Franklin Templeton, managing roughly $1.64 trillion in property, is reportedly exploring the launch of a personal fund for institutional traders centered on altcoins.

This transfer indicators a strategic enlargement past Bitcoin and Ethereum. It displays the rising curiosity in diversified crypto property amongst institutional traders.

Franklin Templeton Eyes Altcoin Fund

A current report reveals that Franklin Templeton goals to offer institutional traders with publicity to altcoins via a brand new fund. The initiative additionally provides staking rewards, probably enhancing the attraction of altcoin investments.

Whereas particular altcoins weren’t disclosed, Franklin Templeton has praised Solana’s vital development.

“On Solana, we see Anatoly’s imaginative and prescient of a single atomic state machine as a robust use case of decentralized blockchains, decreasing info asymmetry. And we’re impressed by all of the exercise seen on Solana in This autumn 2023: DePIN, DeFi, Meme Cash, NFTs, Firedancer,” Franklin Templeton stated.

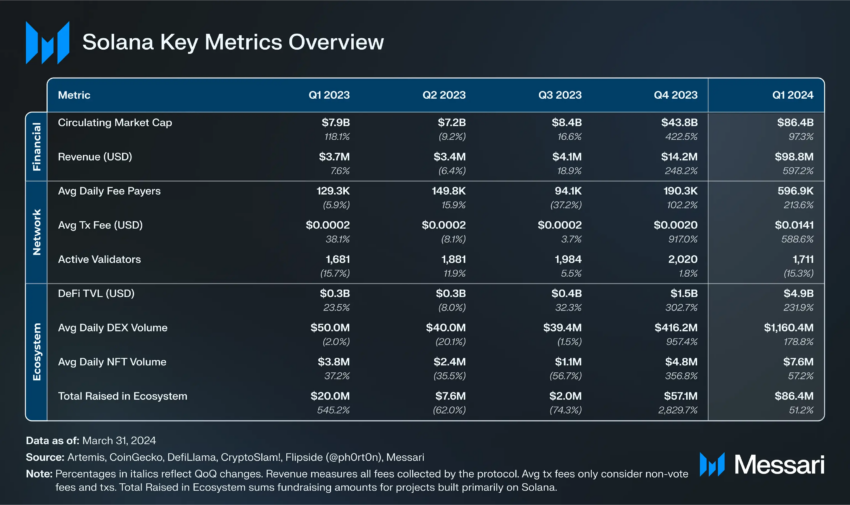

Furthermore, Messari reported Solana’s spot decentralized change quantity surged by 319% to $1.5 billion within the first quarter of 2024.

“Community exercise, measured by non-vote transactions and price payers, continued to rise in Q1. Common day by day price payers elevated by 214% QoQ to 597,000, reaching a peak of over 2 million on March 17. The expansion in addresses was largely pushed by memecoin buying and selling. Common day by day non-vote transactions elevated by 71% QoQ to 70 million,” analysts at Messari wrote.

Learn extra: Which Are the Best Altcoins To Invest in June 2024?

Franklin Templeton’s involvement within the crypto market is already substantial, with notable initiatives together with a spot Bitcoin exchange-traded fund (ETF) launched in January. The agency additionally advocates for a spot Ethereum ETF, which is presently pending approval from the US Securities and Alternate Fee (SEC).

This ongoing engagement with main altcoins underlines Franklin Templeton’s dedication to broadening its crypto asset portfolio.

“We’re enthusiastic about ETH and its ecosystem. Regardless of the midlife disaster it’s not too long ago skilled, we see a shiny future with many sturdy tailwinds to push the Ethereum ecosystem ahead,” Franklin Templeton wrote.

This potential transfer by Franklin Templeton sends a transparent message to crypto analysts and traders. For example, analyst Michaël van de Poppe not too long ago adjusted his crypto portfolio to focus extra on altcoins, anticipating greater returns.

Michaël van de Poppe’s Portfolio Reshuffle

Van de Poppe cited the growing curiosity within the Bitcoin ETF and the anticipated approval of the Ethereum ETF as vital market movers. He additionally emphasised the significance of crypto portfolio management in maximizing returns.

Consequently, he determined to drop Cosmos (ATOM) attributable to its current underperformance. Regardless of a major correction of as much as 50%, it didn’t meet his expectations for restoration and development.

One other altcoin faraway from his portfolio, Curve (CRV), skilled a swift run of roughly 130% from January to March, solely to fall again considerably. Lastly, regardless of being essentially sturdy, Polygon’s (MATIC) persistent underperformance led Van de Poppe to exclude it from his portfolio.

“I simply see much less arguments of getting them in my portfolio as they’re underperforming closely. I need to be positioned into cash that should not have these again holders and are an answer for an issue that now we have been stepping into the earlier cycle and are prone to have the next return,” Van de Poppe defined.

After seeing a list correction and subsequent rise near 8x towards Bitcoin, Van de Poppe views Sei (SEI) as a promising funding. He expects it to rebound strongly, particularly given the present momentum within the Ethereum ecosystem.

A more moderen addition centered on gaming, Portal (PORTAL), has skilled a major drop however reveals potential for top returns. With a totally diluted valuation of $1 billion, it aligns with Van de Poppe’s technique of concentrating on promising new listings. Equally, Wormhole (W) is one other new addition to his portfolio and is predicted to carry out nicely attributable to current favorable market narratives and Binance listings.

Learn extra: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Regardless of the rising curiosity in altcoins, the broader crypto market has seen substantial shifts.

Clients Financial institution, servicing main companies like Galaxy Digital, Coinbase, and Circle, has reportedly told some altcoin hedge-fund shoppers that it could not present banking companies. This comes after the collapse of Silvergate Financial institution and Signature Financial institution final yr, reflecting the continuing challenges confronted by crypto companies in accessing conventional banking programs

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.