Crypto market selloff intensified step by step as world affairs, macroeconomic occasions, and technical weak spot spurred panic amongst traders. The worldwide crypto market misplaced greater than $100 billion during the last 24 hours, with market cap falling to $2.05 trillion.

Bitcoin and Ethereum costs dropped greater than 4% to hit intraday lows of $58,207 and $2,513, respectively. Different prime altcoins akin to BNB, SOL, XRP, TON, and ADA fell 4-7% within the final 24 hours. Main selloffs have been seen in AI cash and meme cash.

Listed below are the the explanation why the crypto market will stay below stress and additional liquidation might proceed within the coming days.

Hypothesis Over Financial institution Of Japan Charge Hike Subsequent Yr

Whereas the Bank of Japan (BOJ) cleared that they gained’t increase rates of interest this 12 months after the current market turmoil, Yen carry trades nonetheless hang-out markets. Specialists and merchants anticipate a second wave of crypto market selloff as folks have swapped on money and carry commerce after Bitcoin ETF launch.

Former BOJ board member Makoto Sakurai not too long ago stated “They gained’t have the ability to hike once more, no less than for the remainder of the 12 months.” Nevertheless, it’s nonetheless unclear whether or not Financial institution of Japan can do another fee hike subsequent March.

Japan’s Monetary Companies Company Commissioner Hideki Ito additionally took a cautious stance on approving crypto ETFs and cited no long-term worth and investor safety issues. The transfer got here throughout the current market meltdown after fee hike by Japan.

Geopolitical Tensions, US Recession Fears, and Extra

The crypto market selloff continues amid the Russia-Ukraine struggle, with current tensions relating to fireplace at Europe’s largest nuclear energy plant. Russia and Ukraine accused one another of beginning a fireplace at Russian-occupied Zaporizhzhia nuclear energy plant in Ukraine.

A number of stories now declare that Israel expects a significant Iranian assault to be launched inside days. As per a report by The Times of Israel, it may occur presumably earlier than renewed ceasefire-hostage deal talks are held on Thursday.

In the meantime, Hindenburg Analysis’s allegations instantly on the SEBI Chairperson of getting stake in obscure offshore entities linked to Adani cash siphoning scandal raised dangers. SEBI Chief Madhabi Puri Buch denied these allegations. However Hindenburg Analysis in a brand new put up on X platform claimed that Buch’s new statements increase important questions on her consulting firms and involvement.

US recession fears nonetheless exist as some economists believe the economic system may very well be in recession, contradicting CEOs and businesspeople’s view that the US economic system is resilient and there aren’t any indicators of recession. The crypto market additionally awaits the roles numbers this week for additional knowledge on the labor market situations.

US Inflation Knowledge Could Drive Additional Crypto Market Selloff

The week has key US macro readings this week. The US Producer Value Index (PPI) on Tuesday, US CPI inflation data on Wednesday, Preliminary Jobless Claims and U.S. Retail Gross sales on Thursday. The US Federal Reserve to contemplate these earlier than deciding on its financial coverage plans. Decrease inflation knowledge to cease crypto market selloff.

In line with the CME FedWatch Software, there are 53.5% odds of a 25 bps fee lower and 46.5% odds of fifty bps fee lower by the Federal Reserve at their September assembly.

Bloomberg’s newest survey of economists confirmed that almost four-fifths of respondents anticipated the Federal Reserve to solely lower rates of interest by 25 bps in September. Furthermore, the common estimate confirmed that the chance of an emergency fee lower earlier than the September assembly was solely 10%.

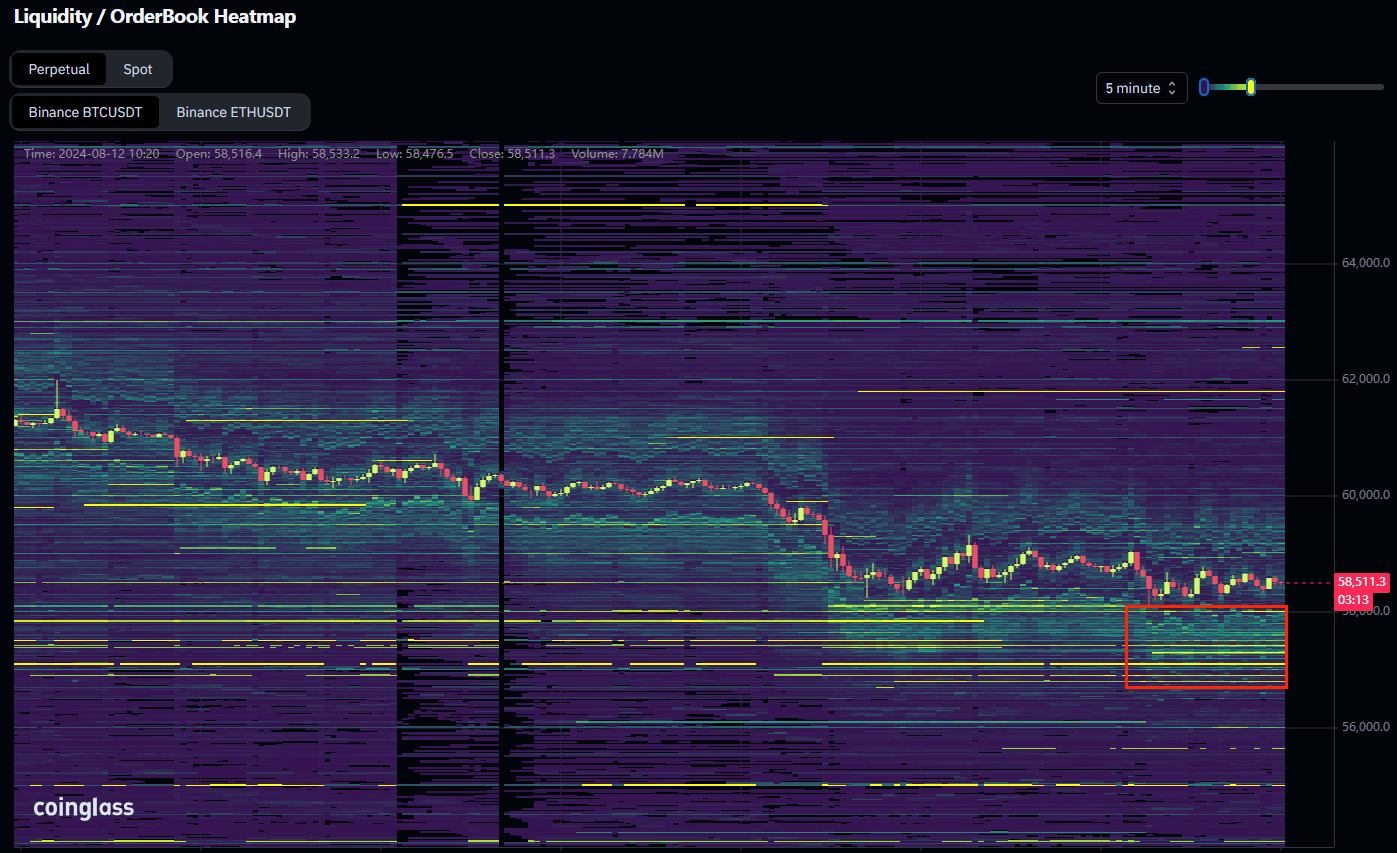

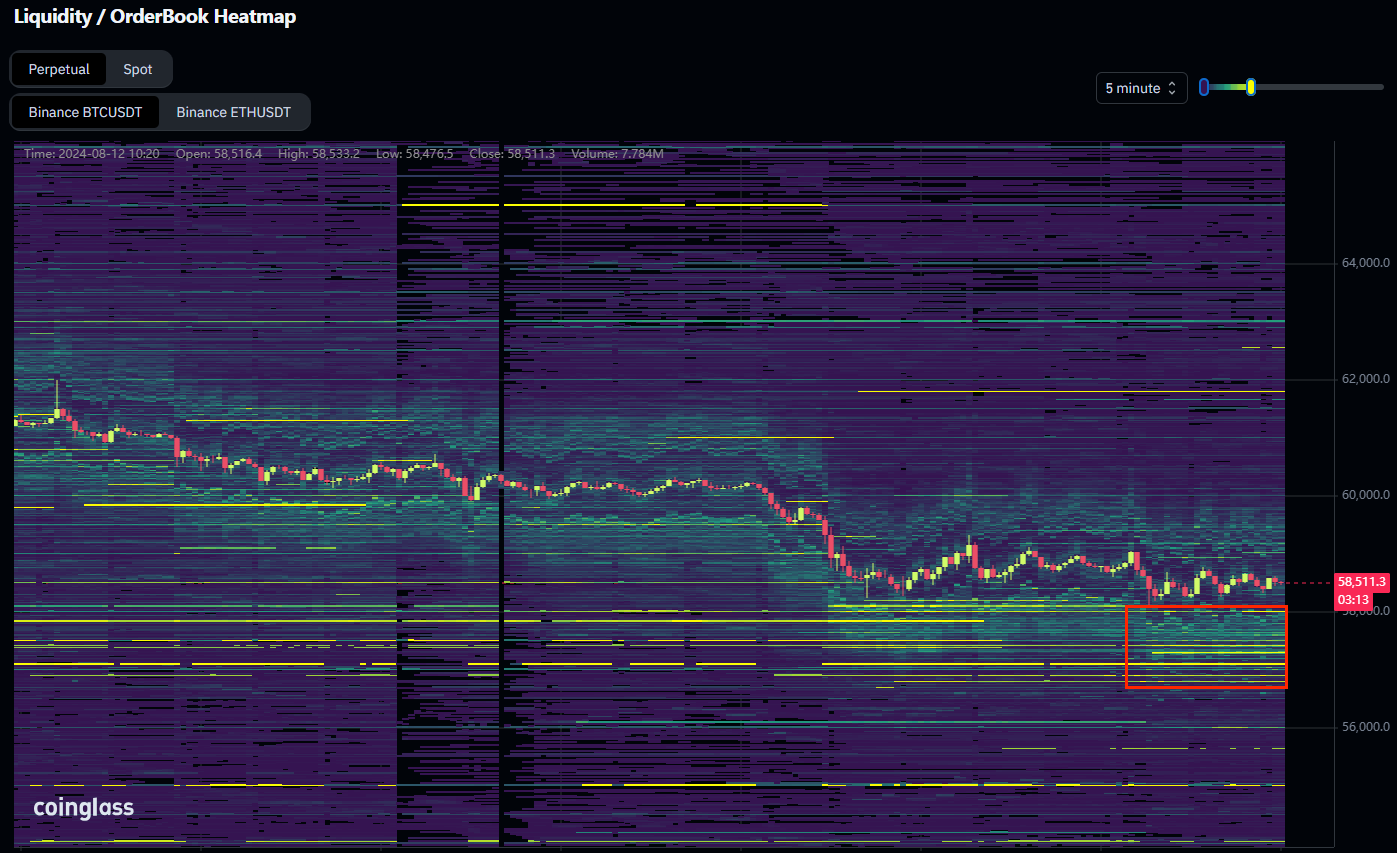

CoinGlass stories that BTC Liquidity / OrderBook Heatmap signifies weak spot. It predicts that BTC price can additional drop to $56,800. Nevertheless, if the bounce is powerful, BTC will take a look at increased ranges. Nevertheless, the costs may drop to decrease ranges, if the bounce is weak. Notably, Bitcoin death cross may set off additional crypto market selloff.

Furthermore, $2 billion in BTC longs dangers getting liquidated under $58,600, as per BTC trade liquidation map knowledge. Within the final 24 hours, 61k merchants have been liquidated as whole liquidation rose above $166 million for prime cryptocurrencies. The most important single liquidation order occurred on crypto trade OKX for ETH-USD-SWAP commerce valued at $2.17 million.

Disclaimer: The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.

✓ Share: