The introduction of Spot Bitcoin exchange-traded funds (ETFs) in the USA marked a historic milestone for the cryptocurrency market. These Spot Bitcoin ETFs, which first went live within the US on January 11, 2024, have had large success in only one 12 months, making them the best ETF launch in historical past.

Associated Studying

Because it stands, US-based Spot Bitcoin ETFs have now develop into one of many main drivers of Bitcoin’s worth development and performed an enormous function in Bitcoin’s break above $100,000. Moreover, these US-based Spot Bitcoin ETFs are actually collectively the biggest holders of Bitcoin.

Efficiency Metrics Of US-Based mostly Spot Bitcoin ETFs

For years, the US Securities and Change Fee (SEC) resisted the approval of Spot Bitcoin ETFs, making their eventual approval in January 2024 a notable turning level for the crypto business. Notably, the SEC authorized the primary 11 Spot Bitcoin ETF purposes on January 10, 2024.

All of the Spot Bitcoin ETFs have demonstrated a optimistic efficiency in their inaugural year apart from Grayscale’s GBTC. The launch of spot Bitcoin ETFs was met with record-breaking enthusiasm, as these funds registered the highest trading volumes of any ETF launch in historical past throughout their first few days of operation.

Other than opening the Bitcoin and crypto business to conventional traders who would in any other case not put money into cryptocurrencies, many massive Bitcoin holders additionally noticed the ETFs as one of the best ways to speculate with a purpose to reap the benefits of their regulatory readability.

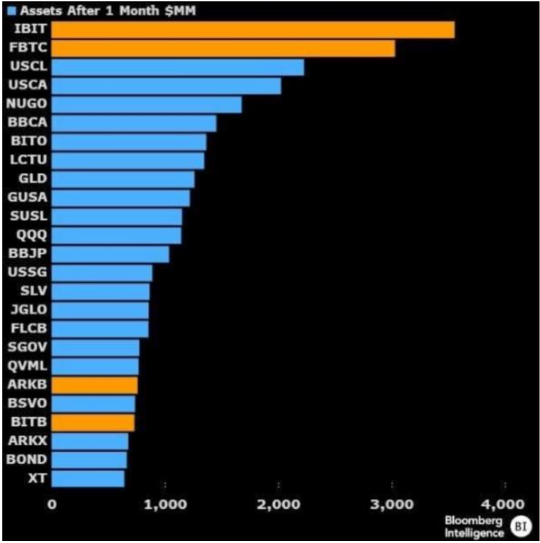

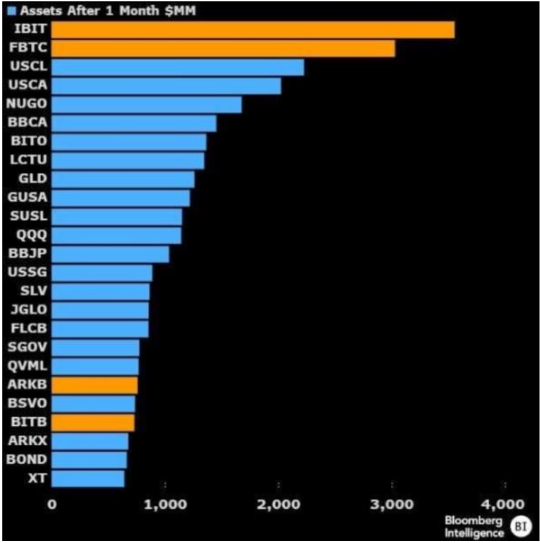

Notably, BlackRock’s iShares Bitcoin Trust (IBIT) and Constancy’s Constancy Sensible Origin Bitcoin Fund have led the charge with substantial inflows all year long. These two funds shortly established themselves as dominant gamers, with every witnessing over $3 billion in inflows inside their first 20 days of buying and selling.

On the time of writing, US-based Spot Bitcoin ETFs now collectively management about $107.64 billion in Bitcoin property, which represents about 5.75% of the overall Bitcoin market cap, based on data from SoSoValue. Since they started buying and selling one 12 months in the past, these ETFs have witnessed a cumulative complete internet influx of $36.22 billion.

By way of cumulative internet inflows, the IBIT has witnessed the best influx quantity within the tune of $37.67 billion, whereas FBTC follows behind with $12.16 billion. These two have been sufficient to stability the $21.57 internet outflows from the pre-existing Grayscale Bitcoin Belief, which was transformed to a Spot Bitcoin ETF.

Different ETF suppliers have additionally witnessed cummulative internet inflows prior to now 12 months, with ARK 21Shares Bitcoin ETF and Bitwise Bitcoin ETF additionally at $2.49 billion and $2.43 billion, respectively, on the time of writing. Nevertheless, the remaining seven ETF suppliers have but to cross the $1 billion threshold in cumulative internet inflows, indicating a extra uneven distribution of investor curiosity throughout the business.

Associated Studying

The place Do Spot Bitcoin ETFs Go From Right here?

The one means for Spot Bitcoin ETFs is up, particularly on the longer timeframe in 2025 and past. Crypto traders are optimistic a few vital inflow of capital into these ETFs in anticipation of crypto-positive policies to be introduced by the incoming Trump administration.

On the time of writing, Bitcoin is buying and selling at $94,057.

Featured picture from Pexels, chart from TradingView