After the Privateness Coin wave, the place would possibly buyers flip subsequent? Knowledge from the primary week of November suggests the highlight could shift to Storage tokens.

At first of November, merchants who missed the Privateness Coin rally look like accumulating decentralized storage initiatives — long-established tokens out there which have but to get better their worth. Which altcoins are drawing consideration?

3 Promising Storage Altcoins for November

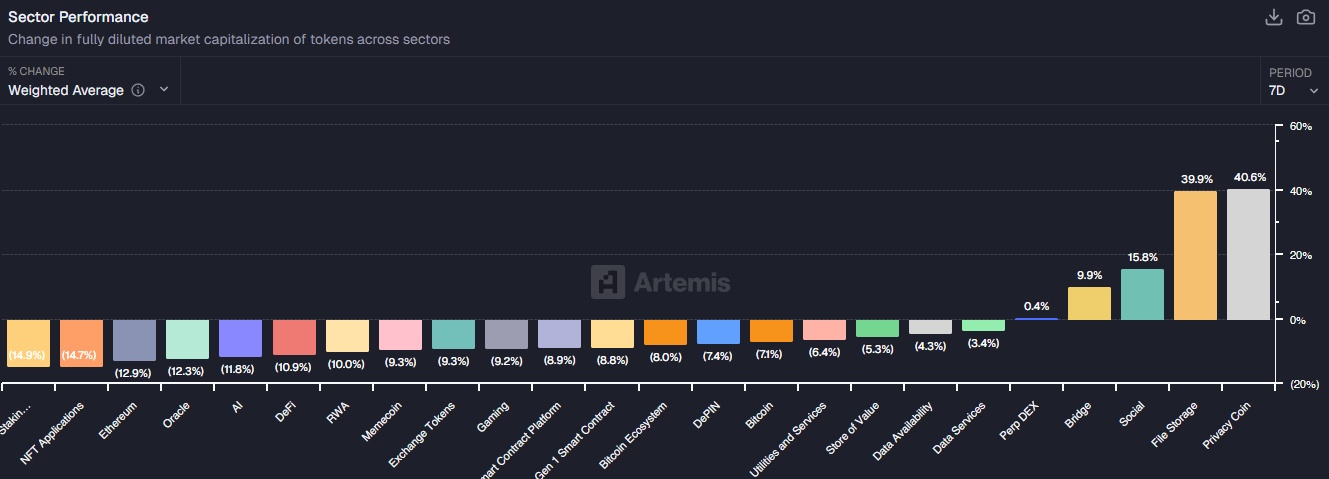

In keeping with Artemis information, Storage tokens have practically caught up with Privateness Cash through the first seven days of November, delivering a mean efficiency of virtually 40%.

Sponsored

Sponsored

These initiatives have real-world functions and generate income from clients, however their token costs have declined considerably.

“After Privateness tokens, File Storage tokens are additionally outpacing BTC,” investor iWantCoinNews predicted.

On this atmosphere, potential altcoins are those who present indicators of accumulation or breakout from long-term consolidation zones. Beneath are a number of notable examples within the decentralized storage sector.

1. Filecoin (FIL)

Knowledge from CoinGecko shows that Filecoin (FIL) is main the Storage Coin class in early November.

A current BeInCrypto report famous that FIL’s buying and selling quantity exceeded $1.4 billion. In the meantime, Grayscale has been rising its FIL holdings this month, reflecting rising investor demand.

Sponsored

Sponsored

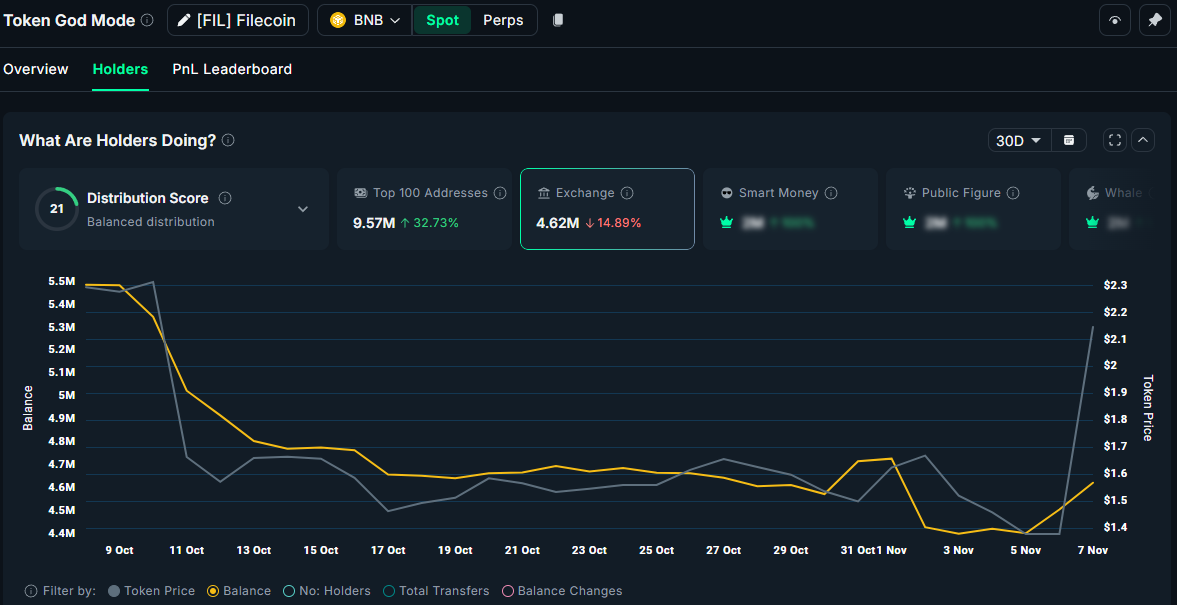

Moreover, Nansen information reveals that high FIL whale wallets have gathered over 32% extra tokens prior to now month, whereas the accessible FIL stability on exchanges has dropped by practically 15%.

These optimistic indicators have led analysts to foretell additional value will increase. CryptoBoss expects FIL to surpass $2.5 quickly and probably attain $5.

2. BitTorrent (BTT)

BitTorrent (BTT) is a decentralized data-sharing platform constructed on blockchain expertise and the BitTorrent protocol — one of many world’s oldest and hottest peer-to-peer (P2P) file-sharing techniques.

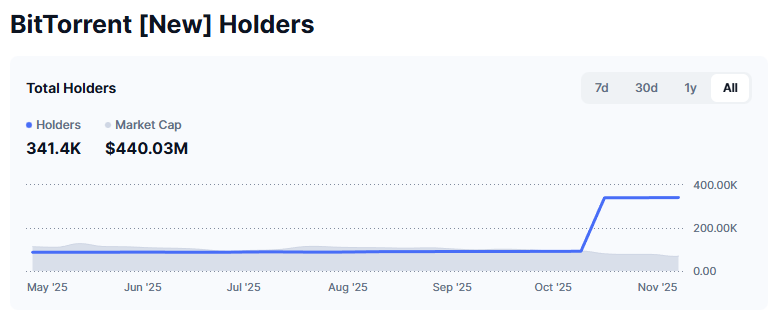

BTT stands out on this listing resulting from vital modifications in its holder information through the fourth quarter.

Sponsored

Sponsored

In October, the variety of BTT holders was round 91,000, however by November it had surged to 341,000.

Since June, the accessible BTT stability on exchanges has fallen by greater than 6%, whereas the highest 100 wallets have elevated their holdings by 5.8%.

These figures point out that buyers are actively accumulating BTT, regardless of the token’s 50% decline over the previous yr.

If this accumulation pattern continues and investor curiosity in Storage Cash stays excessive, BTT might have room for restoration.

Sponsored

Sponsored

3. Storj (STORJ)

Alongside Filecoin, Storj was one of many decentralized storage initiatives highlighted in NVIDIA’s report late final yr.

Santiment information reveals that regardless of STORJ’s extended downtrend, the variety of holders continues to climb, reaching a document excessive of over 103,000 in November.

The token value has additionally risen more than 20% prior to now 24 hours, signaling renewed optimism amongst buyers. Analysts have noticed a rotation of capital into Storage Cash, and STORJ could also be one of many subsequent beneficiaries.

“It’s evident that the storage narrative has began. First ICP > FIL > AR > Storj. Storj appears to be like like a high play amongst low caps with most ROI potential,” investor The BitWhale predicted.

The important thing query now could be how sturdy and the way lengthy the Storage Coin pattern will final. All of those initiatives share a standard threat — many holders are nonetheless caught at excessive entry costs from the earlier cycle. They might be prepared to maneuver tokens again to exchanges and exit if costs get better.