The crypto market rebounded barely on Tuesday and confirmed indicators of shopping for exercise returning to the market, in distinction to a weak US inventory market right now. The worldwide crypto market cap is at $2.04 trillion, pared the sooner 1.50% improve during the last day.

Traditionally, September has been a bearish month for the crypto in addition to for the opposite asset courses. At the moment, the market sentiment factors to “concern” amongst traders, with the Worry & Greed Index dropping to 26 right now from 48 (impartial) final week.

Crypto Market Flashes Indicators of Bearishness

QCP Capital predicts the downtrend of the crypto market to progressively fade in September itself. That is based mostly on historic information of the strongest bullish seasonality in October. Bitcoin worth has recorded optimistic returns and a median acquire of twenty-two.9% in 8 out of 9 instances in October month traditionally.

Regardless of the September bear sentiment, the seasonality play has led to constant name shopping for within the quantity market. QCP reveals that the buying and selling desk noticed one other 150x $80K requires December lifted right now.

“If this sample performs out once more this yr, it will be strategic to build up in the course of the September dip and take earnings in October or towards the year-end.”

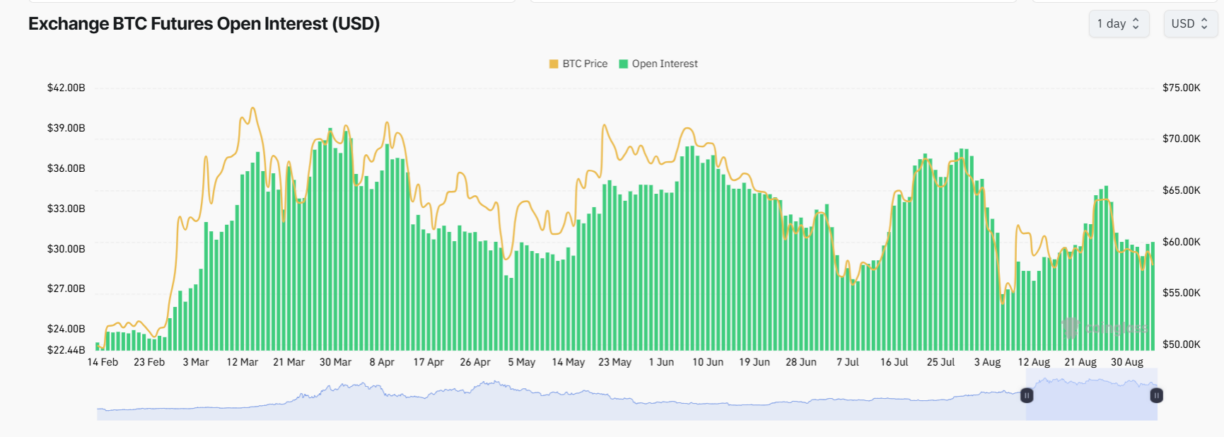

This is the reason the full BTC futures open curiosity noticed a 1% improve within the final 24 hours regardless of damaging sentiment. Whereas the shopping for on CME stays uninteresting, futures demand on exchanges like Binance, Bybit, and OKX stays intact, as per Coinglass data. This means derivatives merchants are nonetheless shopping for whereas remaining cautious attributable to uncertainty within the crypto market.

Bitcoin Drops After US ISM Manufacturing PMI Information

US shares prolonged losses on Tuesday, with all three main indexes falling greater than 1% after the ISM Manufacturing PMI confirmed manufacturing unit exercise slowed for a fifth consecutive month. ISM Manufacturing PMI got here in at 47.2 in August, lacking market expectations of 47.5.

As CoinGape reported Financial institution of Japan Governor Kazuo Ueda affirmed that the central financial institution will elevate rates of interest additional. Two-thirds of economists surveyed pointed to a rate hike by the BOJ by the top of the yr. Notably, 41% of economists anticipate the speed hike in December.

Coinglass information exhibits greater than $100 million have been liquidated throughout the crypto market amid this selloff. Of those, $66 million lengthy positions have been liquidated and almost $44 million brief positions have been liquidated on Tuesday.

Over 40K merchants have been liquidated and the biggest single liquidation order occurred on crypto trade Binance as somebody bought ETH for USDT valued at $1.84 million.

BTC price struggles to interrupt above $60,000 amid uncertainty within the crypto market. BTC has pared right now’s positive factors, falling to the intraday low of $57,568. Moreover, the buying and selling quantity has decreased by 10% within the final 24 hours, indicating a decline in curiosity amongst merchants.

An vital statement on the #Bitcoin 2-month chart: the Stochastic RSI has simply signaled a development reversal from bullish to bearish. Traditionally, previously 10 years, this has preceded a major correction of round 75.50%! pic.twitter.com/YxlwMFxTEl

— Ali (@ali_charts) September 3, 2024

Disclaimer: The offered content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: