The biggest sensible contracts token, ETH, is down 0.4% on Tuesday after bulls misplaced the battle round $1,900. Regardless of the pullback from the weekly excessive of $1,943, Ethereum value nonetheless upholds an 8% achieve in seven days.

As the value wobbles at $1,865 and merchants usher within the European session, Ethereum price is facing two conflicting scenarios.

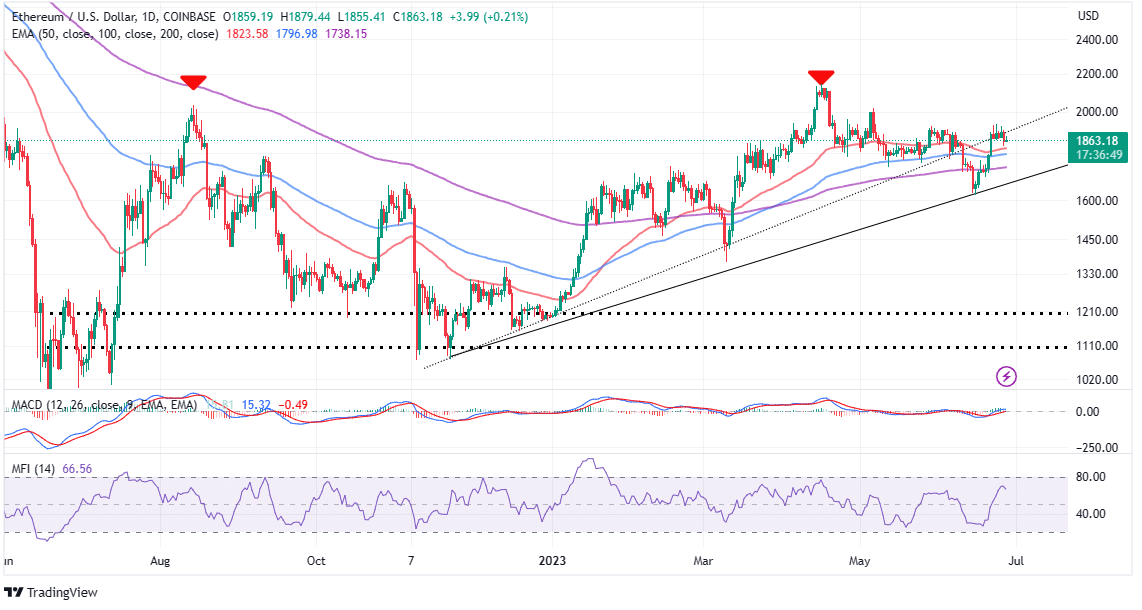

Reclaiming resistance above $1,900 may clear the trail to $2,000. On the flip aspect, dropping assist on the 100-day Exponential Transferring Common (EMA), which is grounded at $1,800, would possibly depart ETH susceptible to declines concentrating on decrease likes resembling $1,730 and $1,600.

Ethereum Staking Accelerates Put up-Shapella Improve

Based on blockchain analysis platform Messari, Ethereum staking has been bettering because the Shapella improve, which occurred in April. Earlier than this community replace that allowed traders to freely stake and unstake Ether, “staking progress was sluggish and perceived as riskier.”

Nonetheless, market circumstances modified and improved drastically following the implementation of the Shapella improve. Customers now have the liberty to “comfortably stake and unstake ETH,” thus accelerating the speed of staking.

On-chain information reveals that Might 2023 noticed the best month-to-month influx because the Shapella improve went dwell.

Previous to Shapella-enabled withdrawals, $ETH staking progress was sluggish and perceived as riskier.

Put up Shapella, customers can comfortably stake and unstake $ETH. This freedom has really accelerated the speed of $ETH staked, with Might 2023 seeing the best month-to-month internet influx. pic.twitter.com/z3iULVOPL0

— Messari (@MessariCrypto) June 27, 2023

An elevated staking charge signifies that traders desire to HODL Ethereum versus storing the tokens on exchanges the place they are often offered simply. Equally, information from one other analytics platform, Santiment, shows that the largest non-exchange addresses have been rising the extent of provide they maintain.

Alternatively, prime non-exchange wallets have seen the availability they account for dwindle and is close to genesis ranges. Santiment says that “ETH provide on exchanges is all the way down to 9.2%.

Ethereum Worth Slows Pullback As $3,000 Beckons

Ethereum value wobbled above $1,900 over the weekend, which handed the baton to bears, who began exerting extra overhead strain on Monday. This, coupled with resistance emanating from the higher rising and dotted trendline, forced ETH to explore downhill levels, testing assist supplied by the 50-day EMA (pink) at $1,823.

The Relative Energy Index (RSI) affirms the rising bearish grip because it abandons the uptick to the overbought area, settling for retracement throughout the impartial zone. Merchants ought to take into account ETH’s response to assist on the 50-day EMA, and particularly the customer congestion on the 100-day EMA (blue) round $1,800.

If push involves shove and Ethereum slips below those two key levels, traders might begin conditioning themselves for an prolonged pullback. On the intense aspect, these retracements are unlikely to be bigger, contemplating the improved market construction for Ether and the remainder of the crypto market usually.

The Transferring Common Convergence Divergence (MACD) upholds the bullish outlook because it settles above the imply line (0.00). With the MACD line in blue above the sign line in pink, the trail with the least resistance can be to the upside.

In that case, a break above the psychological barrier at $2,000 would pave the way for the next recovery phase to $3,000.

Associated Articles

The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.