Bitcoin worth loses steam after the spot Bitcoin ETFs’ approval and itemizing on exchanges, falling over 15% from $48,969 to $40,297. In a paradigm shift, buying and selling volumes dropped considerably on crypto exchanges.

Furthermore, there’s a story available in the market over Grayscale Bitcoin Belief (GBTC) promoting Bitcoin holdings, however CryptoQuant workforce asserts it’s not really the case. Additionally they predict a short-term correction.

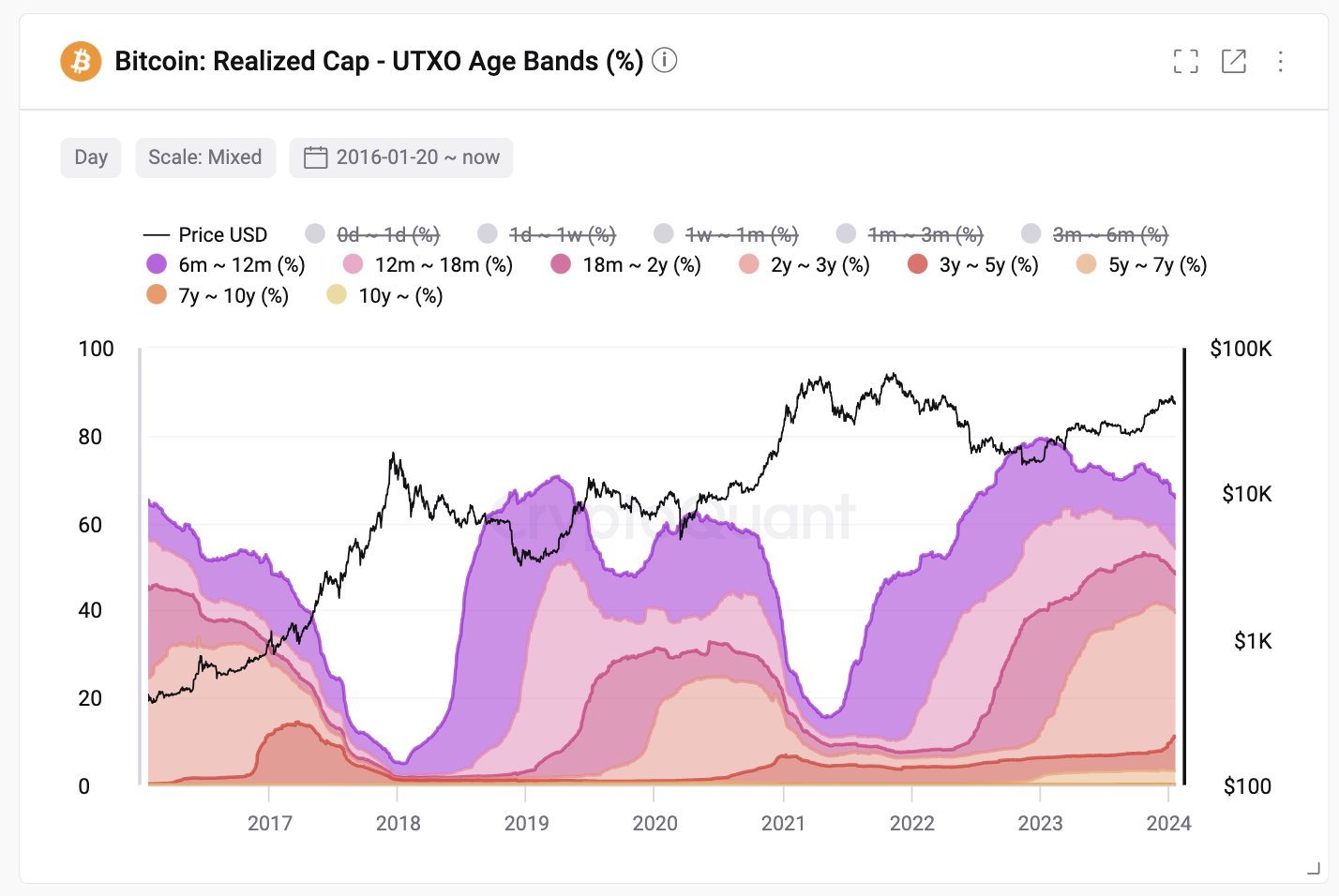

Bitcoin Promoting By Holders

CryptoQuant head of analysis Julio Moreno, stated it’s a flawed narrative circulating available in the market that the present Bitcoin worth correction is because of GBTC promoting Bitcoin holdings.

Grayscale Bitcoin Belief (GBTC) offered about 60K bitcoins, however different 10 spot Bitcoin ETFs akin to BlackRock, Constancy, Bitwise have a mixed internet buy of about 72K bitcoins. It signifies that the influx is certainly growing, with buying and selling volumes exceeding billions.

The Bitcoin selloff has come from holders together with short-term merchants and whales. They capitalized on the “sell-the-news” occasion to e-book revenue of the latest rally.

“A number of On-chain metrics and indicators nonetheless counsel the worth correction is probably not over or not less than {that a} new rally continues to be not on the playing cards. Quick-term merchants and enormous Bitcoin holders are nonetheless doing important promoting within the context of a risk-off perspective. Moreover, unrealized revenue margins haven’t fallen sufficient for sellers to be exhausted,” as per CryptoQuant insights.

Well-liked analyst CredibleCrypto famous that definitive knowledge is proving that ETF flows are internet constructive at +5,000 Bitcoin purchased per day since launch, which is 10 occasions the impact of the upcoming halving. Nevertheless, latest “PA doesn’t appear to mirror that. This actually proves that there are different, extra important components at play which have a better affect on PA within the brief/mid time period.”

Learn Extra: Spot Bitcoin ETFs See Inflows of $33.1 Million on Day 6

BTC Value To Witness Quick-Time period Correction

CryptoQuant founder and CEO Ki Younger Ju in a publish on January 20 revealed that Bitcoin in distribution section isn’t absolutely distributed to retailers. He warns a couple of short-term correction in BTC worth, after a 15% correction in the previous few days.

Nevertheless, he added that this long-term bull market cycle will proceed till Bitcoin is absolutely distributed to retailers. The long-term outlook stays constructive.

BTC price jumped 1% up to now 24 hours, with the worth at present buying and selling at $41,659. The 24-hour high and low are $40,297 and $42,134, respectively. Moreover, the buying and selling quantity has decreased by 16% within the final 24 hours, indicating a decline in curiosity amongst merchants.

Additionally Learn:

The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

✓ Share: