Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

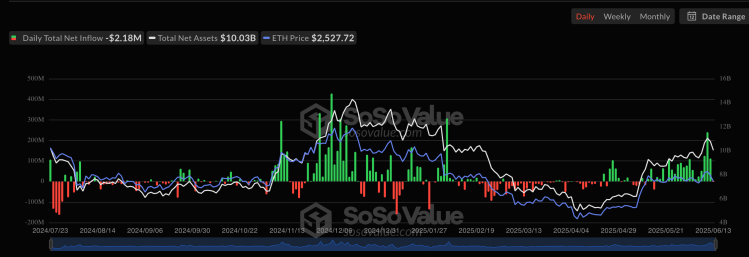

The Ethereum value has not been capable of keep its red-hot begin to the yr’s second quarter, with the altcoin’s worth nonetheless just about round the place it was in the beginning of June. This sluggish efficiency comes regardless of the constant capital inflows witnessed by the US-based spot Ethereum exchange-traded funds (ETFs) prior to now 4 weeks.

ETH ETFs Snap 19-Day Constructive Influx Streak

Nonetheless, this constructive document got here to an finish on Friday, June thirteenth, with the spot ETH ETFs registering their first internet outflow prior to now 20 days. Based on the most recent market information, the crypto-linked monetary merchandise posted a complete every day internet outflow of $2.14 million to shut the week.

Associated Studying

This spherical of withdrawals may very well be linked to the escalating tensions between Israel and Iran on Thursday night, with threat property like crypto and shares feeling many of the affect. Data from SoSoValue exhibits that the Constancy Ethereum Fund (with the ticker FETH) contributed to many of the withdrawals on the day, recording a internet outflow of $8.85 million.

Grayscale’s Ethereum Mini Belief (ETH) was the one different fund that recorded any important exercise, posting a constructive internet influx of $6.67 million on Friday. Cumulatively, the actions of those two exchange-traded funds led to a damaging outflow day, ending the 19-day constructive influx streak.

Nonetheless, this single-day efficiency barely made a dent within the Ethereum ETFs’ record over the past week, which stands at $528.12 million. This important efficiency extends the exchange-traded funds’ weekly streak to 5 consecutive weeks of constructive inflows — registering a complete capital inflow of $1.384 billion in that span.

Ethereum Worth And Rising Spot ETF Demand

As seen with Bitcoin and its spot ETFs, the Ethereum value tends to react to the exercise of the ETH exchange-traded funds buyers. As such, durations of serious capital inflows for the spot ETFs have been correlated with upward price movements for the cryptocurrencies.

Nonetheless, the value of Ethereum didn’t precisely comply with this pattern throughout its current 19-day interval of considerable capital inflows. This constructive streak began on Could 16, with the Ethereum value ranging between the $2,500 and $2,600 area on the day.

Associated Studying

Whereas the altcoin’s value has exceeded this stage since then, it has not been capable of mount a sustained upward run. Not too long ago, the Ethereum value broke above the $2,800 stage on Thursday, June 12, earlier than crashing down in direction of $2,500 because of the navy actions in Asia.

As of this writing, the value of ETH stands at round $2,511, reflecting an over 1% decline prior to now 24 hours. With the Ethereum value nonetheless just about the place it was in the beginning of the constructive ETF influx streak, there’s a fear about what may very well be holding again the second-largest cryptocurrency.

Featured picture created by Dall-E, chart from TradingView