The MSTR inventory has outperformed all corporations on the S&P 500 because the MicroStrategy Bitcoin adoption started in 2020. The software program firm has continued to build up the flagship crypto because of its former CEO and co-founder, Michael Saylor. This transfer has paid off to this point, contemplating MSTR’s efficiency since then.

MSTR Inventory’s Efficiency Since MicroStrategy Bitcoin Adoption

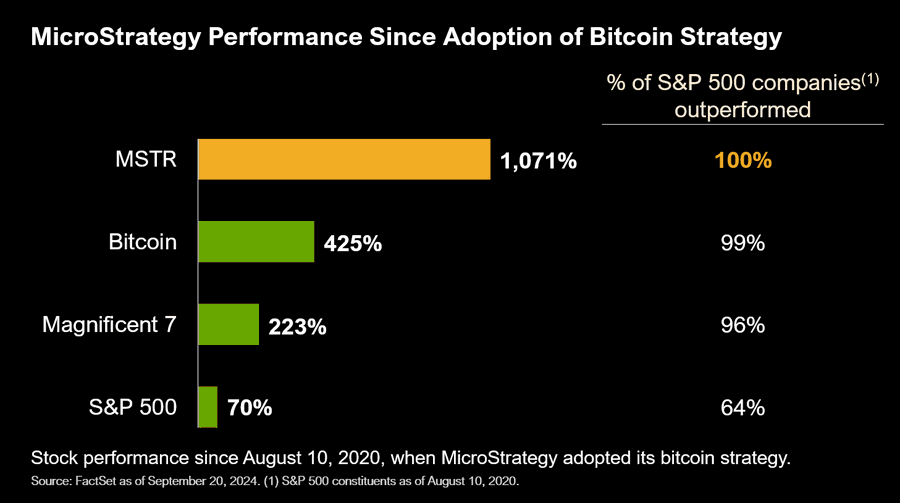

In an X publish, Micheal Saylor highlighted MSTR’s efficiency because the software program firm adopted Bitcoin in 2020. Based mostly on the info he shared, MicroStrategy’s inventory has outperformed 100% of the S&P 500 corporations since they started buying BTC.

Apparently, the MSTR stock price has additionally outperformed Bitcoin during the last 4 years. Since MicroStrategy Bitcoin adoption, the corporate’s inventory has surged by over 1,000%. In the meantime, BTC and the S&P 500 have surged by 425% and 70%, respectively.

MicroStrategy’s co-founder, Michael Saylor, pushed for the software program firm to start shopping for the flagship crypto, and his guess on BTC has undoubtedly paid off. Due to this Bitcoin technique, many institutional traders have lengthy regarded the corporate as an avenue to realize publicity to the flagship crypto. This explains how the MSTR inventory has achieved such immense progress.

There have been projections that MicroStrategy was going to lose its Bitcoin edge following the launch of the Spot Bitcoin ETFs. Nevertheless, that hasn’t been the case, with MSTR boasting a year-to-date (YTD) acquire of over 120%.

In the meantime, MicroStrategy Bitcoin adoption has continued to develop. The company recently bought 7,420 BTC ($458.2 million). Earlier than this buy, it had additionally purchased $1.11 billion price of Bitcoin, its single largest purchase to this point. The agency presently holds 252,220 BTC at a median worth of $39,266 per Bitcoin.

Michael Saylor Expects Institutional Adoption To Develop

Michael Saylor not too long ago claimed that the approval of choices buying and selling for BlackRock’s Spot Bitcoin ETF will “speed up” Bitcoin adoption. The SEC approved options for the IBIT ETF on the Nasdaq change, which is predicted to develop the Bitcoin ETF market and additional appeal to extra institutional traders, similar to Saylor predicts.

Bloomberg analyst Eric Balchunas shared an identical sentiment, remarking that the choices buying and selling will “appeal to extra liquidity, which can in flip appeal to extra massive fish.”

Binance CEO Richard Teng additionally not too long ago said that the institutional adoption witnessed to this point is simply the tip of the iceberg. He expects extra institutional traders to allocate crypto quickly sufficient as soon as they’ve accomplished their due diligence.

Nevertheless, it stays unlikely that any of those establishments can match MicroStrategy Bitcoin funding. For context, the corporate holds virtually 1.2% of BTC’s whole provide.

Disclaimer: The introduced content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.

✓ Share: