Crypto asset administration agency Grayscale Investments has introduced the launch of a brand new investible asset on Tuesday. The brand new Grayscale Pyth Belief will supply accredited buyers publicity to PYTH, the governance token of the Pyth community.

Grayscale’s strategic initiatives place it as a notable conduit for buyers in search of publicity to varied digital property.

Grayscale Unveils Pyth Belief

The Grayscale Pyth Belief is open for each day subscription to eligible particular person and institutional accredited buyers. It features equally to Grayscale’s different single-asset funding trusts, focusing solely on the PYTH token.

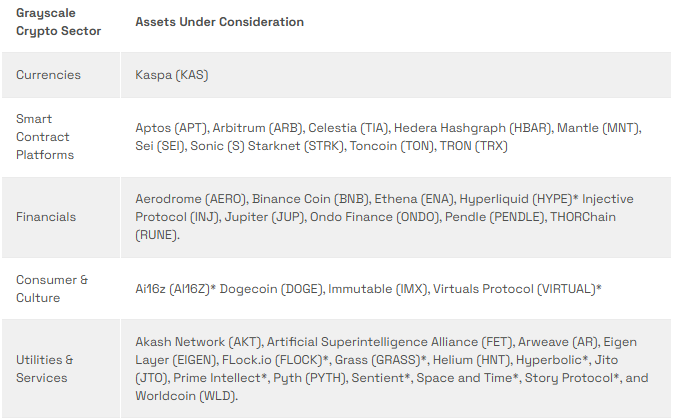

Notably, this product marks Grayscale’s selection of a brand new investible asset from its listing of potentials shared a month in the past. As BeInCrypto reported, the funding supervisor adjusts its product catalog 15 days after quarter-end. In its most up-to-date overview, Grayscale recognized 39 potential assets for its future investment offering.

Furthermore, PYTH was on the listing beneath the utilities and companies class. This choice, due to this fact, highlights the growing significance of oracle networks like Pyth within the broader blockchain house.

In response to Grayscale, the choice comes amid the Pyth community’s rising worth within the Solana ecosystem. It delivers correct and real-time information feeds important for decentralized applications (dApps).

“The Pyth community performs one of the crucial vital roles within the Solana ecosystem. By introducing Grayscale Pyth Belief, we intention to provide buyers entry to extra higher-beta and higher-upside alternatives related to the continued development of Solana,” mentioned Grayscale’s Head of Product & Analysis, Rayhaneh Sharif-Askary in a press release shared with BeInCrypto.

In response to Solana Compass, 95% of dApps on Solana depend on Pyth’s value feeds, highlighting its essential position and market dominance.

Grayscale’s Rising Wager on Altcoins

In the meantime, this launch is a part of Grayscale’s broader technique to diversify its funding merchandise. The agency launched the Grayscale Dogecoin Trust in January, capitalizing on the rising curiosity in various cryptocurrencies.

The Dogecoin Belief got here solely weeks after Grayscale launched the Horizen Trust, offering buyers with publicity to ZEN, the native token of the Horizen community. This transfer was adopted by introducing trusts based on Lido DAO and Optimism, reflecting Grayscale’s dedication to supporting decentralized finance (DeFi) and layer-2 scaling solutions.

Past these, Grayscale additionally runs XRP Trust trading, providing buyers direct publicity to the native token of the Ripple community. This improvement got here amid growing discussions in regards to the potential for an XRP-based ETF (exchange-traded funds), signaling Grayscale’s anticipation of future regulatory approvals.

Different Grayscale trusts embrace Aave, which targets the decentralized lending and borrowing sector. Equally, the MakerDAO Trust grants buyers entry to MKR, the governance token of the MakerDAO ecosystem. This initiative aimed to faucet into the rising demand for decentralized stablecoin options and real-world asset (RWA) tokenization.

Grayscale’s constant growth of its product suite displays its dedication to providing numerous funding alternatives amid the first-paced digital asset house. Past broadening its portfolio, introducing the Grayscale Pyth Belief additionally offers buyers entry to a pivotal part of the Solana ecosystem.

Regardless of this report, nonetheless, the response to the PYTH token was fairly muted. As of this writing, the token is down by over 5%, buying and selling for $0.20.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.