The current retreat in Bitcoin value has taken the market by storm, whereas some specialists stay optimistic about its future. Newest on-chain information and technical indicators counsel a major bullish reversal could also be on the horizon, doubtlessly driving Bitcoin to $88,000.

Notably, this optimistic forecast is fueled by a mixture of historic tendencies and a notable flag sample, igniting investor confidence amid the broader market volatility.

On-Chain Information Signifies Bitcoin Value Rally To $88K Quickly

Distinguished crypto market analyst Crypto Faibik has predicted a bullish flip for Bitcoin, citing a “Bullish Flag Sample” on the weekly chart. In a publish on the X platform, Faibik asserted that Bitcoin may surge to $88,000 by July or August.

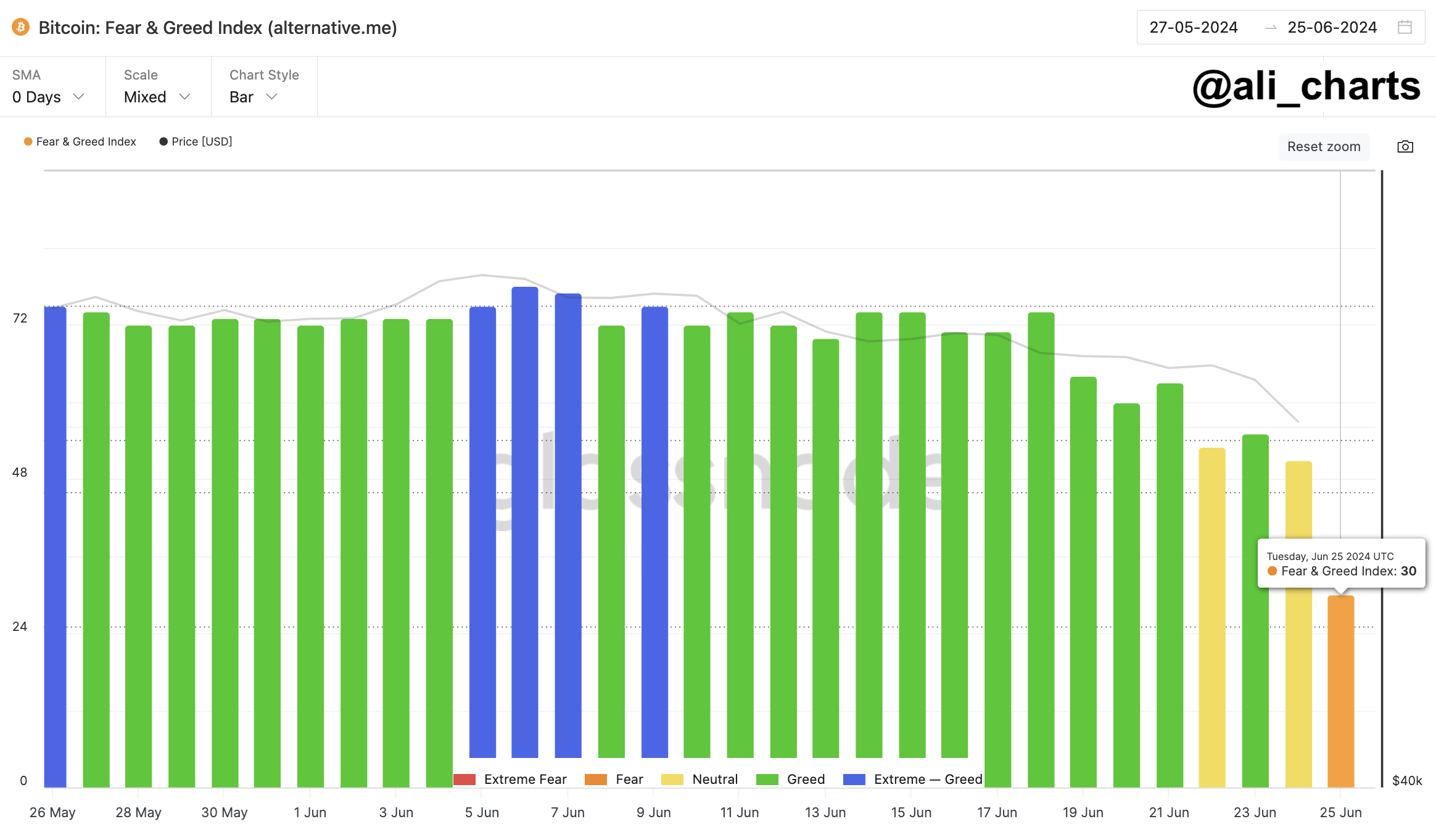

Notably, the flag sample, usually seen as a continuation sign, means that Bitcoin is likely to be making ready for one more upward transfer after its current consolidation. Supporting this outlook, one other well-known analyst, Ali Martinez, emphasised the present “Concern” sentiment available in the market, as mirrored by the Bitcoin Concern and Greed Index, which has fallen to 30.

In the meantime, Martinez famous that this drop in sentiment usually presents shopping for alternatives. In addition to, he identified that the Relative Strength Index (RSI) hitting oversold ranges has traditionally preceded substantial value rebounds.

Martinez highlighted that in earlier situations over the previous two years, comparable RSI circumstances led to Bitcoin value will increase of 60%, 63%, and 198%. As well as, Martinez additionally pointed to the Market Worth to Realized Worth (MVRV) Ratio, which is at present beneath -8.40%.

Wanting on the historic tendencies, such ranges have led to notable value surges. He noticed that the MVRV ratio dipping to those ranges beforehand triggered value jumps starting from 28% to 100%. With Bitcoin at present beneath $60,000 and the MVRV ratio at -8.96%, Martinez suggests this might be a super time for traders to purchase the dip.

Additionally Learn: Jack Mallers’ Strike Launches In UK, Will It Boost Bitcoin Adoption?

Institutional Accumulation and Market Dynamics In-Play

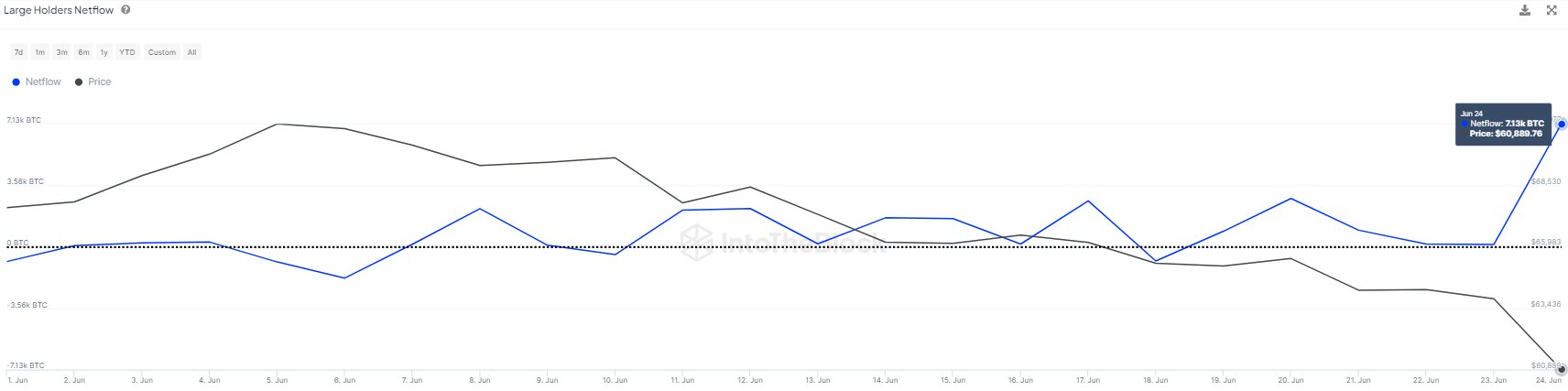

Complementing these technical analyses, information from on-chain analytics agency IntoTheBlock signifies substantial accumulation by giant Bitcoin holders. In keeping with their report, wallets controlling not less than 0.1% of the overall Bitcoin provide added 7,130 BTC, valued at roughly $436 million, in a single day.

This vital internet influx marks the very best stage since late Could, suggesting that regardless of market fears, uncertainty, and doubts (FUD) institutional traders are capitalizing on the current value dip to build up extra Bitcoin.

The mixed insights from Crypto Faibik, Ali Martinez, and IntoTheBlock spotlight a rising sentiment amongst market individuals that Bitcoin’s recent decline is likely to be a precursor to a powerful restoration. The flag sample and on-chain accumulation align with the historic resilience of Bitcoin in periods of market concern, suggesting a potential rally towards $88,000.

Alternatively, current experiences point out that Morgan Stanley is prone to approve Bitcoin ETFs on its platform for patrons by August 2024 finish. The report, citing a “very senior supply”, has additional fueled optimism over rising institutional curiosity within the flagship crypto.

As of writing, Bitcoin price exchanged arms at $61,254.19, noting a flat change from yesterday. Moreover, the crypto has touched a low of $58,601.70 within the final 24 hours, with its buying and selling quantity hovering over 32% to $37.15 billion.

Additionally Learn: Metaplanet Creates Offshore Arm for Enhanced Bitcoin Strategy

The introduced content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

✓ Share: