After the U.S. Securities and Alternate Fee (SEC) accepted all 11 Spot Bitcoin ETFs on the identical time, SEC Chair Gary Gensler admitted that Grayscale’s court docket victory was the important thing purpose behind approving spot Bitcoin ETFs. Nonetheless, Grayscale has been shifting Bitcoin to a number of addresses together with crypto exchanges within the final 30 days.

Grayscale Dumping Bitcoin Throughout Spot Bitcoin ETF Hypothesis

The primary day of spot Bitcoin ETF was sturdy by way of $4.6 billion in whole buying and selling quantity. Nonetheless, specialists imagine the Bitcoin inflows had been a lot decrease than anticipated, with GBTC recording $95 million of outflow. The overall internet move for the day into the brand new ETFs was $625.8 million.

BitMEX Analysis knowledge confirmed that on the second day of itemizing of the spot Bitcoin ETF, GBTC outflows had been $484 million, and the entire GBTC outflows within the earlier two days had been $579 million.

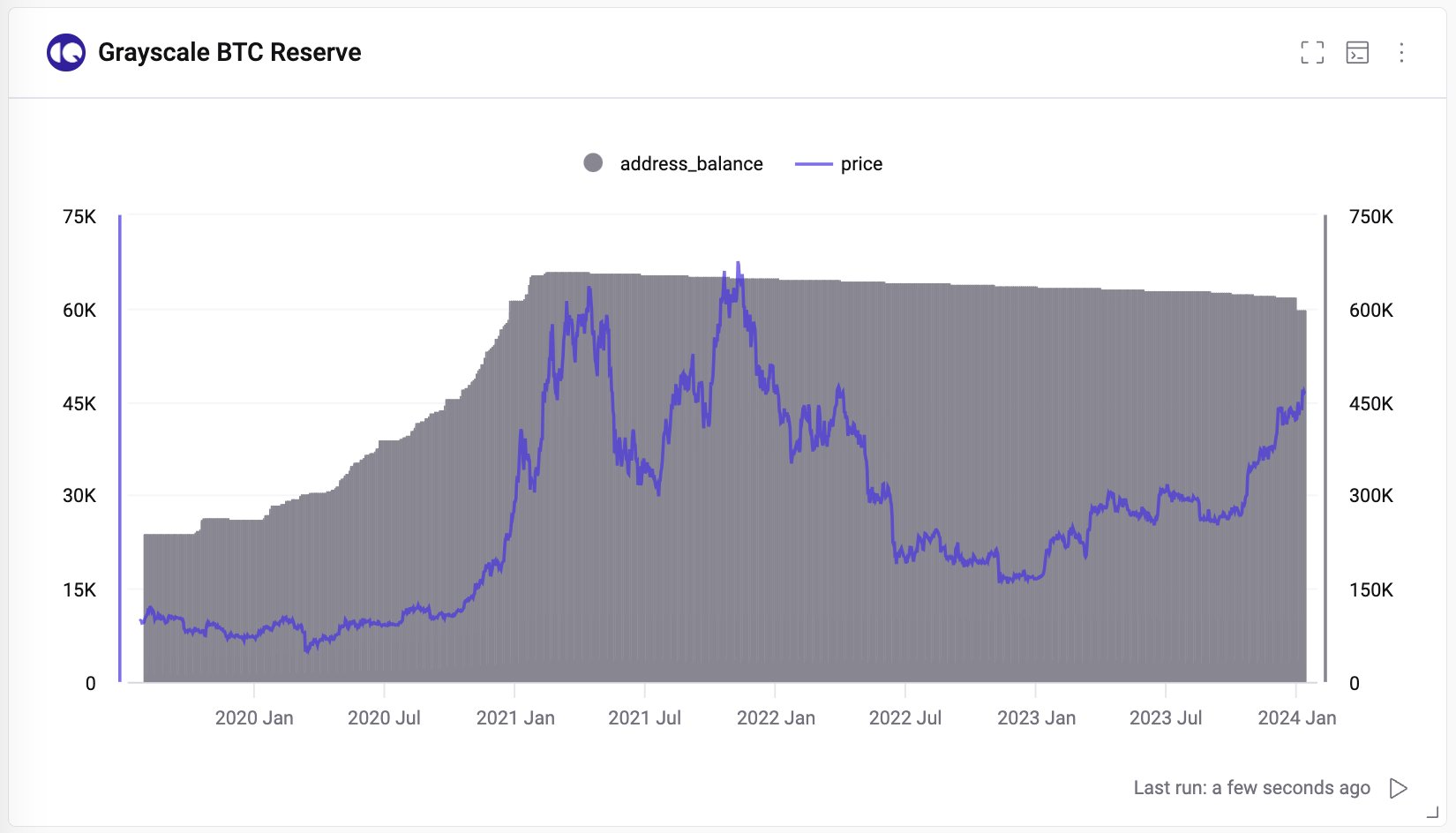

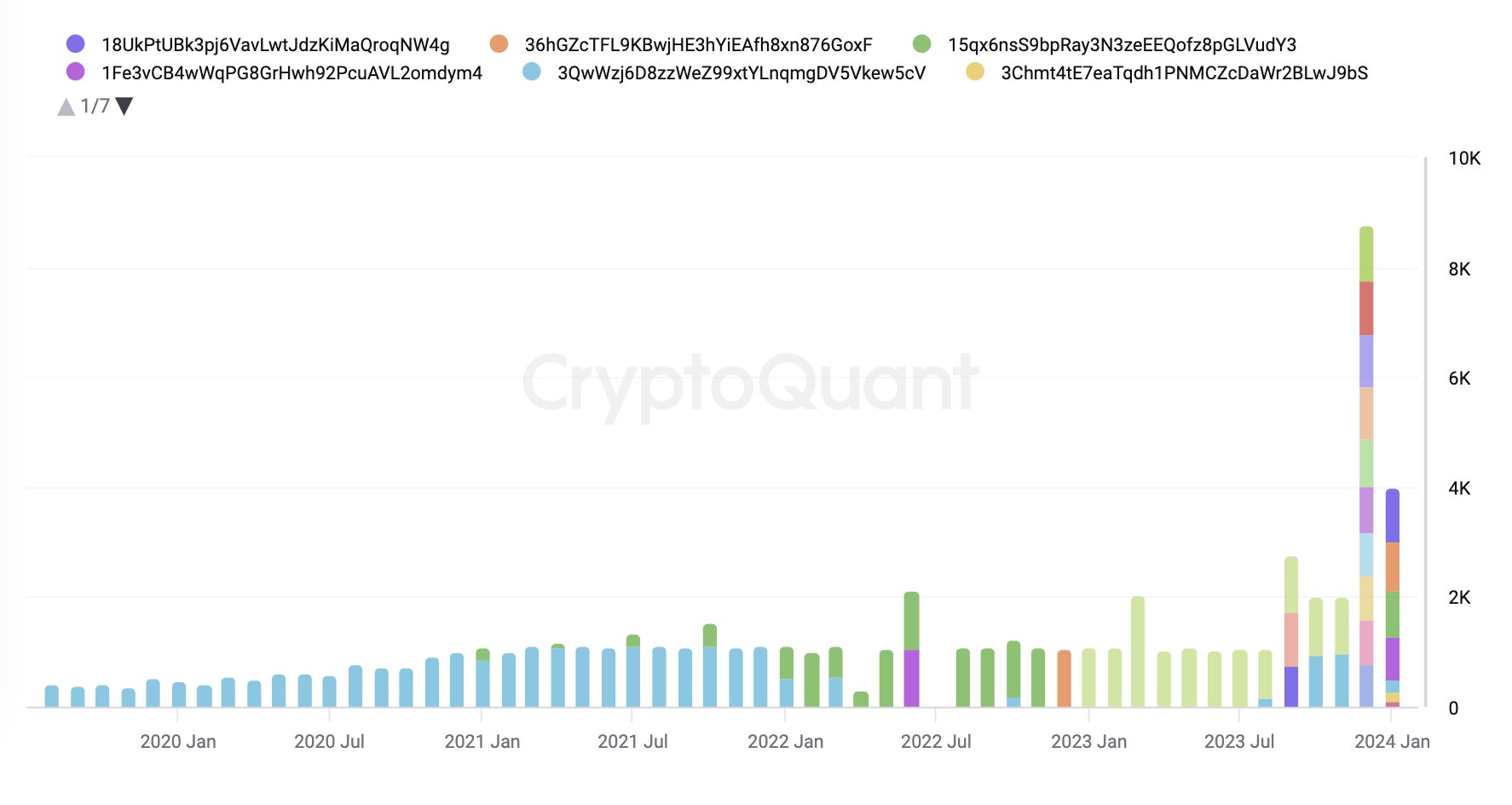

CryptoQuant founder and CEO Ki Younger Ju in a put up on January 13 revealed that Grayscale moved 21,400 BTCs value over 900 million within the final 30 days. Grayscale despatched bitcoins to a number of addresses together with Coinbase, which signifies holders are promoting as spot Bitcoin ETF approval got here close to.

Furthermore, a breakdown of outflows from Grayscale wallets reveals that the Grayscale BTC reserve pockets steadiness modified most lately. Grayscale despatched 4,000 BTC value $183 million to a Coinbase Prime deposit deal with yesterday. This may very well be as a consequence of traders switching their property to different spot Bitcoin ETFs because it has the very best charge of 1.5%.

BTC price tumbled over 6% up to now 24 hours, with the value presently buying and selling at $42,846. The 24-hour high and low are $0.643 and $0.664, respectively. Moreover, the buying and selling quantity has decreased within the final 24 hours, indicating a decline within the curiosity of merchants.

Additionally Learn:

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: