Hyperliquid (HYPE) is taking the market by storm as its month-to-month income surpasses $110 million, with perpetual buying and selling quantity hitting $2.5 trillion.

Dubbed crypto’s new “killer app,” the platform opens up explosive progress alternatives whereas elevating questions on dangers and sustainability.

Sponsored

Sponsored

Hyperliquid Surges

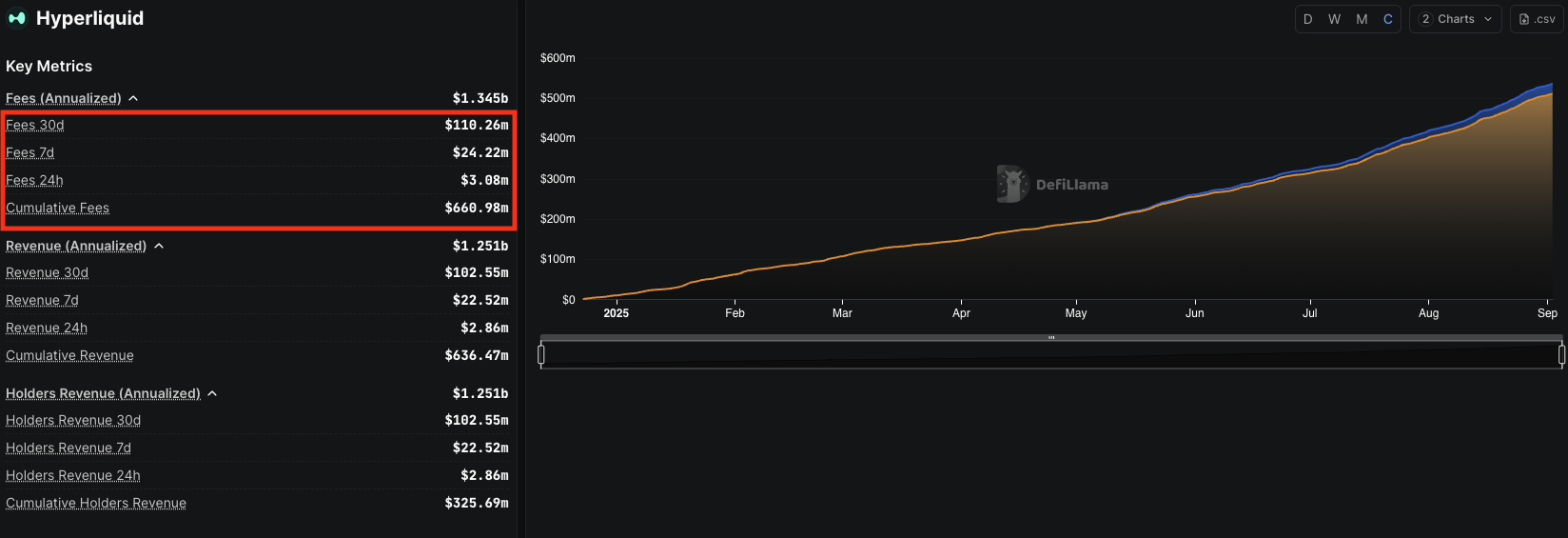

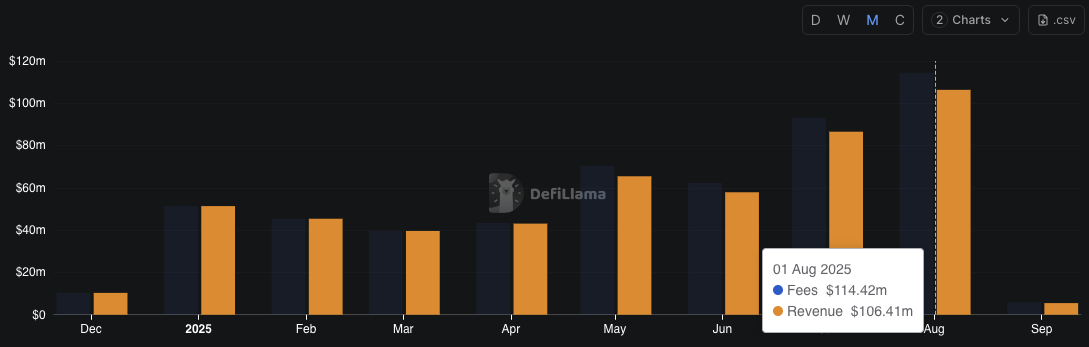

Up to now 30 days, Hyperliquid’s income exceeded $110 million, bringing its cumulative income to almost $661 million. This can be a uncommon progress trajectory for a non-custodial perp DEX. Information from DefiLlama reveals that the protocol’s charge technology continues to rise steadily regardless of the market’s “gradual summer season.”

In response to DefiLlama, in August alone, Hyperliquid’s income and costs reached $106 million and $114 million, respectively. These numbers had been larger than July’s $86 million and $93 million. In July, Hyperliquid accounted for as a lot as 35% of the total revenue throughout the blockchain sector.

Sponsored

Sponsored

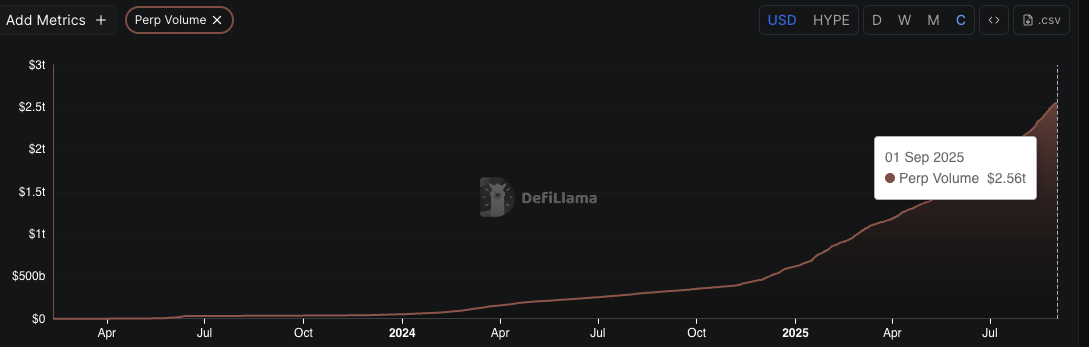

Past income and costs, Hyperliquid’s perpetual quantity has surpassed $2.5 trillion. In actual fact, in line with a user on X, even throughout the so-called “gradual summer season,” the platform nonetheless recorded greater than $1 trillion in buying and selling exercise.

This progress highlights a stark distinction to DEX exercise on Solana. In response to Will Clemente, whereas Solana-based DEXs have declined in exercise for the reason that memecoin frenzy earlier this 12 months, Hyperliquid’s customers and volumes have been “trending up and to the appropriate all 12 months just about.”

The Subsequent Potential App?

Hyperliquid’s latest surge has additionally sparked blended reactions. With its easy product, CEX-like expertise, and skill to develop its ecosystem shortly, Hyperliquid has the potential to turn out to be crypto’s new “killer app.”

Sponsored

Sponsored

Nonetheless, from one other perspective, some customers argue that Hyperliquid nonetheless faces structural dangers resembling admin management and potential downtime. In actual fact, Hyperliquid faced a brief frontend outage that prevented customers from putting, closing, or withdrawing orders, though backend operations continued unaffected.

“If Hyperliquid goes down can customers withdraw funds? (e.g., submit proofs). If Hyperliquid turned evil, can they steal consumer funds?” X consumer Ryan questioned.

In the meantime, competitors within the perp DEX race is heating up with new entrants like Lighter. With options resembling order match/liquidation verification and unified yield–margining, Lighter is taken into account a “formidable competitor.”

Hyperliquid’s scale benefit and present consumer base stay dominant, particularly as income and buying and selling volumes preserve momentum. If the execution milestones in its roadmap are carried out, Hyperliquid has the muse to proceed shaping crypto’s subsequent main momentum shift.

Regardless of this, HYPE is displaying indicators of retracement, at the moment buying and selling at $44.63 USD. Technicals confirmed $50–$51 as key resistance turned support, with targets at $55, $58, and $73 if bullish momentum sustains.