with the value at present buying and selling at $70,993. The 24-hour high and low are $69,654 and $72,715, respectively. Moreover, the buying and selling quantity has elevated by 90% within the final 24 hours.

BTC Futures Open Curiosity dropped 0.30% within the final 4 hours and BTC Choices Open Curiosity rose barely within the final 24 hours.

Additionally Learn: US Treasury Seeks Stronger Crypto Controls for National Security

The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: