Aster, a decentralized perpetuals alternate launched in early September, has skilled a ten% drop within the final 24 hours alone.

Regardless of robust early traction and backing from Binance founder Changpeng Zhao (CZ), cracks in sentiment are starting to point out.

Analyst Explains Why Aster Worth is Dropping

Sponsored

Sponsored

As of this writing, Aster’s powering token, ASTER, was buying and selling for $1.87, down 8% within the final 24 hours. The token is down over 20% from its native high of $2.43, established on September 24.

In opposition to this backdrop, analysts have dissected what could possibly be driving the value drop of the decentralized exchange (DEX) token.

Worth Stress and Consumer Doubts

The sell-off comes amid rising skepticism round Aster’s platform efficiency. Investor Mike Ess revealed on X (Twitter) that he bought 60% of his Aster holdings, rotating into Bitcoin (BTC) and Plasma (XPL).

Whereas he stays worthwhile, he stated his determination was pushed by intestine intuition after Changpeng Zhao’s current feedback and dissatisfaction with Aster’s product.

“For those who’ve used HYPE, then switched to Aster, you understand precisely what I imply. It feels slower, much less polished, and copy-paste… The extra capital I’ve on it, the riskier it feels,” wrote Ess.

Sponsored

Sponsored

Different merchants have echoed related issues. Clemente, one other famend voice on X, disclosed that he exited his Aster place solely in favor of Hyperliquid’s HYPE token.

“Hyperliquid is clearly the chief in each metric apart from crime and CEX distribution,” the analyst argued.

Combined Indicators From CZ

CZ’s involvement has been a double-edged sword. On September 28, the crypto government framed Aster as a complementary venture to the broader BNB Chain ecosystem regardless of rivaling the Binance exchange.

Sponsored

His enterprise agency, YZi Labs (formerly Binance Labs), holds a minority stake in Aster, which additionally boasts a crew of former Binance staff.

Nevertheless, merchants like Ess interpreted CZ’s tone on a current Spaces call as distancing, elevating doubts about his degree of engagement. For some, this notion was sufficient to spark de-risking.

“If CZ stops speaking about it, HYPE wins fingers down,” Ess warned.

Nonetheless, bullish voices stay. A consumer often called Cooker expressed conviction that Aster will make a long-term mark on the perp DEX market.

In the meantime, others, like Crash, argued that Aster may outperform Solana and Ethereum in share phrases over the subsequent cycle.

Sponsored

Sponsored

Robust Fundamentals, Lingering Uncertainty

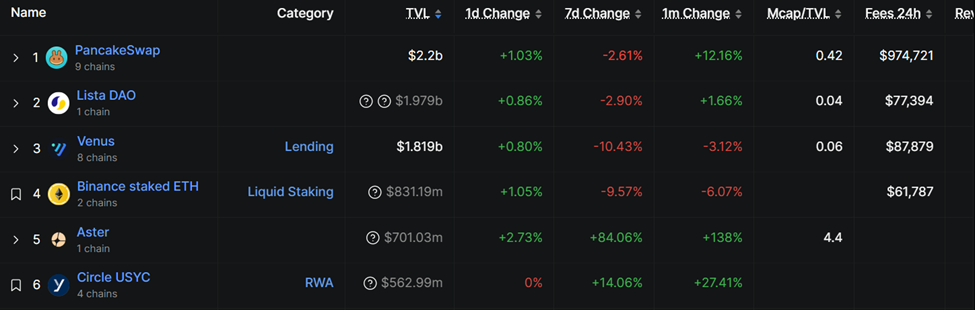

By a number of measures, Aster’s fundamentals stay strong. Since launch, the platform has generated over $82 million in charges, whereas whole worth locked (TVL) has ascended to $701 million on BNB Chain. For a venture solely weeks outdated, these numbers replicate vital adoption.

But the short drawdown highlights the problem of balancing early progress with consumer belief and product reliability.

Analysts warn that competition with Hyperliquid is intensifying, and with out continued product enchancment, momentum may fade.

Due to this fact, the Aster worth’s trajectory stays contested, with supporters seeing it as a daring new participant with CZ’s stamp of approval amid a fast-paced scaling ecosystem. However, skeptics say Aster could also be unfinished and overhyped.