Information from the buying and selling analytics platform BitMEX Analysis reveals that Constancy’s Bitcoin spot ETF – FBTC – has now witnessed a complete influx of over $1 billion. This growth comes as BTC makes an attempt to rebound from its latest dip during the last two weeks with a 1.56% achieve up to now day, based mostly on data from CoinMarketCap.

Constancy Joins BlackRock On Unique $1-B Checklist, As Grayscale’s ETF Continues To Bleed

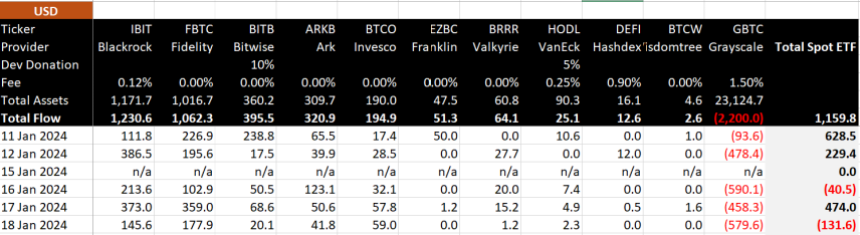

Following the official launch of Bitcoin spot ETF buying and selling on January 11, Constancy has now turn into the second asset supervisor, with its BTC spot ETF recording an accumulative influx of $1 billion. Based on BitMEX Analysis, Constancy’s FBTC skilled an influx of $177.9 million on January 18, bringing its whole inflows to $1.1 billion inside 5 days of buying and selling.

FBTC now sits on the identical desk as BlackRock’s IBIT, whose whole inflows are valued at $1.2 billion. Collectively, each funding funds by Constancy and BlackRock now account for over 67% of the $3.4 billion inflows recorded within the Bitcoin spot ETF market to date.

Different Bitcoin spot ETFs with a notable constructive efficiency embrace Bitwise’s BITB, Ark Make investments’s ARKB, and Invesco’s BTCO, which have posted particular person whole inflows of $395.5 million, $320.9 million, and $194.8 million, respectively.

Bitcoin Spot ETF Circulation knowledge – Day 5

Information out for all suppliers

Internet outflow of $131.6m on day 5 for all spot ETFs, massive $579.6m GBTC outflow pic.twitter.com/McHZrRghtu

— BitMEX Analysis (@BitMEXResearch) January 19, 2024

Then again, Grayscale’s GBTC continues to experience outflows on a massive scale.

BitMEX Analysis reveals that GBTC recorded an outflow of $579.6 million on January 18, main the Bitcoin spot ETF market to witness a internet outflow of $131.6 million. This represented the second day the BTC spot ETF market recorded a internet outflow since its launch.

GBTC’s whole outflows at the moment are valued at $2.1 billion, leading to Bitcoin spot ETFs having a cumulative internet influx of solely $1.3 billion regardless of the $1 billion standing of BlackRock and Constancy’s ETFs.

Supply: BitMEX Analysis

Bitcoin’s Worth Overview

Towards standard predictions, Bitcoin has witnessed a worth decline within the final two weeks following the approval of the much-anticipated BTC spot ETF on January 10. Many analysts have attributed this sudden growth to the huge promoting strain generated by GBTC’s outflows.

On the time of writing, Bitcoin trades at $41,536, with a decline of two.55% and 5.50% within the final seven and 14 days, respectively. As earlier acknowledged, the premier cryptocurrency has garnered some positive aspects of 1.56% within the final day, which can be indicative of a restoration, nevertheless, it’s too early to name.

BTC buying and selling at $41,561 on the every day chart | Supply: BTCUSDT chart on Tradingview.com

Featured picture from Investopedia, chart from Tradingview

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site solely at your personal threat.