A number of skilled traders recommend it could be time for altcoin merchants to shift their mindset relatively than watch for market situations to enhance. Half of 2025 has already handed, and nothing ensures the second half will likely be simpler.

In the meantime, the buy-and-hold method for altcoins has failed as Bitcoin Dominance (BTC.D) has risen for 2 consecutive years.

Why Shifting From Purchase-and-Maintain to Disciplined Buying and selling

Dealing with widespread losses amongst altcoin merchants, Stockmoney Lizards, a widely known investor on X, shared an easy technique designed for these with restricted expertise. Named the “Low-IQ Altcoin Technique,” it consists of 4 major steps.

- Select respected altcoins: Concentrate on cash which have confirmed resilient over a number of market cycles, similar to SOL, ADA, or ETH. These cash normally have stronger foundations and decrease danger than new, smaller tasks.

- Allocate capital fastidiously: Divide buying and selling capital into 5 equal elements to unfold danger throughout completely different shopping for factors.

- Outline clear entry factors: Enter positions when the each day RSI drops beneath 30 (an oversold sign). Proceed including after every additional 10% worth drop from the final buy.

- Set strict exit factors: Exit the whole place as soon as earnings attain 30–50%. Keep away from hesitation or ready for even greater beneficial properties, as altcoin markets stay extremely risky and weak to sudden strikes by whales.

Stockmoney Lizards emphasised that this technique doesn’t promise fast wealth however goals to assist merchants keep away from dropping all the pieces, like most altcoin traders. The advice consists of reinvesting half of the earnings into stablecoins and the opposite half into Bitcoin for long-term accumulation.

“You gained’t get wealthy fast. However you additionally gained’t lose all the pieces like 99% of altcoin merchants do…This boring technique is precisely how I survived my early buying and selling days,” Stockmoney Lizards noted.

Michaël van de Poppe, CIO and founding father of MNFund, additionally highlighted a typical mistake: many traders rush in to purchase solely when costs have already soared, which raises the chance of losses.

The disciplined technique instructed by Stockmoney Lizards helps decrease danger and cut back the FOMO mindset described by Michaël van de Poppe.

Nonetheless, sustaining self-discipline will be difficult, as many merchants nonetheless hope for fast and huge earnings.

“Not the technique most individuals in crypto consider in, however must. They need that Lambo yesterday,” one other investor on X commented.

Will Altcoin Season Arrive in H2 2025?

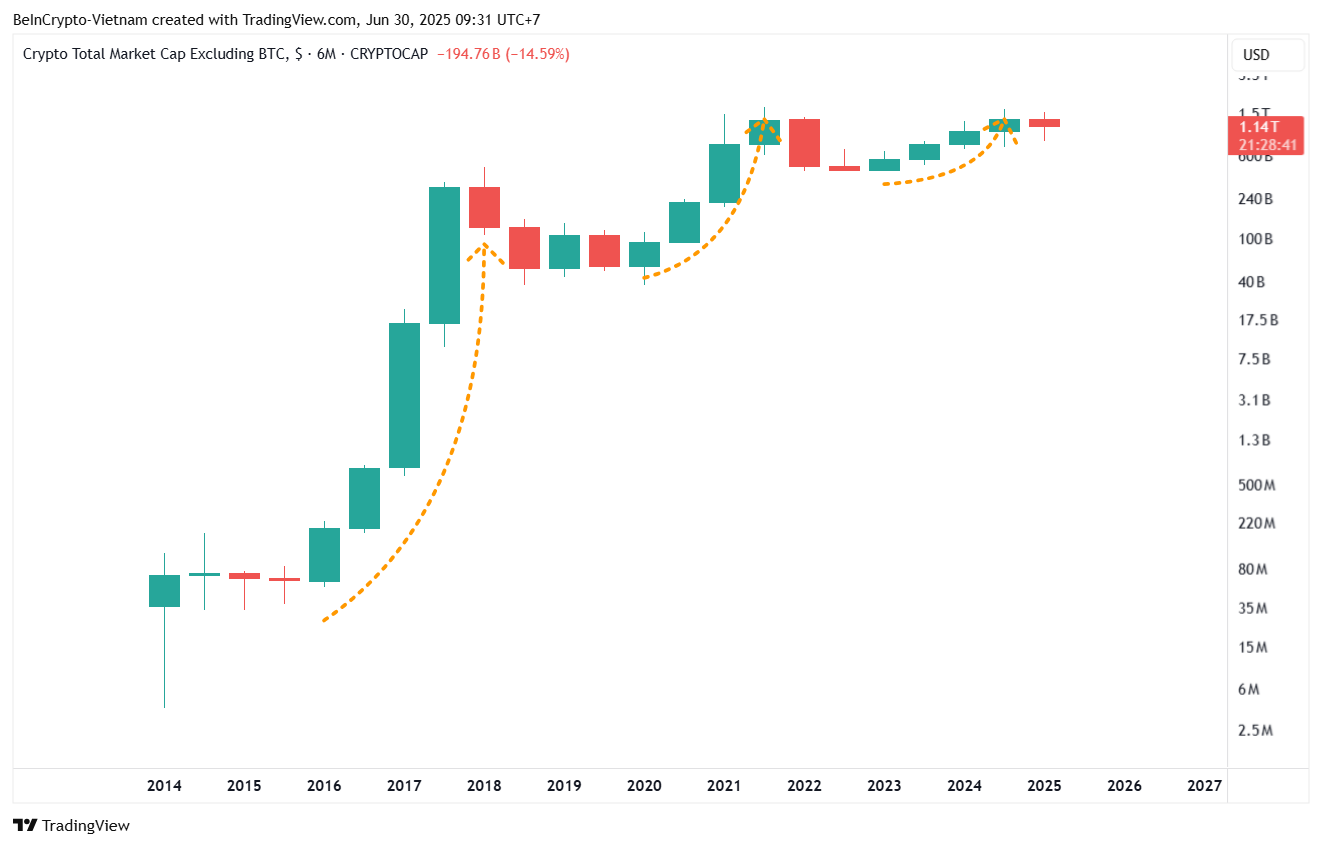

A latest BeInCrypto report recognized indicators that the altcoin winter may continue. Evaluation of the altcoin market cap (TOTAL2) on a six-month chart reveals that TOTAL2 has accomplished 4 consecutive inexperienced candles and now seems to be getting into a purple candle section.

In earlier cycles, 4 inexperienced six-month candles sometimes ended with two purple candles, suggesting that the second half of 2025 may stay difficult for altcoins.

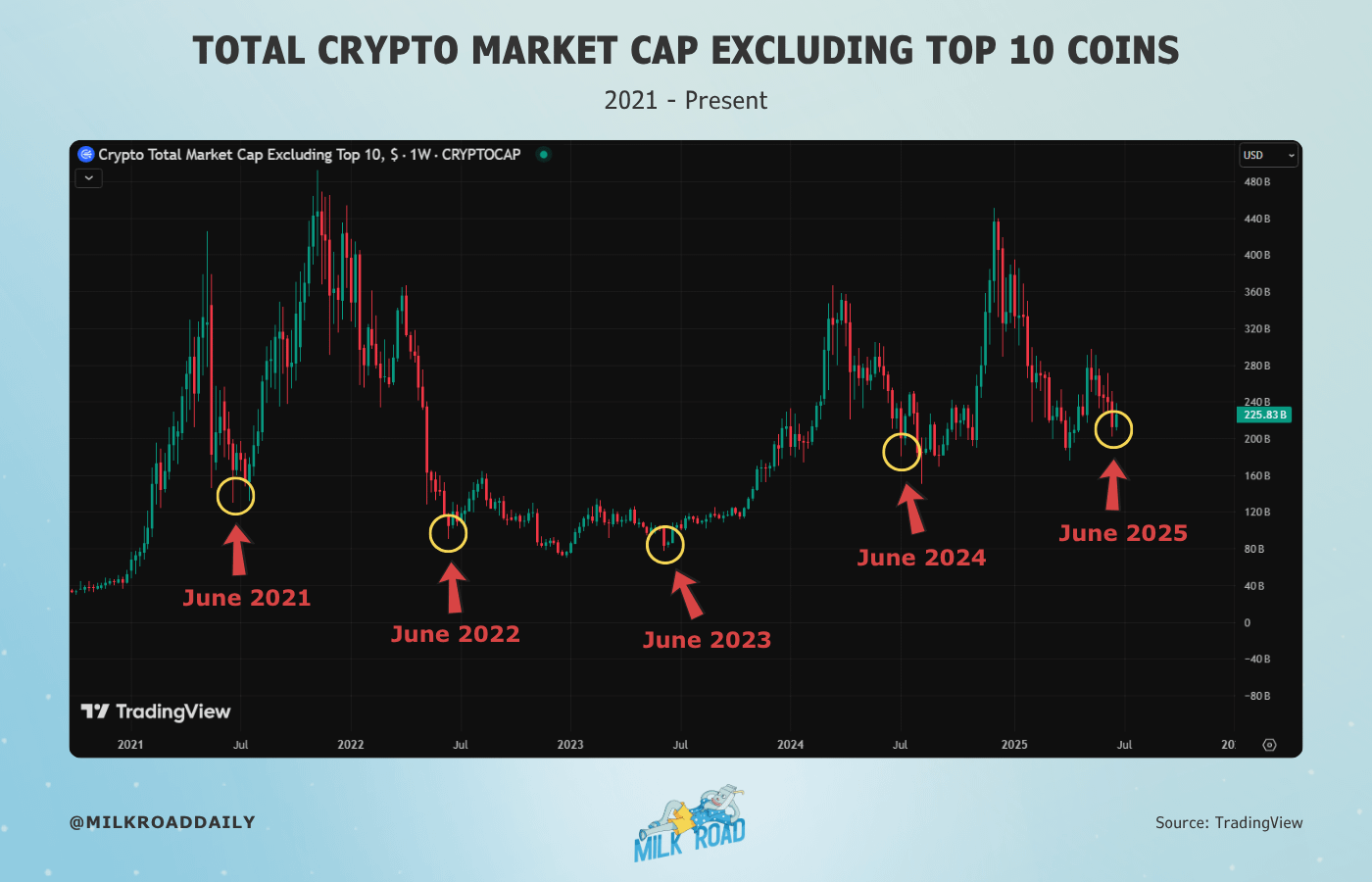

Nonetheless, investor Milk Street noticed a extra optimistic historic sample: the market cap backside for altcoins excluding the highest 10 typically varieties in June annually.

“Each June since 2021 has marked a key turning level within the altcoin market… And June 2025 could possibly be following the identical script,” Milk Street observed.

This angle is supported by different traders who hope the altcoin market cap could reach new highs in late 2025.

Conflicting indicators from completely different knowledge fashions add uncertainty to forecasts for H2 2025. On the identical time, Bitcoin Dominance (BTC.D), which generally wants to say no to sign an altcoin season, stays above 65%, its highest level since February 2021, with no indicators of retreat.

Altcoin traders stay divided. Some attempt to regulate expectations and techniques after earlier losses, whereas others proceed to attend for important returns to justify years of holding.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please observe that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.