As the present Bitcoin halving cycle continues to advance, right here’s what the earlier cycles appeared like at related factors of their lifespan.

The most recent Bitcoin Cycle Not too long ago Handed The 150,000 Blocks Milestone

A “halving” is a periodic occasion the place Bitcoin’s mining rewards (that’s, the block rewards that miners obtain for fixing blocks) are minimize in half. This takes place each 210,000 blocks or roughly each 4 years.

Because the block rewards are principally the quantity of latest BTC provide being created, being halved signifies that the asset turns into extra scarce. This is the reason the halving is a function of the BTC blockchain; by controlling shortage like this, the inflation of the coin may be checked.

To date, Bitcoin has noticed three halving occasions: first in November 2012, second in July 2016, and third in Could 2020. The following such occasion is estimated to happen someday in 2024. At first, the reward for mining a block was 50 BTC, however right this moment, in spite of everything these halvings, miners are receiving simply 6.25 BTC per block.

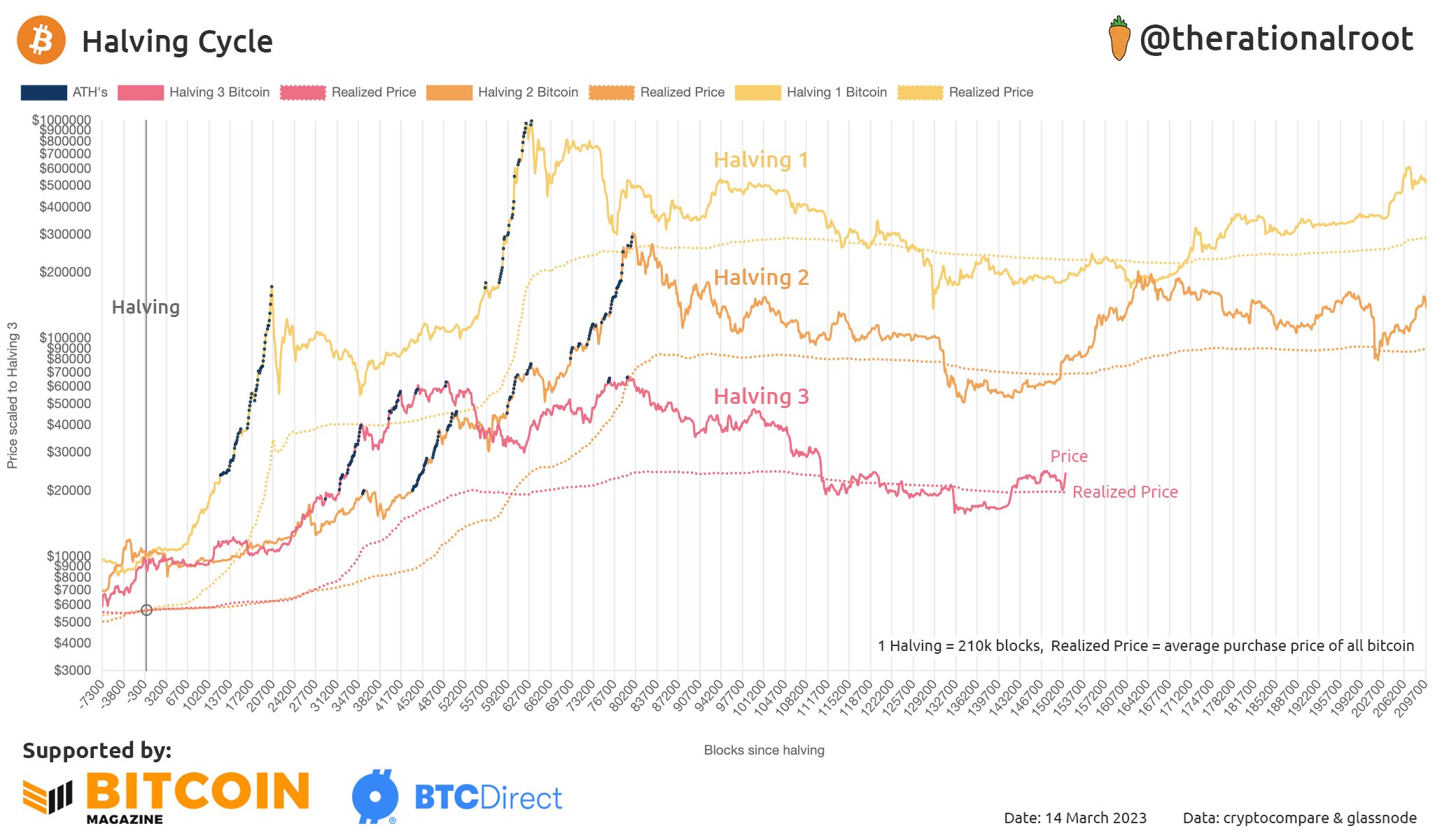

Since halvings are periodic, they’re a well-liked method of mapping BTC cycles by utilizing them as the beginning and finish factors. An analyst on Twitter has accomplished the identical and has in contrast the completely different cycles to this point in opposition to one another utilizing the variety of blocks for the reason that cycle begins because the frequent denominator between them.

Here’s a chart depicting this comparability:

The earlier two halving cycles in contrast with the present one to this point | Supply: therationalroot on Twitter

As you possibly can see within the above graph, the completely different Bitcoin cycles to this point have proven some related options. Particularly the earlier and present ones share some weird similarities.

The tops of each these cycles seem to have fashioned after an analogous variety of blocks had been created within the cycles. The halving 1 cycle noticed this occur earlier, however not by an excessive amount of nonetheless. The bear market bottoms of all three cycles additionally had intently timed occurrences, with the halving 2 and three cycles once more sharing a tighter timing.

Though the timing isn’t as putting because the bottoms, the most recent cycle build up a rally out of the bear lows additionally seems just like what occurred within the second cycle, the place the April 2019 rally befell.

One thing that additionally appears to have held up all through these cycles is the connection between the worth of Bitcoin and its realized worth. The realized price is a metric derived from the realized cap, which is the capitalization mannequin for the cryptocurrency that goals to offer a “truthful worth” for it.

Briefly, what the realized worth signifies is the common acquisition worth or price foundation available in the market. Because of this when the worth dips beneath this stage, the common holder enters into the loss territory.

Throughout bull markets, this stage has acted as assist in all of the cycles, whereas this conduct has flipped in bearish intervals, the place the extent has supplied resistance to the asset as an alternative.

From the chart, it’s seen that Bitcoin retested this stage very lately and efficiently bounced off it, with the worth of the asset gaining some sharp upwards momentum.

If the sample held all through the halving cycles is something to go by, this might counsel {that a} bullish transition has now taken place available in the market and a rally just like the April 2019 rally might need begun.

BTC Value

On the time of writing, Bitcoin is buying and selling round $24,600, up 11% within the final week.

BTC has surged in current days | Supply: BTCUSD on TradingView

Featured picture from iStock.com, chart from TradingView.com