Knowledge from Glassnode exhibits greater than $7 billion in Bitcoin losses was realized inside three consecutive days, probably the most within the historical past of the crypto.

Highest Ever Bitcoin Loss Realization Took Place Throughout The Final Few Days

Newest on-chain knowledge launched by Glassnode exhibits BTC traders took a heavy quantity of losses up to now few days.

The related indicator right here is the “realized loss,” which measures the whole USD quantity of losses that Bitcoin traders are taking proper now.

This metric calculates this worth by wanting on the switch historical past of every coin being bought proper now to see what worth it was final moved at.

If the final promoting worth of a coin was greater than the present Bitcoin worth, then that particular coin realized some loss.

When the worth of the realized loss spikes up, it means holders are at present promoting a considerable amount of underwater provide.

Associated Studying | Bitcoin Hashrate Slams Down After New ATH As Price Continues Struggle

Such a pattern, when extended over a interval, can counsel BTC traders could also be going by means of a capitulation section in the meanwhile.

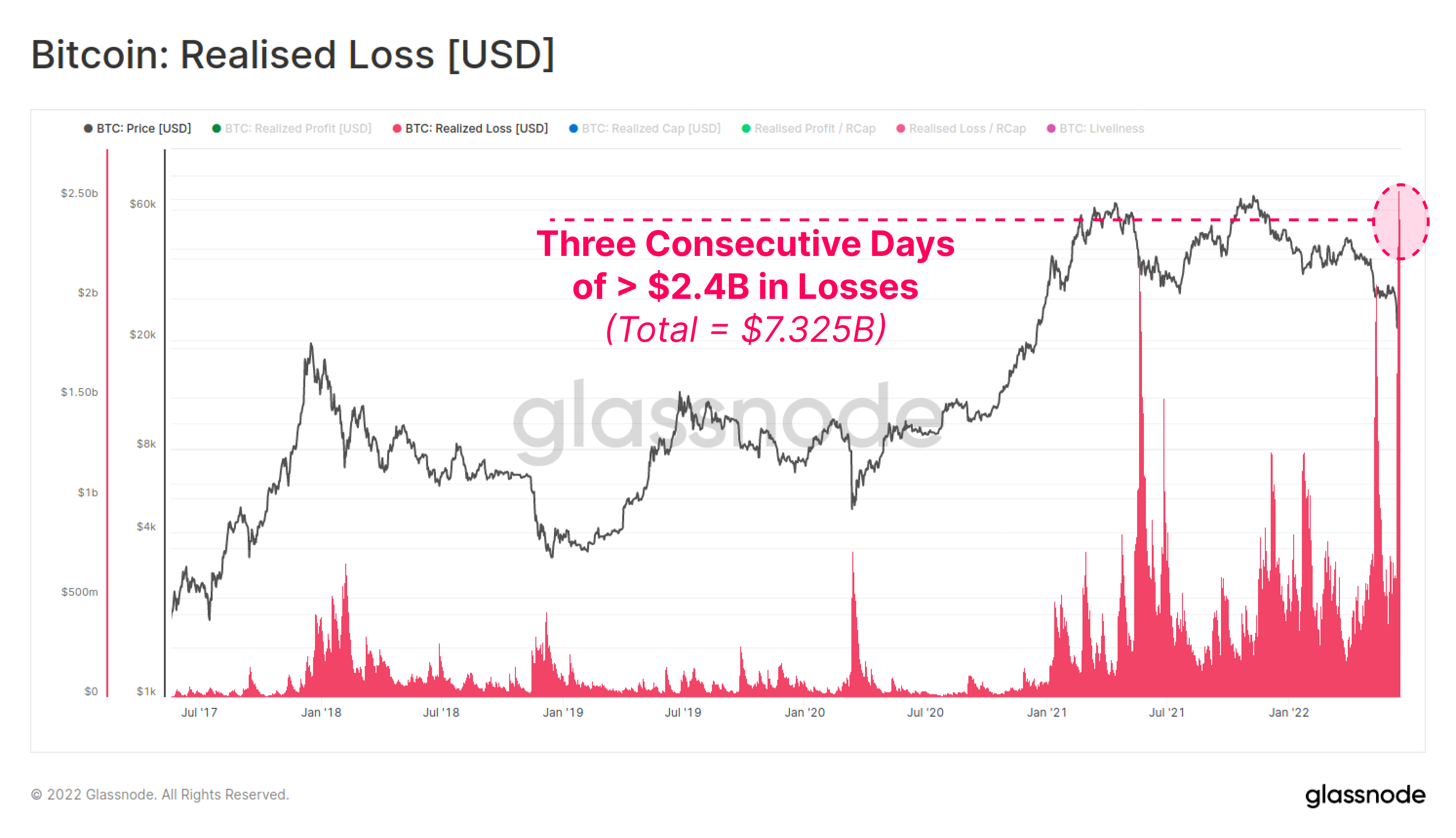

Now, here’s a chart that exhibits the pattern within the Bitcoin realized loss over the previous few years:

The worth of the metric appears to have been fairly excessive in latest days | Supply: Glassnode on Twitter

As you may see within the above graph, Bitcoin traders have realized a fairly excessive quantity of losses in the previous few days.

In reality, spikes of the indicator on three straight days through the previous week corresponded to a loss taking of greater than $7 billion.

Associated Studying | 14 Members Of The US Congress School EPA On Bitcoin Mining And Green Energy

This worth of loss realization is the best it has been within the historical past of the crypto over a interval of three consecutive days.

Further knowledge from the analytics agency exhibits that long-term holders (LTHs) additionally took a deep capitulation throughout this file loss taking.

Appears to be like just like the long-term holders realized a considerable amount of losses just lately | Supply: Glassnode on Twitter

A few of these LTHs who capitulated purchased on the $69k high and bought on the $18k low, thus realizing an enormous 75% in loss.

Typically, LTHs are the least seemingly bunch to promote and as is seen within the chart, heavy loss taking from them has solely occurred round bottoms.

BTC Value

On the time of writing, Bitcoin’s price floats round $20.5k, down 13% up to now week. The beneath chart exhibits the pattern within the worth of the coin over the past 5 days.

The worth of BTC seems to be to have jumped again up within the final two days | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, Glassnode.com