MicroStrategy, underneath the management of CEO Michael Saylor, has been making waves within the funding world with its important Bitcoin acquisitions. The corporate’s current buy of huge Bitcoins has additional intensified hypothesis in regards to the correlation between its Bitcoin holdings and the hovering MSTR inventory value.

In the meantime, as Bitcoin continues to garner institutional curiosity, questions come up about whether or not MicroStrategy’s bullish stance on the cryptocurrency is driving its inventory valuation or resulting in overvaluation.

Bitcoin Increase Help In Inventory Value Rally

MicroStrategy, led by CEO Michael Saylor, has turn out to be synonymous with Bitcoin funding, amassing a formidable stash of the cryptocurrency. Notably, the corporate’s current acquisition of an extra 9,245 BTC additional solidifies its place as a significant Bitcoin holder within the company world.

As well as, with MicroStrategy’s total Bitcoin holdings now surpassing 214,000 BTC, equal to 1% of the utmost Bitcoin provide, consideration has turned to the impression of this accumulation on the agency’s inventory, and MSTR efficiency.

In the meantime, as Bitcoin good points mainstream acceptance, MicroStrategy’s unwavering dedication to the digital asset has propelled its inventory value to new heights. In 2024 alone, the MSTR inventory surged by roughly 170%, fueled by rising optimism surrounding Bitcoin and MicroStrategy’s strategic Bitcoin acquisitions. Furthermore, over the previous month, the inventory witnessed a exceptional improve of over 65%, reflecting the fervor surrounding the cryptocurrency market.

Additionally Learn: Ethereum Network Struggles With Missed Slots, bloXroute and Lighthouse In Debate

Is MicroStrategy Overvalued Amid Bitcoin Hype?

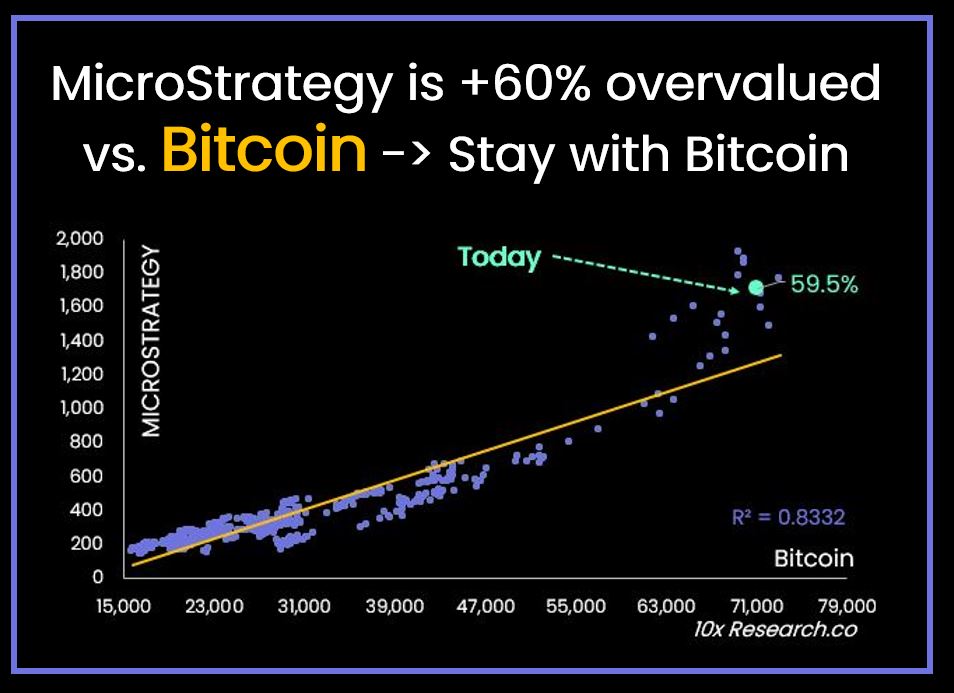

Regardless of MicroStrategy’s bullish outlook and its spectacular Bitcoin holdings, issues in regards to the inventory’s valuation have emerged. In response to Markus Thielen’s 10X Analysis, a distinguished crypto analysis agency, MicroStrategy shares are deemed overvalued by as a lot as 60% primarily based on regression with Bitcoin. Then again, when evaluated in opposition to the corporate’s precise Bitcoin holdings, the overvaluation jumps to just about 100%.

In the meantime, Thielen’s evaluation means that MicroStrategy’s inventory value could not precisely mirror its intrinsic worth, contemplating its heavy reliance on Bitcoin efficiency. Whereas MicroStrategy has emerged as a flagbearer for Bitcoin fanatics within the company sector, questions linger about whether or not the inventory’s meteoric rise aligns with basic market ideas.

With Thielen’s analysis pointing in direction of a extra modest valuation vary for MicroStrategy, traders are urged to train warning amidst the Bitcoin-fueled euphoria. In the meantime, the MSTR stock price closed at $1,704.56 on March 28, down 11.18% from its earlier session.

Additionally Learn: LUNC Price Rallied 400%, Analyst Predicts Further 270% Upside on Breakout

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: