Ethereum value is struggling to maintain help at $1,830 intact, while the entire crypto market continues with its longstanding lull. Because the rejection from $2,000 round mid-July, restoration makes an attempt have been minimal, with the least resistance path primarily downward.

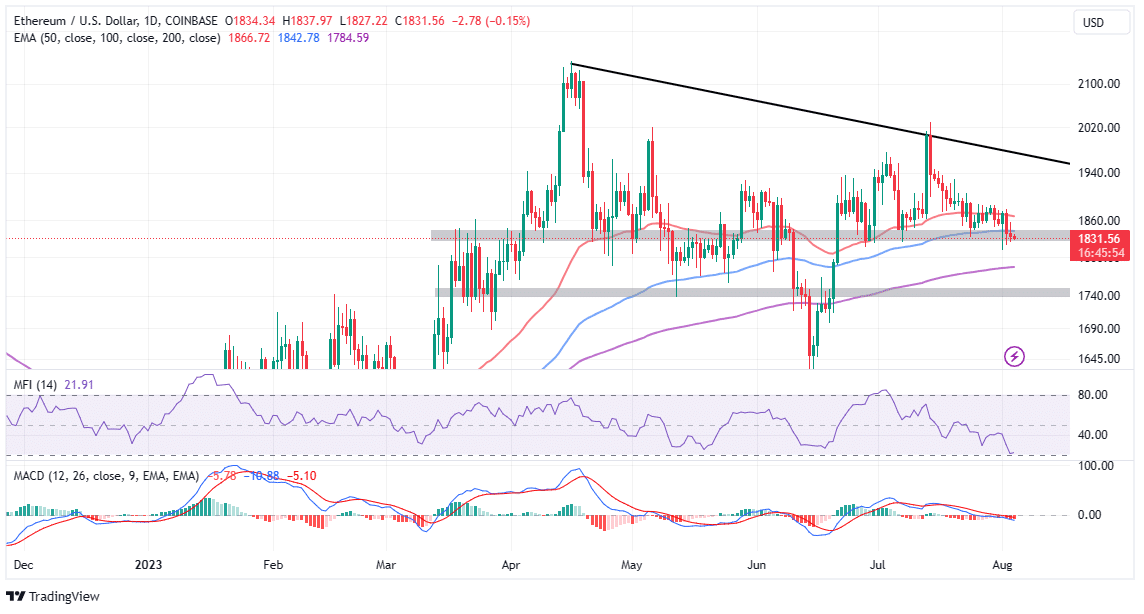

Primarily based on the prevailing technical image, bears have the higher hand, particularly with Ethereum price under all the key transferring averages such because the 50-day EMA (crimson), the 100-day EMA (blue), and the 200-day EMA (purple).

Help at $1,830 is essential for the resumption of the uptrend, but when declines intensify, the customer congestion at $1,800 will turn out to be useful.

Ethereum Worth Last Capitulation

The crypto winter has lasted properly over two years with attribute to many assaults on the blockchain ecosystem, together with the Terra crash “by which governments are stepping in with a regulatory framework… to guard traders,” Michaël van de Poppe, a well-liked analyst instructed traders on Friday.

Buyers Perspective in Crypto Markets Follows Historical past

I’ve seen many individuals suggesting that we’ll see Bitcoin drop to $12,000 and altcoins to have one other capitulation. I don’t assume we’ll have that and on this put up I’ll clarify why. 👇

Altcoin traders are slowly dropping… pic.twitter.com/eP6pR14Zr5

— Michaël van de Poppe (@CryptoMichNL) August 3, 2023

This push to manage the market, though comprehensible, is exerting a number of stress to the extent of risking the survival of the crypto ecosystem.

Along with the lately resolved matter between Ripple and the SEC, the regulator is suing Coinbase and Binance, and the DoJ has been investigating the latter exchange platform. In all this, proposals for Ethereum and Bitcoin exchange-traded funds (ETFs) have surged previously couple of months, bringing establishments like Blackrock and Valkyrie into the business.

Ethereum and most different altcoins, in accordance with Poppe, “have been trending downwards for 18-24 months straight.

Nonetheless, one notable basic issue is that the availability on trade continues to shrink to the bottom ranges whereas staking each on the Ethereum protocol and liquid staking platforms like Lido soar to the very best ranges for the reason that implementation of the Shanghai upgrade.

The mundane market construction represents “the second stage of capitulation, which is time.” Buyers will proceed to really feel like markets are unresponsive, with some shunning crypto for different business sectors.

As for traders, maybe excluding merchants, it’s sensible to maintain calm and be affected person with the market. Accumulation, in accordance with Poppe the most effective technique for the time being, with establishments like Blackrock leaping in.

What’s Subsequent for Ethereum Worth in The Brief Time period?

The bearish outlook in each the Shifting Common Convergence Divergence (MACD) and the Cash Move Index (MFI) hints at declines persevering with to $1,800 within the brief time period. Along with the promote sign, the MACD holds under the imply line (0.00), additional reinforcing the bearish grip.

If bulls handle the arrest the bearish scenario at $1,830 merchants can put together to hunt contemporary publicity to ETH longs after the worth steps above the 100-day EMA. The following break above the 50-day EMA at $1,866 would function affirmation for a stronger uptrend to be validated by restoration previous the descending trendline for positive factors above $2,000.

Associated Articles

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.