Crypto market noticed a pointy correction, plunging the worldwide crypto market cap by greater than 8% to a low of $2.38 trillion. General the crypto market noticed over $250 billion in market worth misplaced within the latest selloff.

Bitcoin worth tumbled to $65,254o from $70,978 as a result of numerous causes together with choices expiry, historic Bitcoin halving patterns, macroeconomic elements, and technical chart weak spot. Bitcoin triggered a selloff within the crypto market, with Ethereum worth plunging 12%. This prompted altcoins SOL, XRP, ADA, DOGE, SHIB, and others to fall 15-30%. Meme cash are among the many most liquidated cryptocurrencies within the final 24 hours.

Crypto Market Selloff Began by Choices Expiry and Prolonged by Different Elements

The crypto market really began displaying indicators of weak spot forward of U.S. CPI information earlier this week. Bitcoin price rise to $72k was a range-bound motion in response to rising Bitcoin ETF influx and demand for lengthy positions as a result of FOMO surrounding Bitcoin halving, as reported by CoinGape.

Consultants corresponding to Benjamin Cowen, Peter Brandt, and Arthur Hayes predicted a downfall, presumably a market crash, if BTC worth repeats the same chart sample seen throughout earlier Bitcoin halving occasions and most not too long ago spot Bitcoin ETFs itemizing. Cowen predicted BTC worth might drop beneath $60,000 after the halving.

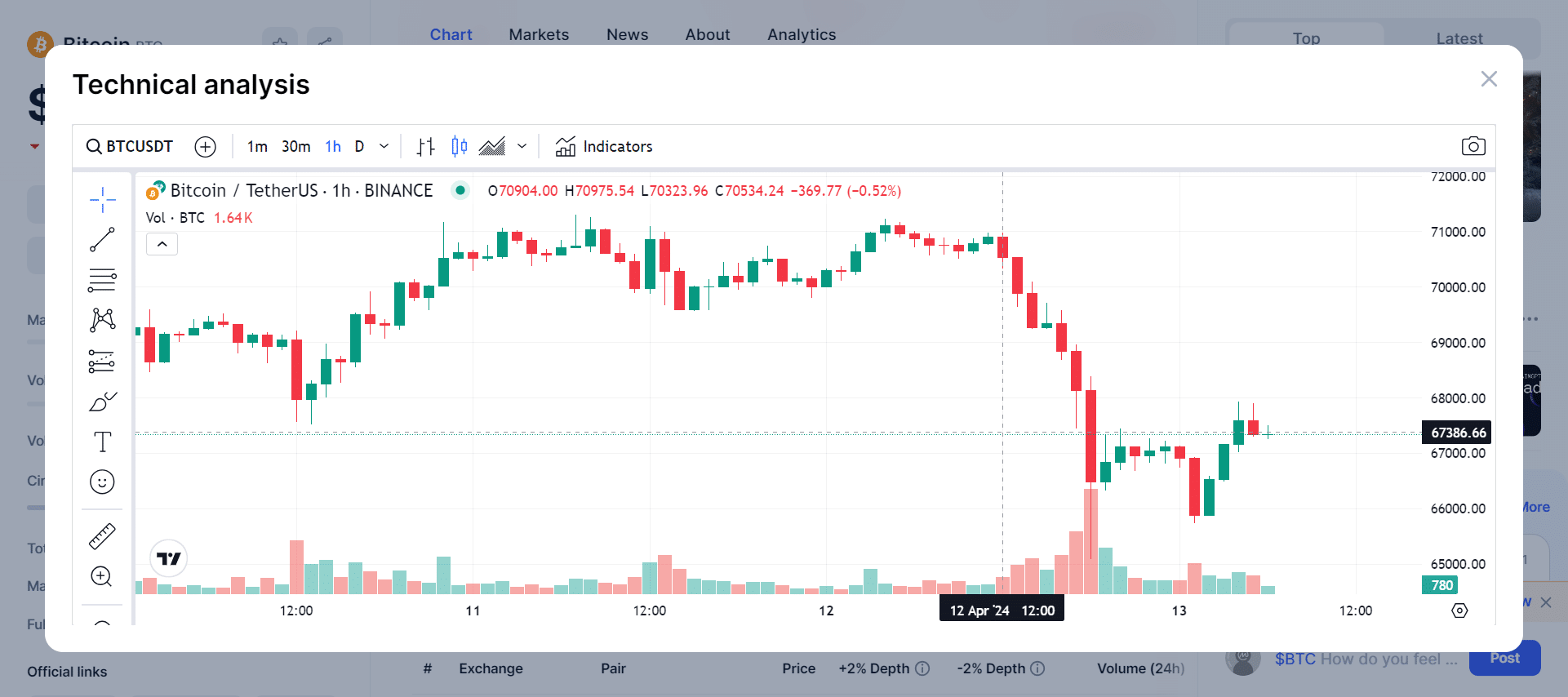

CoinGape additionally predicted a drop in BTC and ETH costs after options expiry. The crypto market selloff began with choices expiry at 12 PM UTC, as clearly proven within the above chart. The explanations have been decrease max ache factors than the buying and selling costs, dominant promote trades within the derivatives market amid low volumes, and subdued sentiment after the hotter CPI.

BTC worth broke key help ranges at $70,400 and $68,200 and additional prolonged the selloff as a result of geopolitical tensions within the Center East and destructive sentiment after earnings reviews from main banks. JPMorgan Chase shares fell 6.47% on Friday.

The worldwide macroeconomic occasions prompted US greenback index (DXY) to climb above 106, the very best stage since early November, and the US 10-year Treasury yield jumped to a 6-month excessive of 4.585%. As Bitcoin strikes reverse to DXY and Treasury yields, an increase in each has prompted a downfall in Bitcoin worth to $65k, triggering a crypto market crash.

Crypto Value Correction Not Over But

Coinglass information reveals greater than $950 million have been liquidated throughout the crypto market amid this sturdy correction. Of those, $830 million lengthy positions have been liquidated and practically $120 million brief positions have been liquidated within the final 24 hours.

Over 297K merchants have been liquidated and the biggest single liquidation order occurred on crypto change OKX as somebody swapped ETH to USD valued at $7.19 million.

QCP Capital stays structurally bullish however believes deleveraging dips can go deep, significantly as a result of extent of the bull run this yr. It means that merchants seeking to hedge short-term draw back should think about BTC worth on the Could 31 expiry.

Markus Thielen, CEO of 10x Analysis, says Bitcoin miners might promote $5 billion in Bitcoin after the halving occasion, with whales main the selloff.

BTC price at the moment trades at $67,211 and continues to stay below selloff strain if worth stays beneath help and fails to cross above the 20-simple shifting common. ETH price trades at $3,252 on the time of writing.

Additionally Learn: GBTC Outflows Surge Past $16 Billion, Defies CEO’s ‘Equilibrium’ Comment

- Four Ethereum Whales Dump $106 Million Worth ETH, Sub $3000 ETH Price Soon?

- GBTC Outflows Surge Past $16 Billion, Defies CEO’s ‘Equilibrium’ Comment

- Crypto Market Crash: Here’s Why Bitcoin, ETH, SOL, XRP, SHIB Fell Sharply

- Crypto Prices Today April 13: Bitcoin Dips To $67K, ETH At $3200, SOL, XRP, ADA Crash

- Dogecoin Whales Shift 324 Mln DOGE Amid Price Slip Below $0.18, What’s Next?

The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

✓ Share: