Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin bulls are trying to push higher from slightly below $97,000, trying to verify its newest breakout above a multi-day consolidation vary. After stalling close to $95,000 for over every week, Bitcoin broke out to $97,000 earlier than reversing and forming a good worth hole.

Associated Studying

This has led to a surge in exercise on the Bitcoin blockchain, and the subsequent outlook is whether or not the present structure holds for a continuation to $100,000 or if this momentum might falter at a zone of resistance.

Bitcoin Reaches 6-Month Peak In Community Exercise

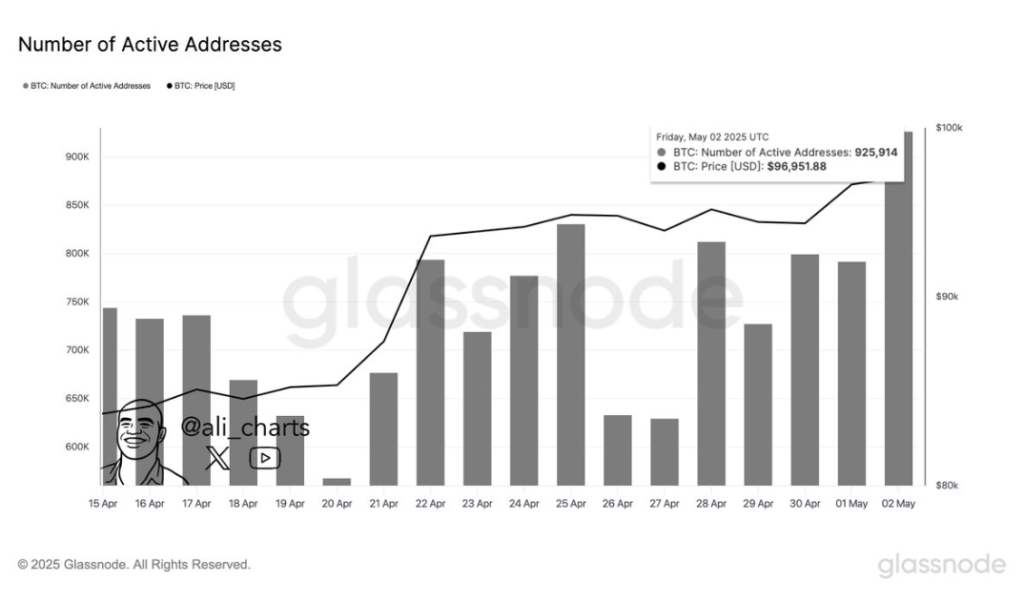

Some of the notable shifts in market dynamics got here from the on-chain facet. In line with crypto analyst Ali Martinez, Bitcoin just recorded its highest number of energetic addresses previously six months. As shared in a put up on social media platform X, Martinez famous that 925,914 BTC addresses had been energetic inside a single day, which is an unusually high level of engagement on the Bitcoin blockchain.

The accompanying Glassnode chart reveals how steep this surge has been, constructing on a gradual climb that began within the final week of April. Curiously, the spike in Bitcoin exercise coincides with its latest reclaim of the $95,000 value vary.

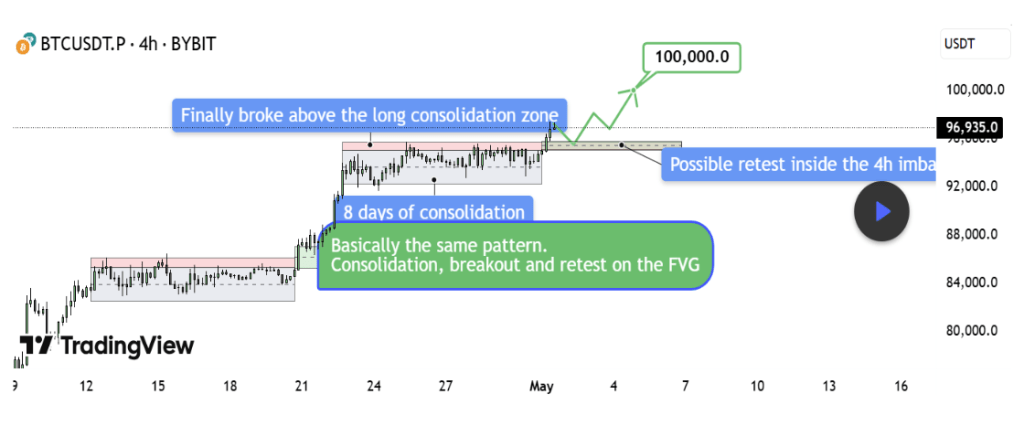

Including to the bullish case, crypto analyst TehThomas shared a compelling technical evaluation that pointed to a breakout continuation toward $100,000. Interpretation of the BTCUSDT 4-hour timeframe exhibits an nearly equivalent construction to the one seen in mid-April.

Again then, Bitcoin consolidated close to $86,000, broke out, left behind a good worth hole (FVG), retested the hole, and rallied practically $10,000. A mirror image of this pattern is at the moment unfolding. The Bitcoin value compressed beneath $95,000, broke via resistance, and created a contemporary FVG between $94,200 and $95,000.

TehThomas famous that the secret’s to not chase the breakout however to attend for a clear retest of the brand new FVG. If consumers defend that space as they did earlier this month, the street to $100,000 is structurally intact. Nonetheless, regardless that the construction at the moment favors the bulls, the state of affairs might flip bearish if Bitcoin drops again into the previous vary beneath $94,000.

Chart from TradingView

Bearish Golden Pocket Setup Highlights Danger Forward

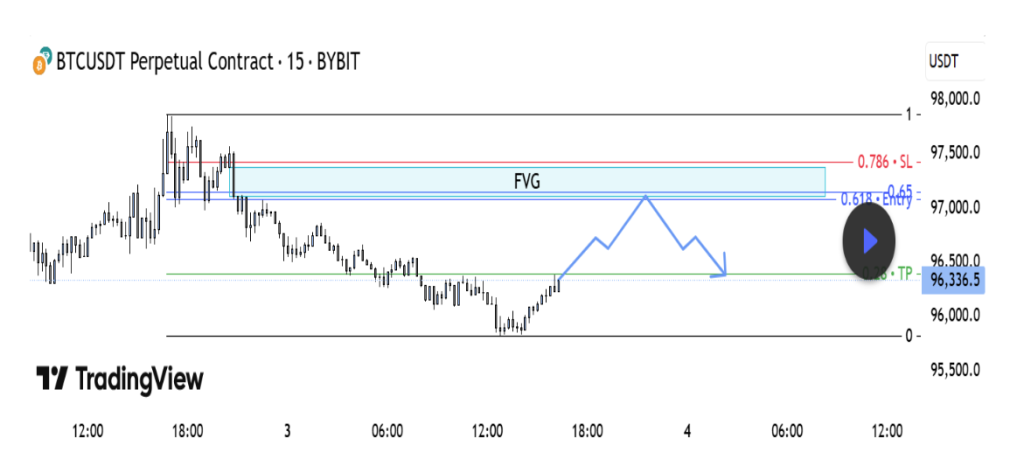

Not all analysts are convinced that Bitcoin will attain $100,000 once more with out a shakeout first. A counterview on the TradingView platform highlights a potential short-term bearish setup based mostly on the BTCUSDT 15-minute chart.

In line with the analyst, the present upward retracement seems corrective fairly than impulsive, forming a basic quick setup inside a powerful truthful worth hole resistance zone. Technical evaluation exhibits that Bitcoin has retraced right into a area that aligns with a bearish truthful worth hole and the golden pocket zone outlined by the 0.618 to 0.65 Fibonacci ranges.

Associated Studying

Because it stands, the truthful worth hole is sitting between $97,000 and $97,450. Ought to value fail to interrupt via this provide area, it might reverse and catch bulls off guard.

Chart from TradingView

On the time of writing, Bitcoin was buying and selling at $96,040.

Featured picture from Unsplash, chart from TradingView