The crypto market noticed large retracement after the spot Bitcoin ETFs listings, with market cap tumbling again to $1.66 trillion from $1.82 trillion. Altcoins similar to Ethereum rebounded amid Bitcoin dominance slipping beneath 50%.

Bitcoin value has traded sideways close to $42,500 all through the week and merchants look to build up beneath $40,000, however specialists predict the times of the short-term influence of Bitcoin ETF approval are largely over.

Why Crypto Market Is Down Immediately

The buying and selling volumes throughout cryptocurrencies took a success attributable to components together with volatility, earnings season, and macro. Robust US greenback inflicting promoting stress on Bitcoin. The US greenback index (DXY) reverses again above 103.50 from 101 in early January.

Nonetheless, Coinglass knowledge and newest macro knowledge point out that Bitcoin promoting stress is easing steadily. Within the final 24 hours, the crypto market noticed over $100 million in complete liquidation, with 75% longs and 25% shorts liquidated. Bitcoin recorded $22 million liquidation and Ethereum noticed $20 million liquidation. Nonetheless, the pattern is altering as quick liquidation is rising within the final 12 hours.

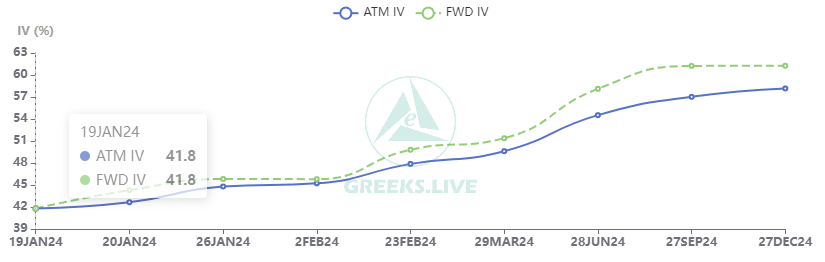

BTC’s volatility degree dropped to a brand new low previously month, with each main phrases RV and IV displaying important declines, and short-term IV plummeting to beneath 45%.

In response to futures and choices knowledge, the short-term influence of the spot Bitcoin ETF is basically over. The funding price seems to be engaging to merchants and a shopping for will begin quickly. BTC futures and choices open pursuits (OI) each are rising once more within the final 4 hours. BTC OI throughout exchanges together with CME, Binance, and Coinbase are recovering, with a 0.35% leap to $18.31 billion of complete BTC futures open curiosity.

In distinction, Ethereum open curiosity (OI) fell over 2% within the final 24 hours, with a complete ETH OI of $8.85 billion. Nonetheless, Solana and XRP OI are rising once more and costs might make a comeback quickly.

Additionally Learn: GBTC Outflows Make Way Into Spot Bitcoin ETFs, Bitwise Records $68 Million Inflows

Bitcoin and Crypto Appears Promising

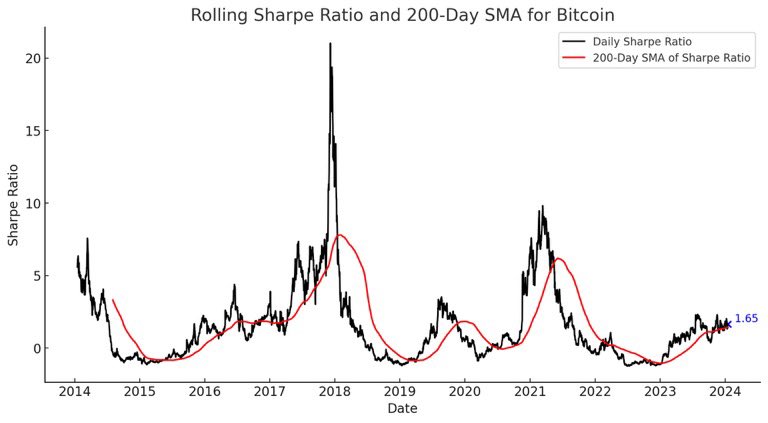

Fashionable analyst Crypto Birb stated the cyclical nature of risk-adjusted returns of Bitcoin seems to be promising for the following 12-18 months. He predicts that if historic patterns come into impact, holding BTC after the 4th halving and till 2026 is tremendous bullish.

High analyst and dealer Michael van de Poppe stated “Persons are bearish on Bitcoin and have a unfavourable outlook. Don’t be like that. Purchase the dip and maintain.”

The ETFs on #Bitcoin have a internet influx of $782 million over the primary three days.

That is greater than 50% increased than ALL ETFs mixed have completed in 2023 when it comes to quantity.

Persons are bearish on #Bitcoin and have a unfavourable outlook.

Do not be like that. Purchase the dip and maintain.

— Michaël van de Poppe (@CryptoMichNL) January 17, 2024

BTC price is at present buying and selling at $42,745. The 24-hour high and low are $42,189 and $42,880, respectively. The buying and selling quantity stays low forward of Friday’s expiry. Bitcoin gaining upside momentum will convey a pullback throughout altcoins, with the primary trace of Ethereum open curiosity falling.

Additionally Learn: Bitcoin Miners On A Aggressive Selling Spree, BTC Hashrate Tanks 34%

The offered content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: