The crypto house witnessed a historic second yesterday with the approval of 11 spot Bitcoin Change-Traded Funds (ETFs), a growth that’s been eagerly anticipated because the Winklevoss twins filed for the primary proposed Bitcoin ETF again on July 1, 2013. This pivotal occasion coincides with the fifteenth anniversary of Hal Finney’s tweet “Running Bitcoin,” marking a symbolic milestone within the digital forex’s journey.

Regardless of the monumental approval by the US Securities and Change Fee (SEC), Bitcoin’s worth response was muted, sustaining stability across the $46,000 mark. This means that the approval had already been factored into the market worth. Nevertheless, the panorama might shift dramatically with at the moment’s graduation of buying and selling for these ETFs.

Spot ETFs, versus future ETFs, necessitate the acquisition of bodily Bitcoins by the issuers, thereby exerting direct shopping for stress available on the market. This facet, mixed with the high conviction among long-term investors (“hodlers”) and the historic low Bitcoin reserves on crypto exchanges, units the stage for doubtlessly risky worth actions.

Staggering Bitcoin Influx Projections For Day 1

Projections for ETF inflows are staggering. Bloomberg anticipates a record-breaking $4 billion influx on the primary buying and selling day for spot Bitcoin ETFs, with issuers collectively contributing $312.8 million in Bitcoin seeding. BlackRock’s ETF is especially notable, with an anticipated $2 billion in inflows, as per Bloomberg Intelligence.

Commonplace Chartered just lately projected that 2024 might see $50-100 billion in spot Bitcoin ETF inflows, with a possible Bitcoin worth reaching $200,000 by the tip of 2025. Mike Alfred, a Bitcoin knowledgeable, commented on the potential scale of those inflows:

Bitwise has confirmed they’ve $100M+ of investor commitments for tomorrow on day 1. I’m sure Blackrock is hoping for $3-4B. Invesco/Galaxy may even come out swinging. That’s a variety of corn. Hope the exchanges are prepared.

Tuur Demeester of Adamant Analysis highlighted the importance of the continuing payment struggle amongst issuers, suggesting that the extraordinary competitors displays expectations of considerable capital inflows. “The depth of this Bitcoin ETF bidding struggle is telling me the issuers imagine that the winner’s low charges can be compensated by HUGE $$ inflows,” he remarked.

Alistair Milne from Altana Digital echoed these sentiments, anticipating record-breaking inflows and a resultant surge in international curiosity in Bitcoin. “Tune in tomorrow once we’ll attempt to break the document for first day ETF inflows, create international FOMO and provoke the Bitcoin supercycle,” Milne wrote through X.

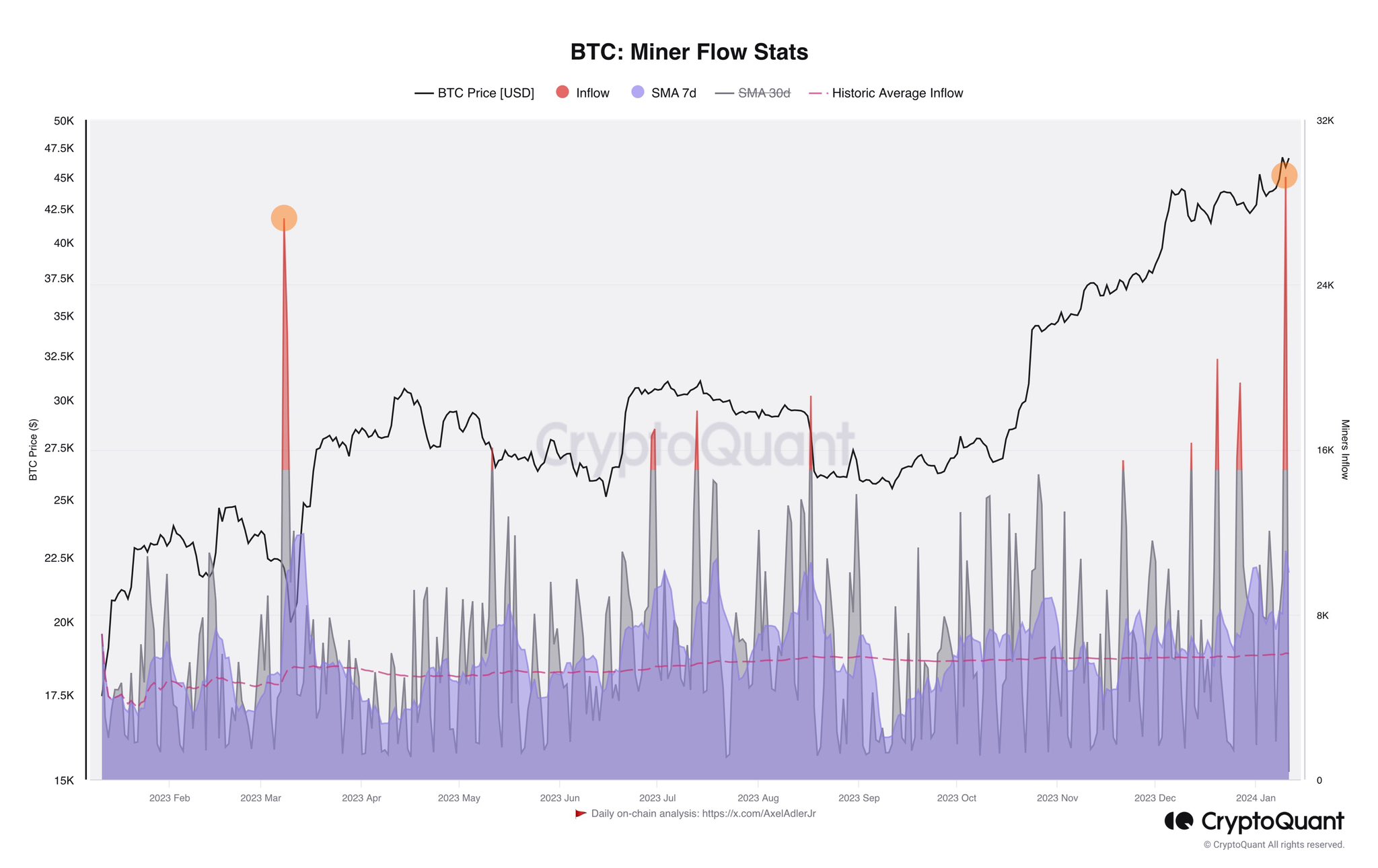

In the meantime, on-chain analyst Axel Adler Jr. could have found a cause for Bitcoin’s lagging efficiency to date. He identified that “miners have determined to benefit from the money influx into the market.”

Subsequent Goal $50,000?

Raghu Yarlagadda, CEO of FalconX, in an interview with Bloomberg Expertise, emphasised the essential affect of web inflows on BTC’s worth within the coming week:

What we’ve been listening to is most individuals are pricing in web inflows into Bitcoin within the first week or so at $1 to $2 billion. So if the web inflows are much less $1 to $2 billion, it can have an hostile impact on worth, and whether it is greater than $1 to $2 billion, it can have a constructive impact on worth.

1/ Based mostly on buyer conversations, $1 to $2 billion of spot #BitcoinETF inflows within the first week are priced into Bitcoin at $45K. Inflows might be extra with ETF payment wars starting this morning. 2024 is setup effectively for crypto with ETF approval, BTC halving, Ethereum improve, and… pic.twitter.com/L71Lkscfh5

— Raghu Yarlagadda (@2Ragu) January 8, 2024

British HODL, a identified analyst on X, supplied a deeper perception into the present market dynamics, explaining the shortage of fast worth motion post-ETF approval and outlining eventualities for important worth modifications relying on the inflows after the ETFs begin buying and selling.

“For anybody questioning, Bitcoin worth has not moved as a result of: Leverage was worn out yesterday, everybody who wished in earlier than the ETF, appears to be in. Solely after 9.30am tomorrow can the ETFs really begin accepting capital and thus begin buying Bitcoin,” he stated and added that if Bloomberg is correct with $4 billion coming in on the primary day, “we *might* see a worth of $50k-$57k by shut of buying and selling on Friday. The shopping for stress has not even STARTED but.”

At press time, BTC continued its sideways development and traded at $46,267.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site completely at your personal threat.