On-chain knowledge exhibits the Bitcoin HODLers are presently displaying web accumulation conduct, as they develop their holdings by 15,000 BTC per thirty days.

Bitcoin Lengthy-Time period Holders Have Been Accumulating Just lately

In line with knowledge from the on-chain analytics agency Glassnode, these traders have been beforehand aggressively distributing through the bear market lows. The HODLers, or extra formally, the “long-term holders” (LTHs), make up a Bitcoin cohort that features all traders which have been holding onto their cash since no less than 155 days in the past.

The LTHs make up one of many two foremost holder teams out there; the opposite cohort is named the “short-term holder” (STH) group and naturally contains solely traders that purchased their BTC lower than 155 days in the past.

Statistically talking, the longer a holder owns a coin, the much less probably they turn into to promote it at any level. Which means that the LTHs are the extra resolute bunch of the 2 teams, which is why they’re referred to as the “HODLers” or the diamond fingers of the market.

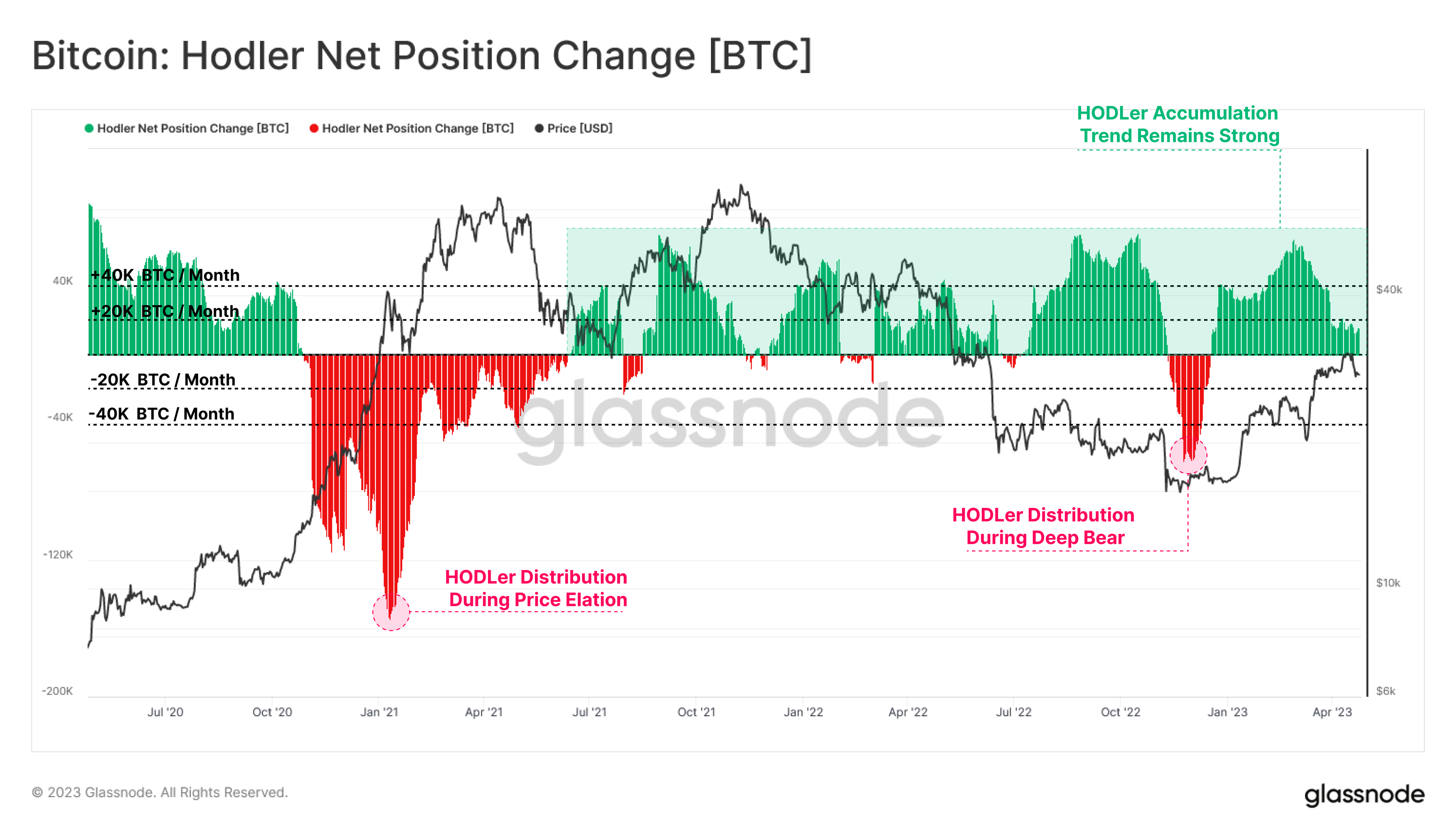

As these traders are an vital a part of the sector, their actions might be price monitoring. An indicator referred to as the “HODLer net position change” measures the month-to-month price at which these traders are shopping for or promoting a web quantity of Bitcoin proper now.

The chart beneath exhibits the pattern on this metric over the previous few years:

The worth of the metric appears to have been inexperienced in current months | Supply: Glassnode on Twitter

When the HODLer web place change has a constructive worth, it means these traders are receiving inflows into their holdings presently. However, destructive values recommend a web variety of cash are exiting the availability of the LTHs.

As displayed within the graph, the Bitcoin HODLer web place change had a deep pink worth through the bear market lows that adopted the November 2022 FTX crash. Which means that the LTHs had been promoting throughout this era.

This sharp destructive spike has been an exception to the long-term pattern, nonetheless, because the HODLers have truly been displaying an total robust accumulation conduct over the previous couple of years. The final time these traders participated in constant distribution was through the bull rally within the first half of 2021.

From the chart, it’s seen that after the aforementioned temporary interval of distribution on the bear market lows, the LTHs switched again to accumulation simply earlier than the present rally started.

These diamond fingers have continued so as to add to their holdings all through the rally to this point, displaying that they haven’t been allured by the profit-taking alternative. This is usually a bullish signal for the long-term sustainability of the rally.

Although, very just lately, the month-to-month quantity that they’ve been including to their holdings has been trending down. Nonetheless, the indicator’s worth nonetheless stays constructive, because the Bitcoin LTHs are accumulating at a price of 15,000 BTC per thirty days presently.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $29,100, up 1% within the final week.

BTC has seen some heavy fluctuations through the previous day | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com