Ethereum is buying and selling beneath the $2,300 mark after failing to carry key demand ranges final week. The worth has confronted intense promoting strain, fueling considerations amongst buyers that ETH might not see a robust bull market forward. Market sentiment stays unsure as Ethereum struggles to reclaim misplaced floor, with analysts divided on whether or not the correction will proceed or if a restoration is on the horizon.

Associated Studying

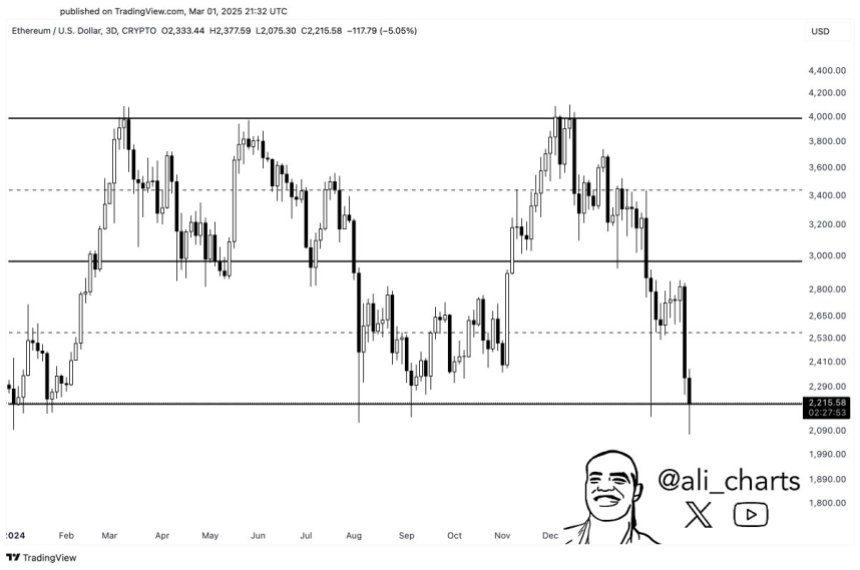

A technical perspective means that ETH should still have an opportunity to bounce again. Crypto analyst Ali Martinez shared an analysis on X, noting that if Ethereum holds above the $2,200 degree, it might arrange for a rebound towards $2,500. Martinez highlights that Ethereum is buying and selling close to a vital assist degree, which traditionally has triggered robust upward strikes.

Bulls should defend the $2,200 mark to forestall additional declines, whereas reclaiming $2,500 would sign power and a possible development reversal. Nevertheless, continued weak spot might result in one other wave of selling pressure, pushing ETH even decrease. Buyers stay cautious as they await affirmation of Ethereum’s subsequent transfer on this risky market.

Ethereum Faces A Crucial Take a look at

Ethereum has been struggling beneath heavy promoting strain and destructive sentiment, resulting in excessive speculative exercise favoring bearish futures positions. The uncertainty surrounding ETH’s value motion has fueled doubts about its potential to recuperate within the brief time period.

Associated Studying

Since late December, Ethereum has misplaced 49% of its worth, and investor sentiment stays in despair as the worth fails to reclaim key resistance ranges. Many merchants have began to place themselves for additional draw back, reinforcing the bearish outlook out there.

Nevertheless, some analysts nonetheless imagine that Ethereum might quickly stage a speedy restoration. Ethereum is approaching a crucial inflection level the place a decisive transfer might decide the asset’s subsequent development.

This angle aligns with the few optimistic analysts who argue that Ethereum’s rally, when it begins, can be aggressive. Traditionally, ETH has exhibited sharp rebounds following extended durations of draw back strain, and if the broader market circumstances enhance, the identical might occur once more. For now, buyers stay cautious, carefully watching Ethereum’s potential to defend the $2,200 assist degree and in search of indicators of renewed power.

Value Struggles Under $2,500

Ethereum is buying and selling at $2,222 after struggling for days to reclaim increased costs. The worth has been beneath intense promoting strain, and investor sentiment stays bearish as ETH fails to ascertain a robust assist zone. ETH bulls misplaced management final Monday when the worth began to say no quickly, resulting in a pointy 26% correction in lower than 5 days. This sell-off worn out key assist ranges, leaving Ethereum in a susceptible place.

For Ethereum to regain momentum, bulls should push the worth above the $2,500 degree. Reclaiming this mark would sign power and probably set off a restoration rally. Nevertheless, and not using a robust push from consumers, ETH might stay caught in a sluggish consolidation section beneath $2,500. This might possible result in extended indecision out there, making it troublesome for merchants to ascertain clear positions.

Associated Studying

If ETH fails to reclaim $2,500 quickly, the market might see continued weak spot, with sellers dominating value motion. However, if Ethereum manages to carry above the $2,200 mark and construct assist, the potential of a robust rebound stays on the desk. The following few days can be essential as buyers look ahead to indicators of a possible development reversal or additional draw back motion.

Featured picture from Dall-E, chart from TradingView