Crypto buyers lose $80 billion due to the crypto market selloff on Monday, with the market cap dwindling from $2.1 trillion to $2.03 trillion. Bitcoin and Ethereum costs noticed a sudden selloff amid one other assassination try on Republican presidential candidate Donald Trump at his Florida golf membership Sunday.

Furthermore, the crypto market worry & greed index has slipped from 51 (impartial) to 39 (worry) in a day. Altcoins equivalent to Solana (SOL), XRP, Cardano (ADA), and Dogecoin (DOGE) additionally dropped mirroring Bitcoin and Ethereum fall. Nevertheless, the merchants are upbeat general as they focus on the FOMC meeting and Jerome Powell’s choice on Wednesday.

Why Is Bitcoin Value Dropping?

Bitcoin value fell as merchants turned cautious forward of the highly-anticipated pivot from the Federal Reserve this week. The market expects charge cuts for the primary time since 2020, with hypothesis of a 50 bps charge minimize.

In keeping with CME FedWatch tool, there’s a 61% likelihood of a 50 bps charge minimize and 39% odds of a 25 bps in after the FOMC assembly. Additionally, the information signifies a complete of 125 bps Fed charge cuts this yr.

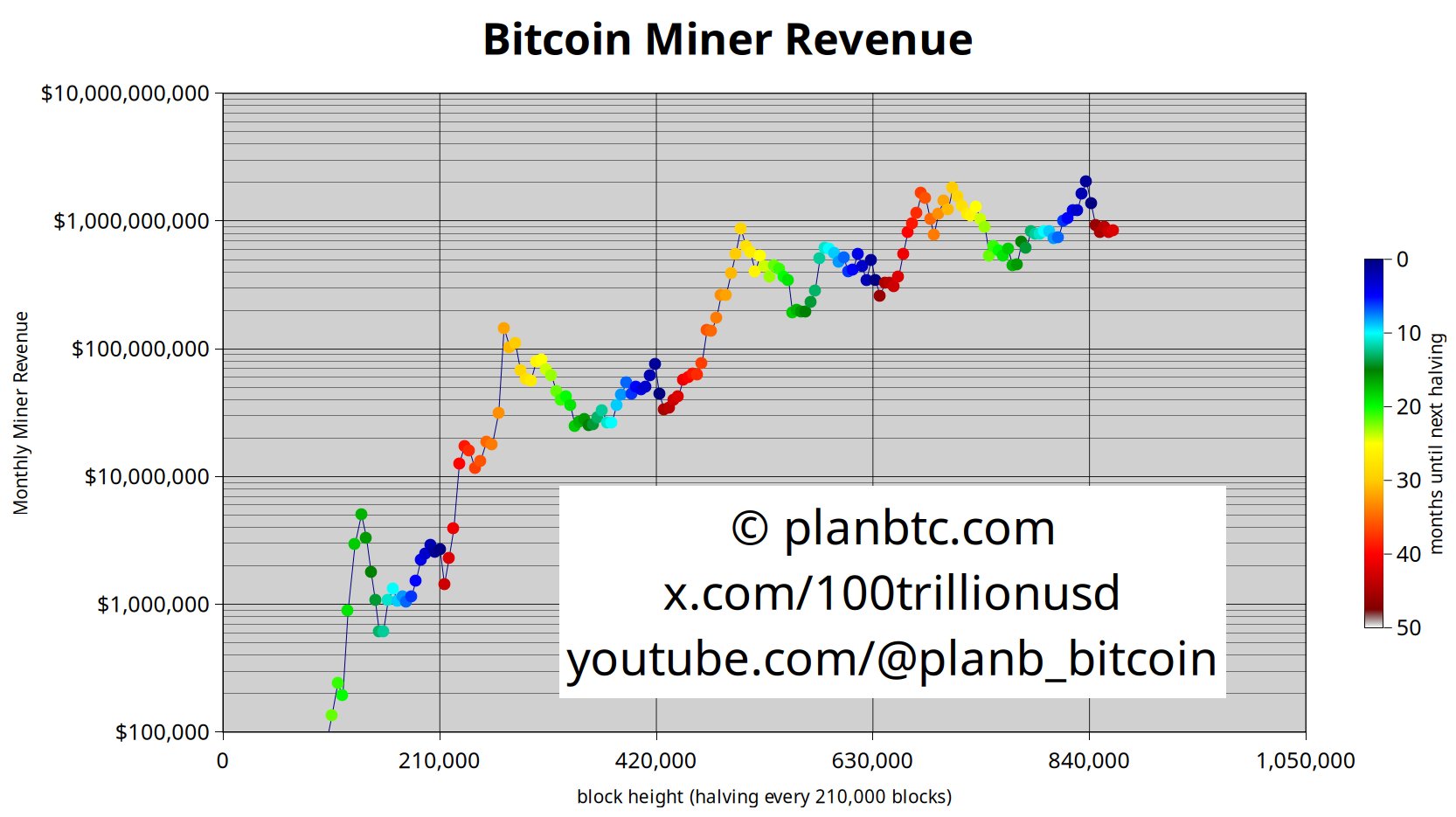

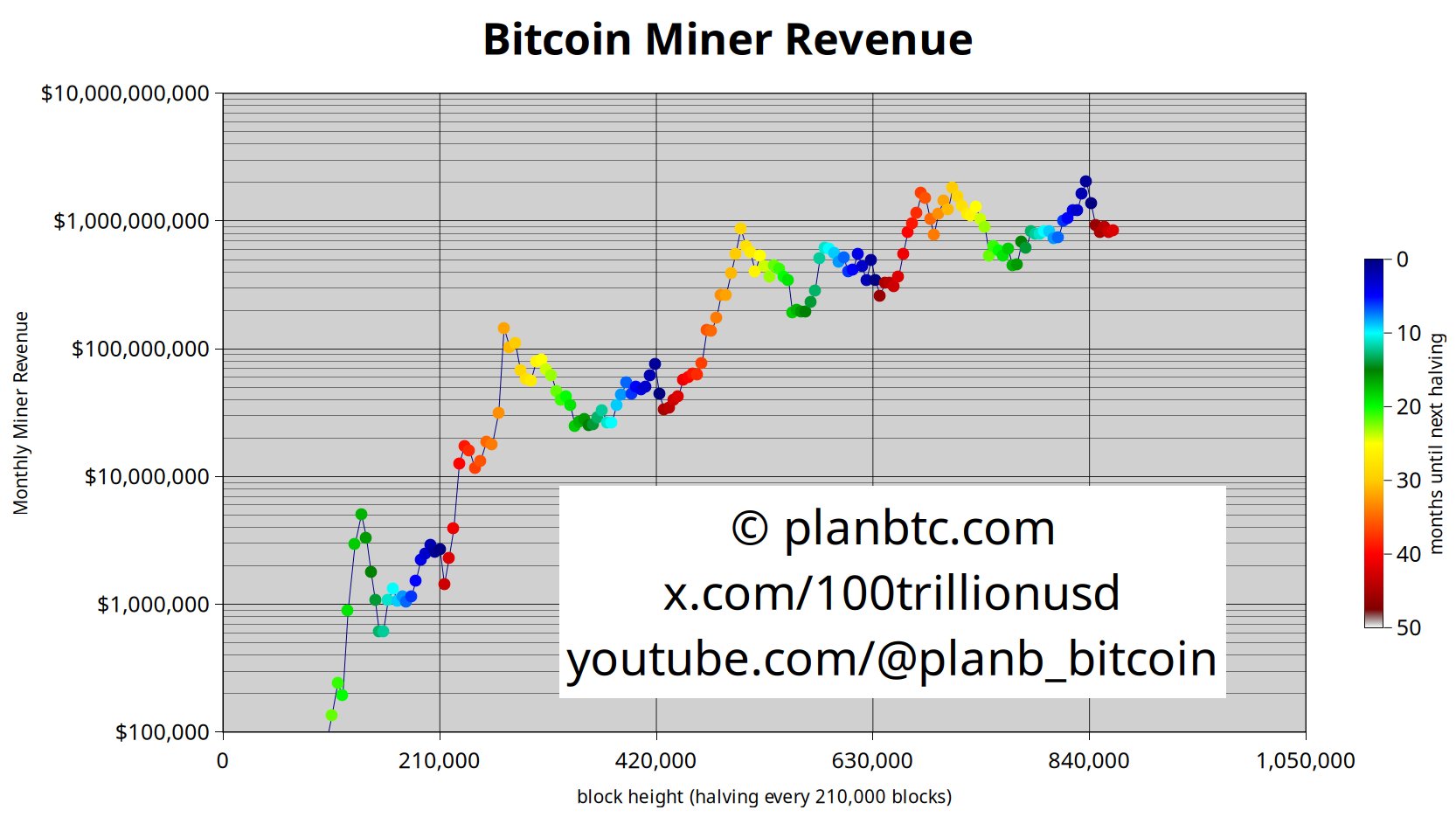

PlanB, creator of the bitcoin stock-to-flow (S2F) mannequin, shared a Bitcoin miner income chart on X. He warned that miners are nonetheless struggling after Bitcoin halving and liquidating their holdings steadily. He mentioned, “We want 2x present BTC value to kick-start the bull pump.” This aligns with historic patterns the place BTC value put up halving sustained miner profitability.

Crypto analyst Credible Crypto famous that BTC value retraced completely from the best $61-62K resistance zone. Nevertheless, the worth is at present holding above the $58,500 degree, which is essential to stop additional flush to the draw back.

Coinglass data reveals practically $35 million in BTC liquidation, with $30 million in longs liquidated. Bitcoin value fell to a 24-hour low of $58,112 as merchants bought BTC when the worth fell beneath 50-SMA (blue).

Furthermore, the worth efficiently reversed from the 0.618 Fib retracement degree to the 0.5 Fib retracement degree within the day by day timeframe. The worth is anticipated to maneuver sideways close to the $59,000 degree till the FOMC assembly. A 50 bps charge minimize will increase sentiment, however costs momentum will stay risky.

Why Ethereum Value Tumbled Beneath $2,300?

A dormant ‘diamond hand’ Ethereum whale has develop into lively after eight years and promoting its ETH holdings. Additionally, different whales have been bearish after Ethereum Basis and Vitalik Buterin bought ETH lately.

Well-liked analyst Ali Martinez famous that ETH value dangers dropping additional if it fails to carry key help between $2,290 and $2,360. Notably, 1.90 million addresses maintain round 52 million ETH on this vary. He added {that a} break beneath this demand zone may result in a wave of sell-off, driving the worth towards $1,800.

ETH price tumbled 6% prior to now 24 hours, with the worth at present buying and selling at $2,308. The 24-hour high and low are $0.643 and $0.664, respectively.

The autumn in Bitcoin value and Ethereum has triggered a fall in different altcoins equivalent to SOL, XRP, DOGE, and ADA. The market is to focus fully on the FOMC assembly for additional cues on path.

Disclaimer: The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: