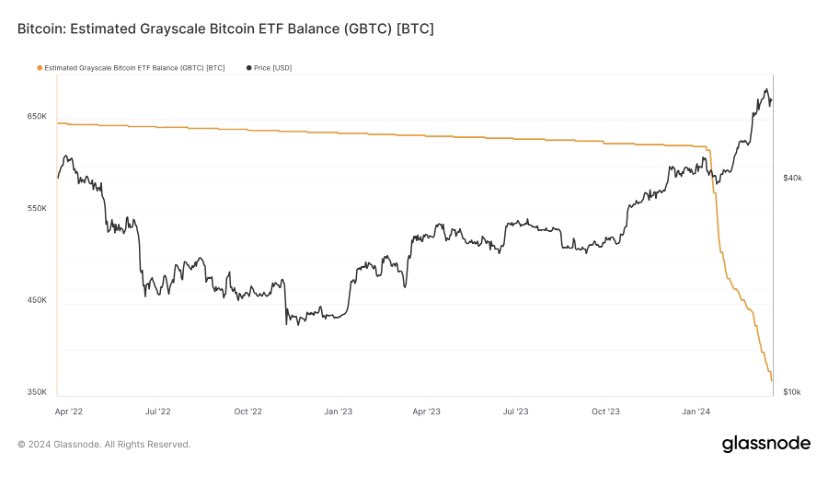

Michael Sonnenshein, chief government supply of crypto asset supervisor Grayscale, discloses that charges on its flagship Grayscale Bitcoin Belief (GBTC) Bitcoin ETF will scale back progressively over time. Sonnenshein mentioned the charges will drop after GBTC outflows reached over $12 billion, backtracking from defending its increased fees.

Grayscale to Scale back GBTC Charges

Grayscale CEO Michael Sonnenshein mentioned the corporate expects to scale back charges on its GBTC Bitcoin ETF within the months forward. The transfer seemingly comes as GBTC continues to witness outflows whereas different rivals resembling BlackRock and Constancy seize huge market share from Grayscale.

“I’ll fortunately verify that, over time, as this market matures, the charges on GBTC will come down,” Sonnenshein told CNBC in an interview on March 18. He added that charges are usually increased throughout the preliminary levels and progressively come down because the market matures and demand for the merchandise rises.

GBTC has witnessed over $12 billion in internet outflows for the reason that conversion to identify Bitcoin ETF. GBTC noticed its highest-ever outflow of $643 million on Monday, with a complete spot Bitcoin ETF outflow of $154.4 million regardless of BlackRock iShares Bitcoin ETF’s (IBIT) $451.5 million influx.

Additionally Learn: Empower Oversight Sues SEC Over Refusing FOIA Compliance, ETHGate

GBTC fees a 1.5% administration payment for holders, which is considerably increased than different Bitcoin ETF suppliers, together with BlackRock and Constancy. In the meantime, VanEck has waived charges on its Bitcoin ETF amid fierce competitors within the BTC ETF market.

The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: